Region:Asia

Author(s):Geetanshi

Product Code:KRAB4048

Pages:83

Published On:October 2025

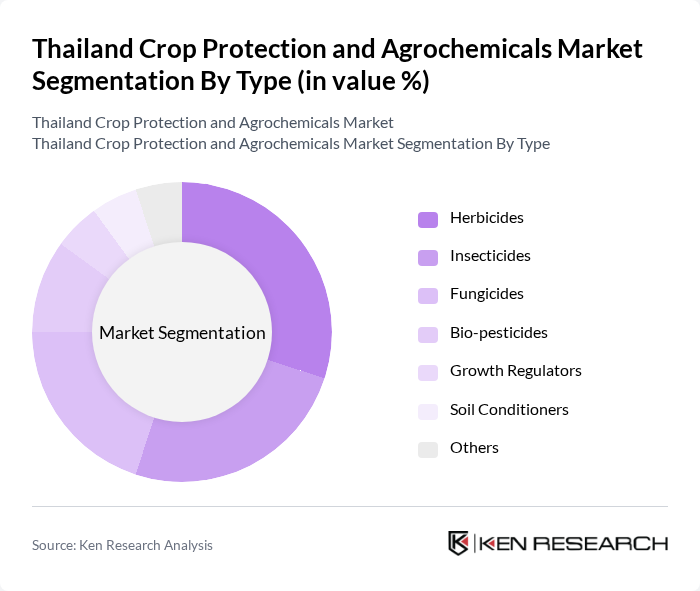

By Type:The market is segmented into various types of agrochemicals, including herbicides, insecticides, fungicides, bio-pesticides, growth regulators, soil conditioners, and others. Each of these segments plays a crucial role in pest management and crop protection, catering to the diverse needs of farmers and agricultural practices. Herbicides remain the largest segment by market share, while bio-pesticides are experiencing the fastest growth due to increasing demand for sustainable and environmentally friendly solutions .

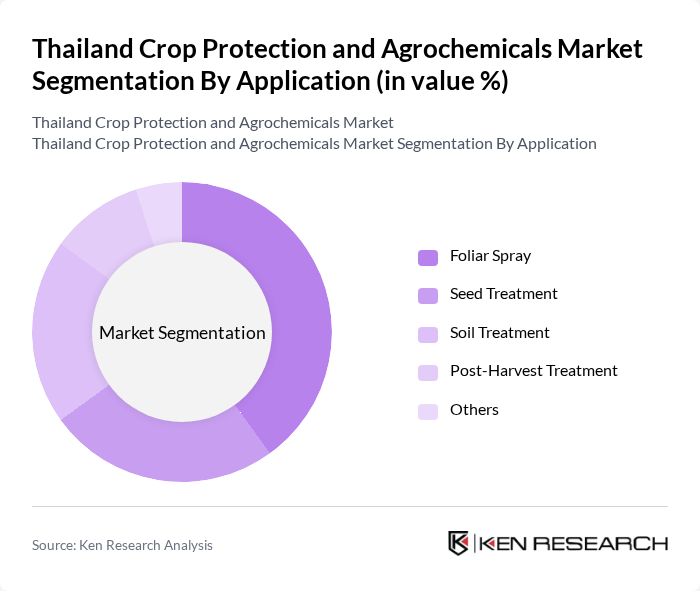

By Application:The application of agrochemicals is categorized into foliar spray, seed treatment, soil treatment, post-harvest treatment, and others. Each application method is tailored to enhance crop yield and protect against pests and diseases at different growth stages. Foliar spray remains the dominant application method, reflecting its widespread use in Thailand’s intensive cropping systems .

The Thailand Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Crop Protection, Bayer CropScience, BASF SE, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions, UPL Limited, Sumitomo Chemical, Nufarm Limited, American Vanguard Corporation, Chr. Hansen, Ginkgo Bioworks Holdings Inc., Dow Chemical Company, Mitsui Chemicals Agro, Inc., Thai Agro Chemicals Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The Thailand crop protection and agrochemicals market is poised for significant transformation as sustainability becomes a central focus. With increasing investments in biopesticides and precision agriculture technologies, the industry is likely to witness a shift towards environmentally friendly solutions. Additionally, the expansion of digital agriculture tools will enhance efficiency and productivity, allowing farmers to optimize their operations. As these trends evolve, market players must adapt to changing consumer preferences and regulatory landscapes to remain competitive and drive growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Bio-pesticides Growth Regulators Soil Conditioners Others |

| By Application | Foliar Spray Seed Treatment Soil Treatment Post-Harvest Treatment Others |

| By End-User | Farmers Agricultural Cooperatives Agrochemical Distributors Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Crop Type | Cereals & Grains Fruits & Vegetables Oilseeds & Pulses Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand Eastern Thailand Others |

| By Price Range | Low Price Mid Price High Price |

| By Product Formulation | Liquid Granular Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Retailers | 100 | Store Managers, Sales Representatives |

| Farmers Using Crop Protection Products | 150 | Smallholder Farmers, Large-scale Farmers |

| Agrochemical Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Government Agricultural Officials | 50 | Policy Makers, Regulatory Officers |

| Research Institutions and Universities | 40 | Agricultural Researchers, Professors |

The Thailand Crop Protection and Agrochemicals Market is valued at approximately USD 890 million, driven by factors such as food security demands, high-value crop expansion, and modern farming techniques. This market is expected to grow significantly in the coming years.