Region:Europe

Author(s):Dev

Product Code:KRAB3008

Pages:84

Published On:October 2025

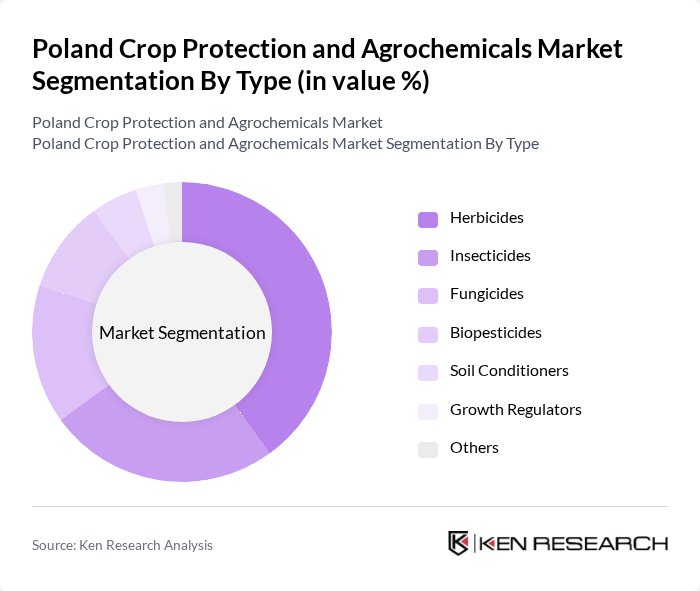

By Type:The market is segmented into various types of agrochemicals, including herbicides, insecticides, fungicides, biopesticides, soil conditioners, growth regulators, and others. Each of these segments plays a crucial role in crop protection and enhancement, catering to different agricultural needs.

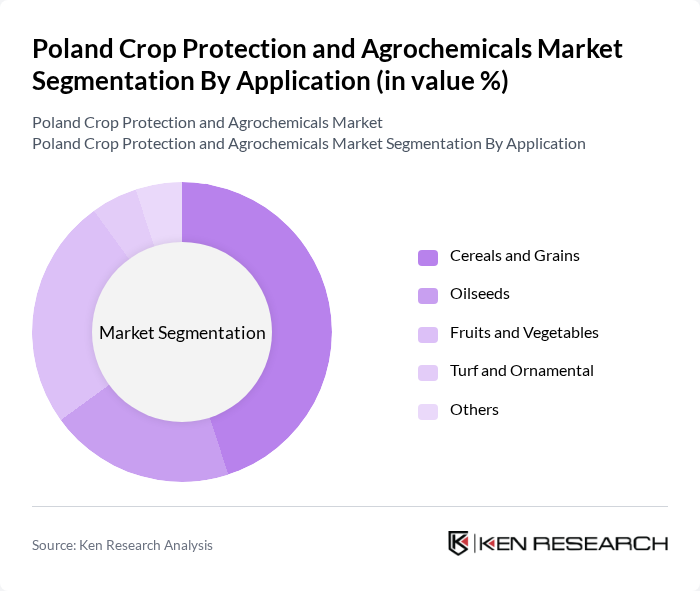

By Application:The application segment includes cereals and grains, oilseeds, fruits and vegetables, turf and ornamental, and others. Each application area has specific requirements for crop protection, influencing the demand for various agrochemicals.

The Poland Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta AG, BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Arysta LifeScience Corporation, Sumitomo Chemical Co., Ltd., Cheminova A/S, Isagro S.p.A., KWS SAAT SE, Belchim Crop Protection, Biobest Group NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland crop protection and agrochemicals market appears promising, driven by a combination of technological innovation and increasing consumer demand for sustainable practices. As the industry adapts to regulatory pressures and environmental concerns, companies are likely to invest more in research and development, focusing on biopesticides and precision agriculture technologies. This evolution will not only enhance productivity but also align with global sustainability goals, positioning Poland as a leader in eco-friendly agricultural practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Soil Conditioners Growth Regulators Others |

| By Application | Cereals and Grains Oilseeds Fruits and Vegetables Turf and Ornamental Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Research Institutions Others |

| By Region | Northern Poland Southern Poland Eastern Poland Western Poland Others |

| By Product Formulation | Liquid Granular Powder Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Manufacturers | 100 | Product Managers, R&D Directors |

| Farmers and Agricultural Producers | 150 | Crop Farmers, Cooperative Leaders |

| Distributors and Retailers | 80 | Sales Managers, Supply Chain Coordinators |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Research Institutions | 40 | Agricultural Researchers, Academic Professors |

The Poland Crop Protection and Agrochemicals Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by the increasing demand for food security and advancements in agricultural technology.