Region:Middle East

Author(s):Dev

Product Code:KRAB6107

Pages:97

Published On:October 2025

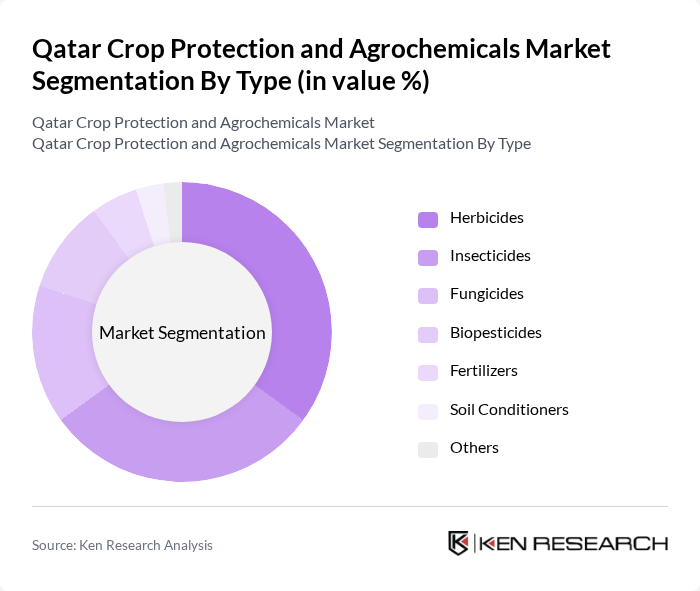

By Type:The market is segmented into various types of products, including herbicides, insecticides, fungicides, biopesticides, fertilizers, soil conditioners, and others. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yields. The increasing focus on sustainable agriculture has also led to a rise in the adoption of biopesticides, which are perceived as safer alternatives to chemical pesticides.

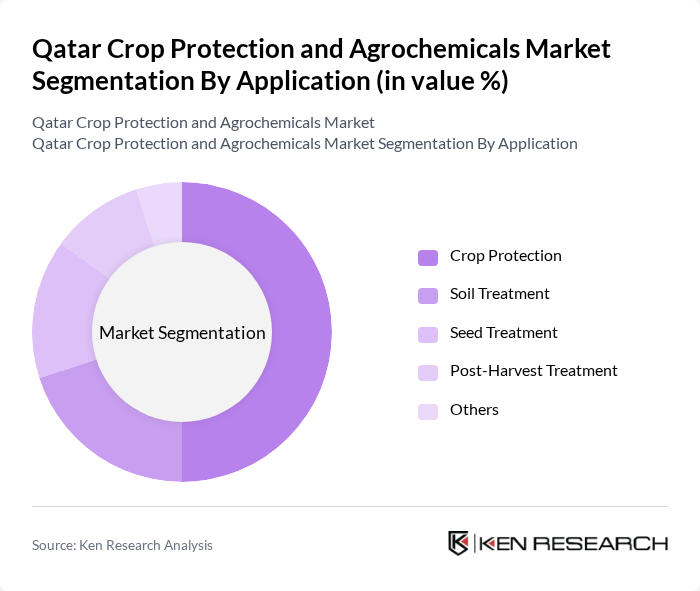

By Application:The applications of crop protection and agrochemicals include crop protection, soil treatment, seed treatment, post-harvest treatment, and others. Crop protection remains the dominant application segment, driven by the need to enhance crop yields and protect against pests and diseases. Soil treatment is gaining traction as farmers increasingly recognize the importance of soil health in sustainable agriculture.

The Qatar Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Chemical Company, Qatar Fertilizer Company, Gulf Agri Group, Al-Faisal Holding, Qatar Agro Industries, Qatar National Chemical Company, Al-Mana Group, Qatar Greenhouse Company, Doha Agro, Qatar Biotech, Al-Jazeera Agricultural Company, Qatar Agricultural Development Company, Qatar Crop Protection Company, Qatar Agrochemicals and Fertilizers, Qatar Plant Protection Company contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar Crop Protection and Agrochemicals Market is poised for transformative growth, driven by technological advancements and a shift towards sustainable practices. The integration of precision agriculture and digital farming technologies is expected to enhance efficiency and reduce environmental impact. Additionally, the increasing focus on organic farming will likely spur innovation in biopesticides and eco-friendly agrochemicals. As the government continues to support agricultural initiatives, the market is set to evolve, presenting new opportunities for stakeholders in the agrochemical sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Fertilizers Soil Conditioners Others |

| By Application | Crop Protection Soil Treatment Seed Treatment Post-Harvest Treatment Others |

| By End-User | Commercial Farmers Smallholder Farmers Agricultural Cooperatives Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Region | Central Qatar Northern Qatar Southern Qatar Eastern Qatar Western Qatar Others |

| By Product Formulation | Liquid Formulations Granular Formulations Powder Formulations Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 100 | Farm Owners, Agronomists |

| Fruit and Vegetable Agrochemicals | 80 | Crop Managers, Agricultural Consultants |

| Pesticide Usage Trends | 70 | Retailers, Distributors |

| Organic Farming Practices | 60 | Organic Farmers, Sustainability Experts |

| Regulatory Compliance Insights | 50 | Policy Makers, Compliance Officers |

The Qatar Crop Protection and Agrochemicals Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing food security demands, advancements in agricultural technology, and sustainable farming practices.