Region:Europe

Author(s):Rebecca

Product Code:KRAB4060

Pages:88

Published On:October 2025

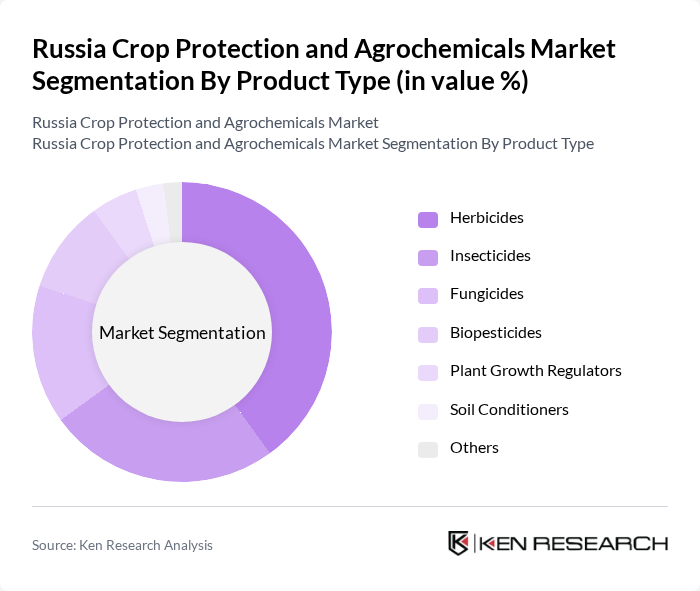

By Product Type:The product type segmentation includes herbicides, insecticides, fungicides, biopesticides, plant growth regulators, soil conditioners, and others. Herbicides remain the leading sub-segment due to their essential role in weed management, which is critical for maximizing crop yields. The increasing adoption of herbicides is driven by the need for efficient weed control in large-scale farming operations, where manual weeding is often impractical. Recent trends indicate a growing share for biopesticides, reflecting regulatory support and sustainability initiatives .

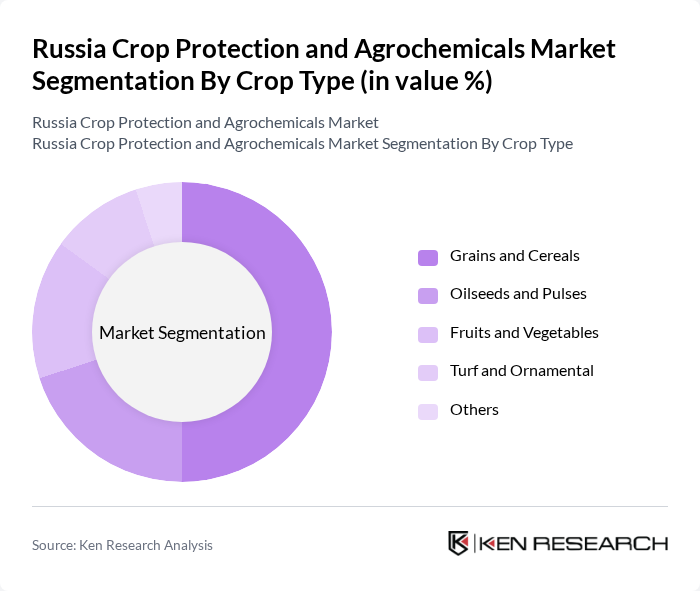

By Crop Type:The crop type segmentation encompasses grains and cereals, oilseeds and pulses, fruits and vegetables, turf and ornamental, and others. Grains and cereals dominate this segment due to their high demand in both domestic and international markets. The increasing consumption of staple foods and the need for higher productivity in grain production are driving the demand for crop protection products in this category. Russia’s record grain harvests and export growth further reinforce the dominance of this segment .

The Russia Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., Dow AgroSciences LLC, ChemChina (Syngenta Group), Arysta LifeScience Corporation, Isagro S.p.A., Marrone Bio Innovations, Biobest Group NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia crop protection and agrochemicals market appears promising, driven by technological advancements and a shift towards sustainable practices. As the demand for organic and environmentally friendly products increases, companies are likely to invest more in biopesticides and integrated pest management solutions. Additionally, the expansion of e-commerce platforms for agrochemical distribution is expected to enhance market accessibility, allowing farmers to access innovative products more efficiently, thus fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Herbicides Insecticides Fungicides Biopesticides Plant Growth Regulators Soil Conditioners Others |

| By Crop Type | Grains and Cereals Oilseeds and Pulses Fruits and Vegetables Turf and Ornamental Others |

| By Formulation | Liquid Formulations Dry Formulations Granular Formulations Others |

| By Distribution Channel | Direct Sales Retail Distribution Online Sales Distributors and Wholesalers Others |

| By Federal District | Central Federal District Southern Federal District Volga Federal District Siberian Federal District Northwestern Federal District Others |

| By Farm Size | Large-Scale Commercial Farms Medium-Scale Farms Small-Scale Farms |

| By Application Method | Foliar Application Soil Application Seed Treatment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Major Crops | 120 | Agronomists, Crop Managers |

| Insecticide Application Trends | 90 | Pest Control Specialists, Farmers |

| Fungicide Market Insights | 60 | Field Researchers, Agricultural Consultants |

| Distribution Channels for Agrochemicals | 100 | Distributors, Retail Managers |

| Regulatory Impact on Agrochemical Sales | 70 | Policy Makers, Compliance Officers |

The Russia Crop Protection and Agrochemicals Market is valued at approximately USD 1.8 billion, driven by factors such as food security demands, grain export expansion, and the adoption of advanced crop protection formulations.