Region:Europe

Author(s):Rebecca

Product Code:KRAB1856

Pages:82

Published On:October 2025

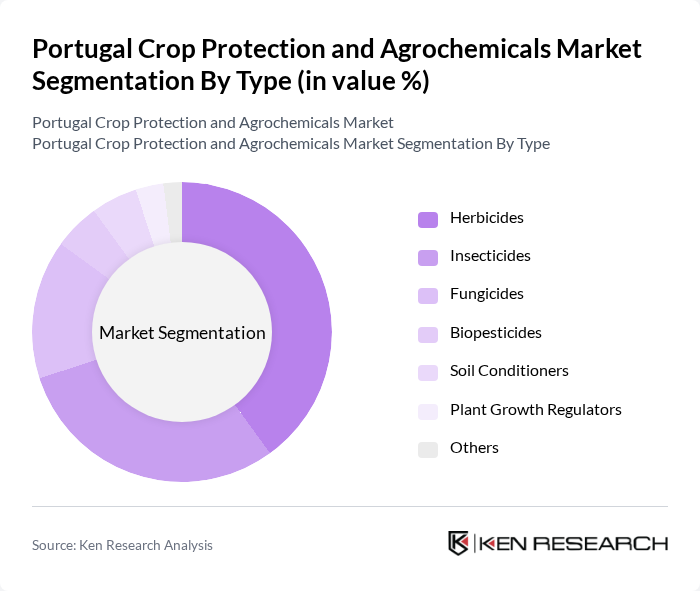

By Type:The market is segmented into various types of agrochemicals, including herbicides, insecticides, fungicides, biopesticides, soil conditioners, plant growth regulators, and others. Among these, herbicides and insecticides remain the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yield. The increasing focus on sustainable agriculture and regulatory pressure is driving the growth of biopesticides, which offer environmentally friendly alternatives to traditional chemicals. Fungicides are particularly important in vineyard regions, while soil conditioners and plant growth regulators are gaining traction for their role in improving soil health and crop quality .

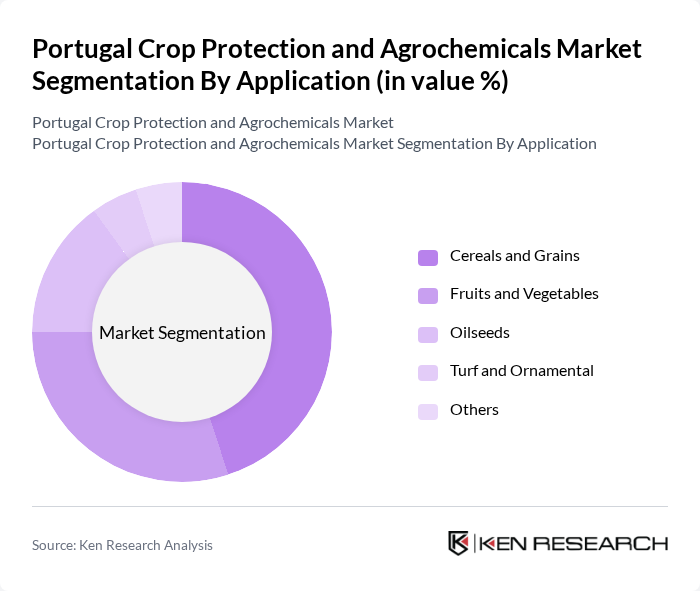

By Application:The applications of agrochemicals in Portugal are diverse, including cereals and grains, fruits and vegetables, oilseeds, turf and ornamental, and others. The cereals and grains segment holds a significant share due to the country's focus on staple crops like wheat and corn, supported by the need to maximize yields on limited arable land. The increasing consumption and export demand for fruits and vegetables, especially grapes for wine production, is driving growth in this segment. Oilseeds and specialty crops such as turf and ornamentals are also important, reflecting the broadening scope of agrochemical use in both traditional and emerging agricultural sectors .

The Portugal Crop Protection and Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience, BASF SE, Syngenta, Corteva Agriscience, ADAMA Agricultural Solutions, FMC Corporation, UPL Limited, Sipcam Portugal, Nufarm, Valagro, Biobest Group NV, Koppert Biological Systems, Isagro S.p.A., Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal crop protection and agrochemicals market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As farmers increasingly adopt precision agriculture and integrated pest management, the demand for innovative agrochemical solutions will rise. Additionally, government initiatives supporting sustainable agriculture will further enhance market growth. Companies that invest in R&D and collaborate with agricultural technology firms will likely lead the market, ensuring they meet evolving consumer and regulatory demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Soil Conditioners Plant Growth Regulators Others |

| By Application | Cereals and Grains Fruits and Vegetables Oilseeds Turf and Ornamental Others |

| By End-User | Farmers Agricultural Cooperatives Distributors Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Distributors Others |

| By Region | Northern Portugal Central Portugal Southern Portugal Azores and Madeira |

| By Product Formulation | Liquid Formulations Granular Formulations Powder Formulations Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 85 | Agronomists, Crop Managers |

| Fruit and Vegetable Agrochemical Usage | 75 | Farm Owners, Agricultural Technicians |

| Distribution Channels for Agrochemicals | 65 | Distributors, Retail Managers |

| Regulatory Compliance Insights | 45 | Compliance Officers, Regulatory Affairs Managers |

| Market Trends and Innovations | 55 | Industry Analysts, R&D Managers |

The Portugal Crop Protection and Agrochemicals Market is valued at approximately USD 320 million, reflecting a five-year historical analysis and recent market data, driven by the increasing demand for food security and advancements in agricultural technology.