Region:Asia

Author(s):Geetanshi

Product Code:KRAA7036

Pages:82

Published On:January 2026

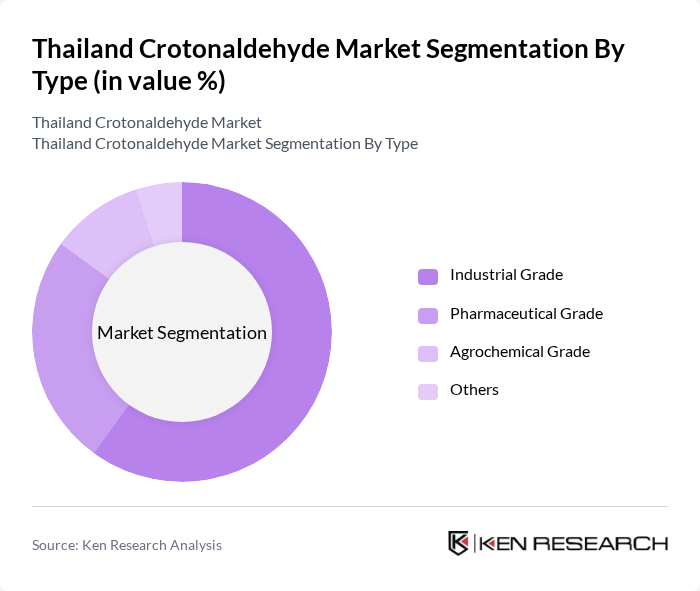

By Type:The market is segmented into various types, including Industrial Grade, Pharmaceutical Grade, Agrochemical Grade, and Others. Among these, the Industrial Grade segment is the most dominant due to its extensive use in chemical manufacturing processes. The demand for industrial-grade crotonaldehyde is driven by its application in producing solvents, resins, and other chemical intermediates. The Pharmaceutical Grade segment is also significant, catering to the growing pharmaceutical industry, which requires high-purity chemicals for drug formulation.

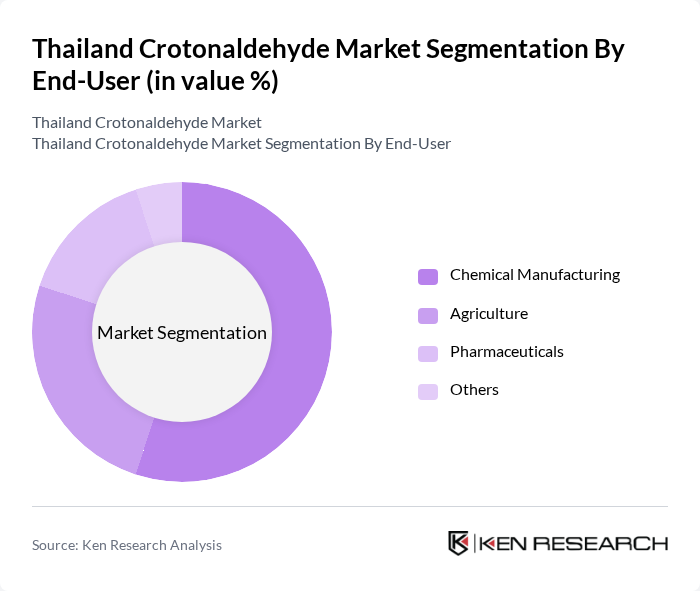

By End-User:The end-user segmentation includes Chemical Manufacturing, Agriculture, Pharmaceuticals, and Others. The Chemical Manufacturing sector is the largest consumer of crotonaldehyde, utilizing it as a key raw material in various chemical processes. The Agriculture segment follows, where crotonaldehyde is used in the production of agrochemicals and pesticides. The Pharmaceuticals segment is also growing, driven by the increasing need for high-quality chemical intermediates in drug development and the expansion of Thailand's pharmaceutical manufacturing capabilities.

The Thailand Crotonaldehyde Market is characterized by a dynamic mix of regional and international players. Leading participants such as PTT Global Chemical Public Company Limited, Thai Oil Public Company Limited, IRPC Public Company Limited, Bangkok Synthetics Co., Ltd., Siam Cement Group, Mitr Phol Group, Charoen Pokphand Group, Thai Plastic and Chemicals Public Company Limited, SCG Chemicals, Indorama Ventures Public Company Limited, Bangkok Industrial Gas Co., Ltd., Thai Ethanol Production Co., Ltd., Thai Chemical Industry Co., Ltd., TPI Polene Public Company Limited, Thai Carbon Black Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand crotonaldehyde market appears promising, driven by increasing industrial applications and a focus on sustainable practices. As the automotive and chemical sectors expand, the demand for crotonaldehyde is expected to rise significantly. Additionally, advancements in production technologies and a shift towards bio-based alternatives will likely enhance market competitiveness. Strategic collaborations with local industries will further bolster growth, positioning Thailand as a key player in the regional crotonaldehyde landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Pharmaceutical Grade Agrochemical Grade Others |

| By End-User | Chemical Manufacturing Agriculture Pharmaceuticals Others |

| By Application | Solvent Production Intermediate in Chemical Synthesis Fuel Additives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Eastern Thailand |

| By Production Method | Catalytic Dehydrogenation Aldol Condensation Others |

| By Packaging Type | Bulk Packaging Drums Containers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crotonaldehyde in Plastics Manufacturing | 45 | Production Managers, Chemical Engineers |

| Crotonaldehyde in Agrochemical Applications | 40 | Product Development Scientists, Regulatory Affairs Managers |

| Crotonaldehyde in Pharmaceutical Production | 35 | Quality Control Managers, R&D Directors |

| Crotonaldehyde in Solvent Applications | 40 | Procurement Managers, Supply Chain Analysts |

| Crotonaldehyde Regulatory Compliance | 30 | Compliance Officers, Environmental Health & Safety Managers |

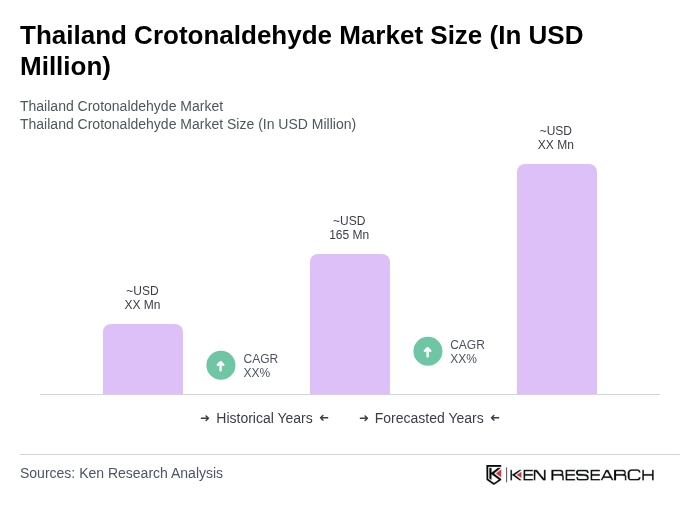

The Thailand Crotonaldehyde market is valued at approximately USD 165 million, reflecting significant growth driven by increasing demand in chemical manufacturing, agrochemicals, and the pharmaceutical sector.