Thailand Furniture and Smart Interiors Market Overview

- The Thailand Furniture and Smart Interiors Market is valued at USD 10 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing trend towards smart home solutions. The demand for innovative and sustainable furniture options has surged, reflecting changing consumer preferences and lifestyle choices. Notably, there is a shift towards multifunctional, ergonomic, and eco-friendly furniture, with manufacturers focusing on customization and design innovation to meet evolving needs .

- Key cities such as Bangkok, Chiang Mai, and Pattaya dominate the market due to their high population density and economic activity. Bangkok, as the capital, serves as a hub for both local and international furniture brands, while Chiang Mai and Pattaya attract a significant number of tourists, boosting demand for hospitality-related furniture and smart interior solutions .

- In 2023, the Thai government implemented the "Smart City" initiative, which encourages the integration of smart technologies in urban development, including furniture and interior design. This initiative is governed by the "Thailand Smart City Master Plan 2018–2037" issued by the Digital Economy Promotion Agency (DEPA), Ministry of Digital Economy and Society. The plan mandates integration of digital infrastructure, smart home solutions, and sustainable urban planning, directly impacting the furniture and interiors sector by establishing compliance standards for smart and sustainable products .

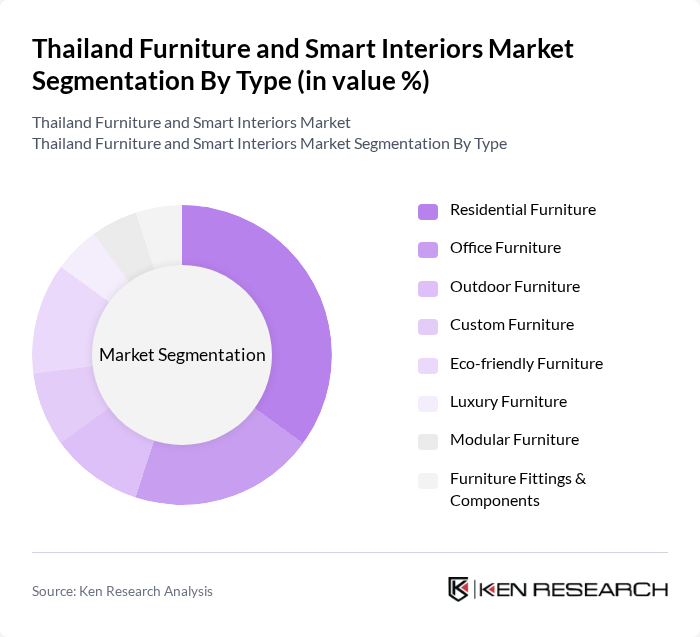

Thailand Furniture and Smart Interiors Market Segmentation

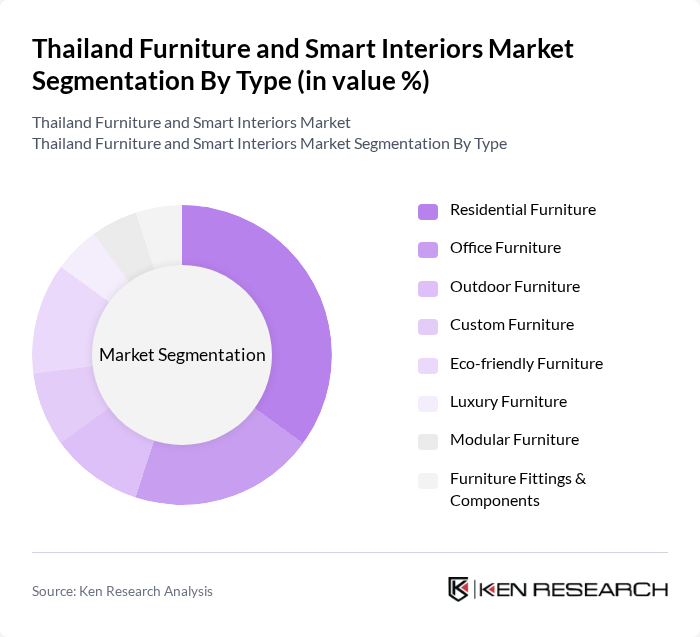

By Type:The market is segmented into various types of furniture, including residential, office, outdoor, smart, custom, eco-friendly, modular, furniture fittings & components, and others. Among these, residential furniture is the most dominant segment, driven by the increasing demand for home furnishings as urban living spaces evolve. The trend towards smart furniture is also gaining traction, reflecting consumer interest in technology integration for enhanced functionality. Eco-friendly and modular furniture are also rising in popularity, supported by consumer awareness of sustainability and space optimization .

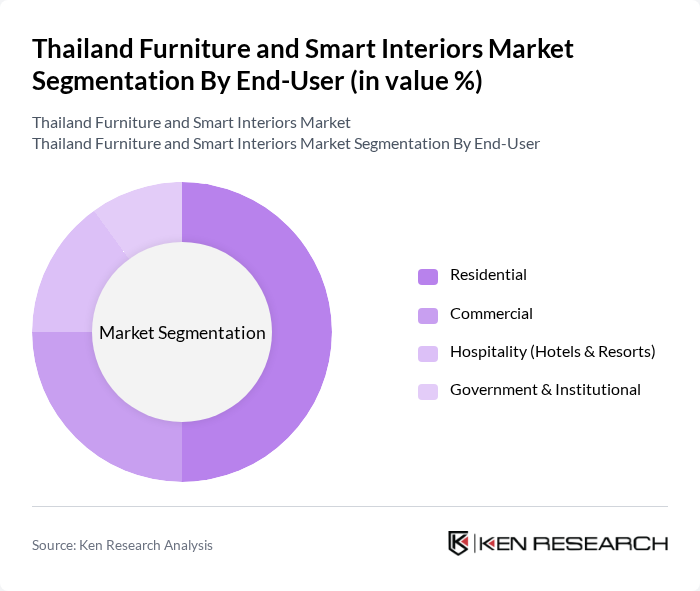

By End-User:The end-user segmentation includes residential, commercial, hospitality (hotels & resorts), government & institutional, and others. The residential segment leads the market, driven by the growing trend of home renovations, the increasing number of households, and the popularity of online furniture purchases. The hospitality sector is also significant, as the tourism industry in Thailand continues to thrive, necessitating high-quality furniture solutions for hotels and resorts. Commercial and institutional demand is supported by ongoing real estate and infrastructure development .

Thailand Furniture and Smart Interiors Market Competitive Landscape

The Thailand Furniture and Smart Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Thailand, SCG Home, Index Living Mall, SB Furniture, Modernform Group Public Company Limited, TPI Polene Public Company Limited, Thai Furniture Industry Co., Ltd., Kittichai Furniture, Home Product Center Public Company Limited (HomePro), Koncept Furniture (SB Furniture Group), Poonphol Furniture Co., Ltd., T.A. Furniture Industry Co., Ltd., P&P Furniture Co., Ltd., S.P. Furniture Co., Ltd., Thai Watsadu (Central Retail Corporation), NocNoc contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Furniture and Smart Interiors Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Thailand's urban population is projected to reach 37 million in future, accounting for approximately 52% of the total population. This rapid urbanization drives demand for modern furniture and smart interior solutions, as urban dwellers seek to optimize limited living spaces. The urbanization trend is supported by government initiatives aimed at improving infrastructure and housing, which further stimulates the furniture market. As cities expand, the need for stylish, functional furniture becomes increasingly critical.

- Rising Disposable Income:Thailand's GDP per capita is expected to rise to approximately $7,000 in future, reflecting a growing middle class with increased purchasing power. This economic growth leads to higher disposable incomes, enabling consumers to invest in quality furniture and smart home technologies. As households prioritize comfort and aesthetics, the demand for premium furniture options is likely to surge, driving market expansion. Enhanced financial stability encourages consumers to explore innovative interior solutions that enhance their living environments.

- Growing Demand for Smart Home Solutions:The smart home market in Thailand is anticipated to reach $400 million in future, fueled by technological advancements and consumer interest in automation. As more households adopt smart devices, the integration of smart furniture becomes essential. This trend is supported by increasing awareness of energy efficiency and convenience, prompting consumers to invest in smart interiors that enhance their quality of life. The convergence of technology and design is reshaping consumer preferences in the furniture sector.

Market Challenges

- Intense Competition:The Thailand furniture market is characterized by a high level of competition, with over 2,000 registered manufacturers as of future. This saturation leads to price wars and challenges for new entrants to establish a foothold. Established brands dominate market share, making it difficult for smaller companies to compete effectively. The competitive landscape necessitates innovation and differentiation, compelling businesses to invest in unique designs and marketing strategies to attract discerning consumers.

- Fluctuating Raw Material Prices:The furniture industry in Thailand faces challenges due to volatile raw material prices, particularly for wood and metal. In future, the price of rubberwood has experienced significant fluctuations due to supply chain disruptions and environmental regulations. These fluctuations can significantly impact production costs and profit margins for manufacturers. Companies must navigate these challenges by optimizing supply chains and exploring alternative materials to maintain competitiveness in the market.

Thailand Furniture and Smart Interiors Market Future Outlook

The Thailand furniture and smart interiors market is poised for significant growth, driven by urbanization, rising incomes, and technological advancements. As consumers increasingly prioritize sustainability and customization, manufacturers will need to adapt their offerings to meet evolving preferences. The integration of smart technologies into furniture design will continue to gain traction, enhancing user experience. Additionally, the hospitality sector's expansion will create further demand for innovative furniture solutions, positioning the market for robust development in the coming years.

Market Opportunities

- Adoption of Sustainable Materials:With growing environmental awareness, the demand for sustainable furniture materials is on the rise. In future, the market for eco-friendly furniture is expected to grow significantly, as consumers increasingly seek products made from recycled or sustainably sourced materials. This shift presents an opportunity for manufacturers to differentiate themselves and capture a niche market focused on sustainability.

- Growth in the Hospitality Sector:Thailand's tourism industry is projected to welcome over 28 million visitors in future, driving demand for high-quality furniture in hotels and resorts. This growth presents a lucrative opportunity for furniture manufacturers to supply innovative and stylish solutions tailored to the hospitality sector. Collaborations with hotel chains can enhance brand visibility and establish long-term partnerships in this expanding market.