Region:Middle East

Author(s):Dev

Product Code:KRAB4891

Pages:98

Published On:October 2025

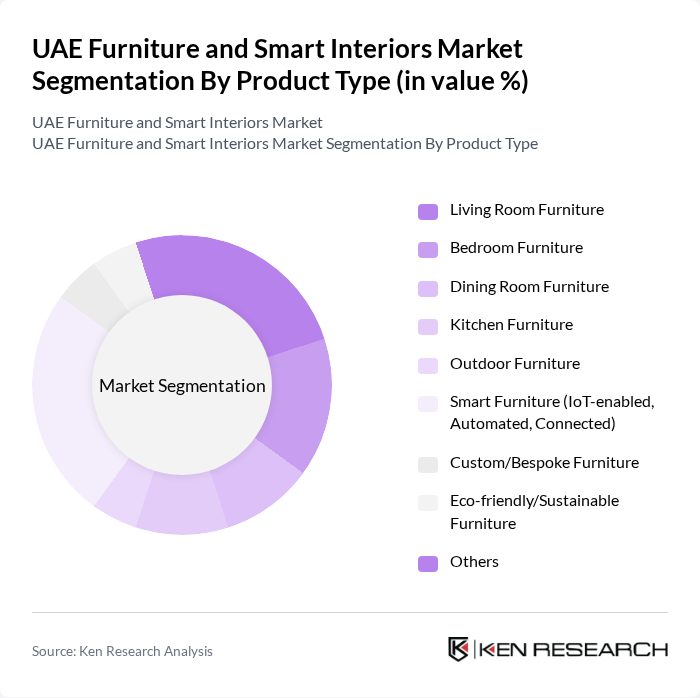

By Product Type:The product type segmentation includes various categories such as Living Room Furniture, Bedroom Furniture, Dining Room Furniture, Kitchen Furniture, Outdoor Furniture, Smart Furniture (IoT-enabled, Automated, Connected), Custom/Bespoke Furniture, Eco-friendly/Sustainable Furniture, and Others. Among these, Smart Furniture is gaining traction due to the increasing integration of technology in home design, appealing to tech-savvy consumers who prioritize convenience and connectivity. The demand for Eco-friendly/Sustainable Furniture is also on the rise as consumers become more environmentally conscious. Modular, multifunctional, and space-saving designs are increasingly popular, reflecting the needs of urban residents and the influence of global design trends .

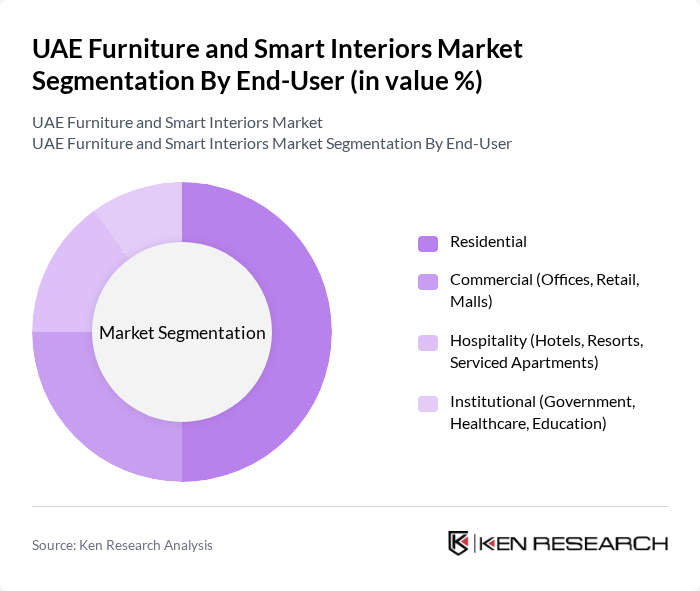

By End-User:The end-user segmentation encompasses Residential, Commercial (Offices, Retail, Malls), Hospitality (Hotels, Resorts, Serviced Apartments), and Institutional (Government, Healthcare, Education). The Residential segment is the largest, driven by a growing population and increasing home ownership rates. The Commercial segment is also significant, as businesses invest in quality furniture to enhance their work environments and customer experiences. The Hospitality sector is expanding rapidly, with new hotels and resorts being developed, further boosting demand. Demand from the institutional sector is supported by ongoing investments in healthcare and education infrastructure .

The UAE Furniture and Smart Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, The One, Danube Home, Royal Furniture, Marina Home, Pottery Barn, West Elm, Crate and Barrel, Al-Futtaim Group, Landmark Group, BoConcept, Natuzzi, Home Box contribute to innovation, geographic expansion, and service delivery in this space.

The UAE furniture and smart interiors market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative and sustainable furniture solutions will rise. Additionally, the integration of smart technologies will enhance user experience, making homes more efficient. Companies that adapt to these trends and focus on customization will likely capture a larger market share, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Living Room Furniture Bedroom Furniture Dining Room Furniture Kitchen Furniture Outdoor Furniture Smart Furniture (IoT-enabled, Automated, Connected) Custom/Bespoke Furniture Eco-friendly/Sustainable Furniture Others |

| By End-User | Residential Commercial (Offices, Retail, Malls) Hospitality (Hotels, Resorts, Serviced Apartments) Institutional (Government, Healthcare, Education) |

| By Distribution Channel | Online Retail Offline Retail (Showrooms, Specialty Stores, Hypermarkets) Direct Sales/Project Sales |

| By Material | Wood Metal Plastic Glass Leather Fabric/Upholstery Others |

| By Price Range | Budget Mid-range Premium/Luxury |

| By Design Style | Modern/Contemporary Traditional/Classic Minimalist Industrial Others |

| By Functionality | Multi-functional Space-saving Ergonomic Smart Features (Automation, Connectivity, Sensors) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Interior Design Projects | 60 | Office Managers, Facility Managers |

| Smart Home Technology Adoption | 50 | Tech-savvy Consumers, Smart Home Installers |

| Furniture Retail Trends | 70 | Retail Managers, Sales Executives |

| Consumer Preferences in Smart Interiors | 40 | End-users, Product Designers |

The UAE Furniture and Smart Interiors Market is valued at approximately USD 4.5 billion, driven by urbanization, a booming real estate sector, and a growing demand for innovative and sustainable furniture solutions.