Philippines Furniture and Smart Interiors Market Overview

- The Philippines Furniture and Smart Interiors Market is valued at USD 4.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, a growing middle class, and a strong shift toward online furniture sales. The demand for innovative furniture designs, eco-friendly materials, and tech-integrated solutions has also contributed significantly to market expansion. Minimalist designs, ergonomic products, and customization options are gaining traction, reflecting evolving consumer preferences for modern living spaces.

- Metro Manila, Cebu, and Davao remain the dominant cities in the Philippines Furniture and Smart Interiors Market. Metro Manila, as the capital region, serves as a hub for commerce and trade, attracting both local and international furniture brands. Cebu is renowned for its craftsmanship and export of high-quality furniture, leveraging indigenous materials and artisanal skills. Davao's expanding economy and urban development have spurred demand for both residential and commercial furniture, with increased investment in new housing and business infrastructure.

- The Philippine Green Building Code, issued by the Department of Public Works and Highways in 2015 and actively enforced, encourages the use of sustainable materials and energy-efficient designs in construction and interior design. This regulation mandates compliance for new buildings above certain floor area thresholds, promoting environmentally friendly practices in the furniture industry and enhancing the market for eco-friendly furniture and smart interiors.

Philippines Furniture and Smart Interiors Market Segmentation

By Type:The market is segmented into various types of furniture, including Residential Furniture, Office Furniture, Outdoor Furniture, Smart Furniture, Custom Furniture, Eco-friendly Furniture, Handcrafted/Artisanal Furniture, and Others. Residential Furniture is the leading segment, driven by the increasing demand for home furnishings as more people invest in their living spaces. The rise of smart furniture reflects consumer preferences for multifunctional, tech-integrated solutions, while eco-friendly and artisanal furniture are gaining popularity due to sustainability and cultural appeal.

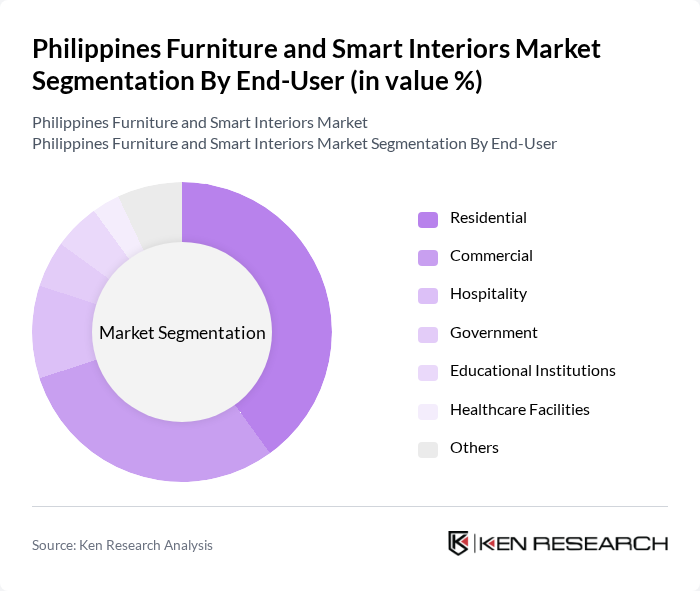

By End-User:The market is segmented by end-users, including Residential, Commercial, Hospitality, Government, Educational Institutions, Healthcare Facilities, and Others. The Residential segment dominates the market, supported by a rising number of households, home renovations, and increased spending on home improvement. The Commercial segment is also significant, as businesses invest in office spaces and retail environments to enhance customer experiences and adapt to flexible work arrangements.

Philippines Furniture and Smart Interiors Market Competitive Landscape

The Philippines Furniture and Smart Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Philippines, Mandaue Foam Industries, Inc., Blims Fine Furniture, Our Home, Furniture Republic, Homeworks, CITI Furniture, Philux, Inc., Sogo Home and Office Center, SB Furniture, Dos Hermanos Furniture, Mejore Furniture, Prizmic & Brill, Designs Ligna Furniture, Murillo Export Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Furniture and Smart Interiors Market Industry Analysis

Growth Drivers

- Rising Urbanization:The Philippines is experiencing rapid urbanization, with urban population growth projected to reach 52% by future, according to the World Bank. This shift is driving demand for furniture and smart interiors as urban dwellers seek to optimize limited living spaces. The increasing number of urban households, estimated at 25 million by future, is expected to further fuel the market, as consumers prioritize modern, space-efficient designs that cater to their evolving lifestyles.

- Increasing Disposable Income:The Philippines' GDP per capita is projected to rise to approximately $3,950 in future, reflecting a growing middle class with increased purchasing power. As disposable income rises, consumers are more willing to invest in quality furniture and smart home solutions. This trend is evident in the furniture sector, where sales are expected to increase by 10% annually, driven by consumer preferences for premium and technologically integrated products that enhance comfort and convenience.

- Growing Demand for Sustainable Furniture:With environmental awareness on the rise, the demand for sustainable furniture is gaining traction in the Philippines. The market for eco-friendly furniture is expected to grow significantly, with a projected value of $1.5 billion by future. This shift is driven by consumers' preference for products made from renewable materials and those that adhere to sustainable practices, reflecting a broader global trend towards environmentally responsible consumption and production.

Market Challenges

- High Import Tariffs on Raw Materials:The Philippines imposes high import tariffs on raw materials, averaging around 15% for furniture components. This significantly increases production costs for local manufacturers, making it challenging to compete with international brands that benefit from lower tariffs. As a result, local producers face pressure to maintain competitive pricing while ensuring quality, which can hinder market growth and innovation in the furniture sector.

- Intense Competition from Local and International Brands:The furniture market in the Philippines is characterized by intense competition, with over 1,000 registered furniture manufacturers. This saturation leads to price wars and challenges in brand differentiation. International brands, leveraging economies of scale and advanced technology, pose a significant threat to local players. As a result, local manufacturers must innovate and enhance their value propositions to maintain market share and attract discerning consumers.

Philippines Furniture and Smart Interiors Market Future Outlook

The Philippines furniture and smart interiors market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, the integration of smart technologies into home furnishings will enhance user experience, making homes more connected and efficient. The focus on sustainability will also shape product offerings, as consumers increasingly seek eco-friendly options that align with their values and lifestyle choices.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in the Philippines, projected to reach $10 billion by future, presents a significant opportunity for furniture retailers. Online platforms enable brands to reach a broader audience, facilitating direct-to-consumer sales and enhancing customer engagement. This shift allows for innovative marketing strategies and personalized shopping experiences, catering to the tech-savvy consumer base increasingly comfortable with online purchases.

- Increasing Interest in Customizable Furniture:The trend towards customizable furniture is gaining momentum, with consumers seeking personalized solutions that reflect their unique tastes. This market segment is expected to grow, driven by a desire for individuality in home decor. Companies that offer modular and customizable options can tap into this demand, providing consumers with the flexibility to design their spaces according to their specific needs and preferences.