Region:Asia

Author(s):Geetanshi

Product Code:KRAA7859

Pages:80

Published On:September 2025

By Type:The market is segmented into various types of furniture, including Residential Furniture, Office Furniture, Outdoor Furniture, Smart Furniture, Custom Furniture, Eco-Friendly Furniture, and Others. Among these, Residential Furniture is the most dominant segment, driven by the increasing number of households and the trend towards home improvement. The demand for Smart Furniture is also on the rise, reflecting consumer interest in technology-integrated living spaces.

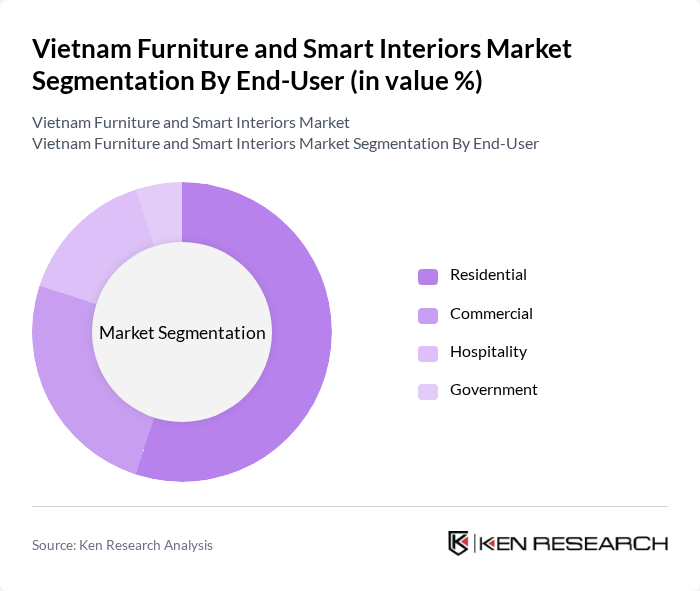

By End-User:The market is segmented by end-users into Residential, Commercial, Hospitality, and Government. The Residential segment leads the market, driven by the growing trend of home renovations and the increasing number of new housing projects. The Commercial segment is also significant, fueled by the expansion of businesses and the need for modern office spaces.

The Vietnam Furniture and Smart Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Scanteak, Hòa Phát Furniture, Xuân Hòa, N?i Th?t Hòa Bình, Lotte Mart, VinGroup, FPT Smart Home, Th? Gi?i Di ??ng, Muji, H? Th?ng N?i Th?t, An Phú Furniture, Duy Tân Plastic, Phú M? Furniture, N?i Th?t ??c contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam furniture and smart interiors market appears promising, driven by urbanization and technological advancements. As more consumers embrace smart home solutions, manufacturers are likely to innovate and offer integrated products that cater to this demand. Additionally, the trend towards eco-friendly materials will shape product development, aligning with global sustainability goals. The hospitality sector's growth will also create new opportunities for customized furniture solutions, enhancing the overall market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Smart Furniture Custom Furniture Eco-Friendly Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale |

| By Material | Wood Metal Plastic Fabric |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Contemporary Minimalist |

| By Application | Residential Use Commercial Use Institutional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 150 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 100 | Office Managers, Facility Coordinators |

| Smart Home Technology Integration | 80 | Tech-savvy Consumers, Smart Home Installers |

| Eco-friendly Furniture Trends | 70 | Sustainability Advocates, Product Designers |

| Market for Custom Furniture Solutions | 90 | Custom Furniture Makers, Interior Decorators |

The Vietnam Furniture and Smart Interiors Market is valued at approximately USD 15 billion, driven by urbanization, rising disposable incomes, and a growing demand for modern and smart living solutions. This market reflects significant consumer interest in eco-friendly and customizable furniture options.