Region:Asia

Author(s):Rebecca

Product Code:KRAB2896

Pages:84

Published On:October 2025

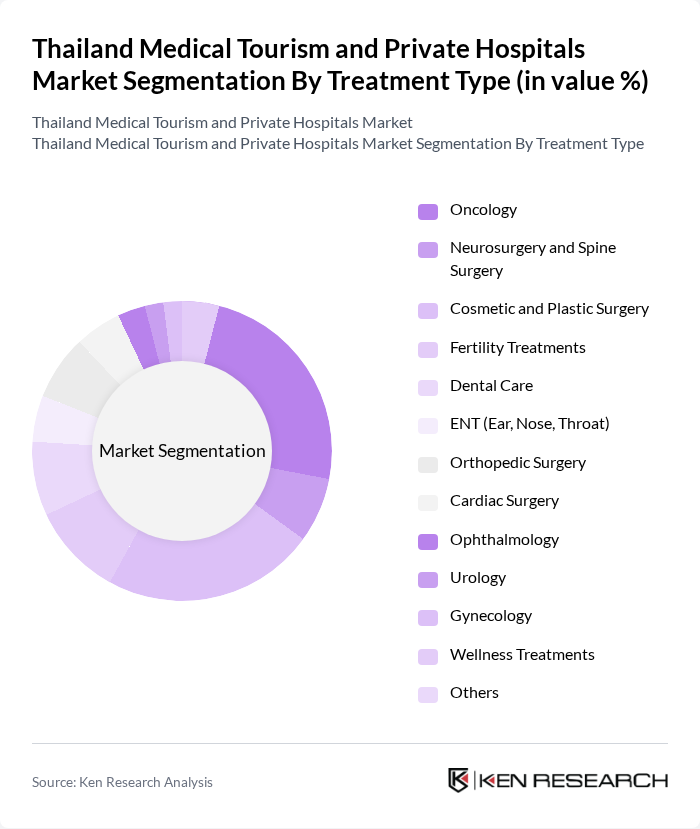

By Treatment Type:

The treatment type segmentation includes various subsegments such as Oncology, Neurosurgery and Spine Surgery, Cosmetic and Plastic Surgery, Fertility Treatments, Dental Care, ENT (Ear, Nose, Throat), Orthopedic Surgery, Cardiac Surgery, Ophthalmology, Urology, Gynecology, Wellness Treatments, and Others. Among these, Oncology is the leading subsegment, driven by Thailand’s advanced cancer care infrastructure, specialized oncologists, and comparatively affordable treatment costs. Cosmetic and Plastic Surgery also represents a significant share, propelled by the increasing demand for aesthetic procedures and the popularity of medical tourism for beauty treatments. Patients are attracted to Thailand for its skilled surgeons, internationally accredited facilities, and affordable prices, making it a preferred destination for both oncology and cosmetic enhancements .

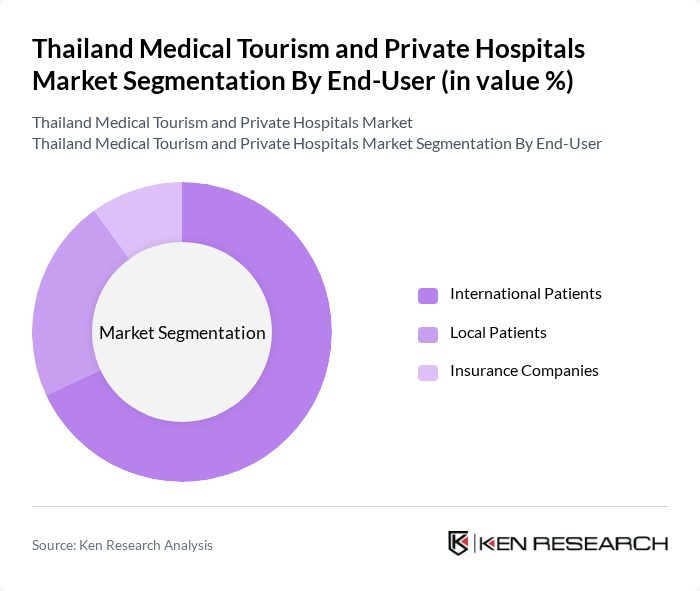

By End-User:

This segmentation includes International Patients, Local Patients, and Insurance Companies. The International Patients subsegment dominates the market, as Thailand is a top destination for medical tourists seeking high-quality healthcare at lower costs. The influx of patients from countries with expensive healthcare systems, such as the United States and Australia, as well as growing partnerships with international insurance providers, has significantly boosted this segment's growth .

The Thailand Medical Tourism and Private Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bumrungrad International Hospital, Bangkok Hospital, Samitivej Hospital, Phyathai Hospital, Bangkok Dusit Medical Services (BDMS), Vejthani Hospital, BNH Hospital, Siriraj Hospital, King Chulalongkorn Memorial Hospital, Piyavate Hospital, Thonburi Hospital, Samitivej Sriracha Hospital, Bangkok Christian Hospital, MedPark Hospital, Theptarin Hospital, Praram 9 Hospital, Paolo Hospital, Ramkhamhaeng Hospital, Mission Hospital Bangkok, Chiva-Som International Health Resort contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's medical tourism and private hospitals market appears promising, driven by increasing global demand for affordable healthcare solutions. As digital health solutions gain traction, hospitals are expected to enhance their service offerings, improving patient engagement and satisfaction. Furthermore, the integration of wellness tourism into medical packages is likely to attract a broader demographic, positioning Thailand as a holistic health destination. Continued government support and investment in healthcare infrastructure will further bolster this growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Oncology Neurosurgery and Spine Surgery Cosmetic and Plastic Surgery Fertility Treatments Dental Care ENT (Ear, Nose, Throat) Orthopedic Surgery Cardiac Surgery Ophthalmology Urology Gynecology Wellness Treatments Others |

| By End-User | International Patients Local Patients Insurance Companies |

| By Service Package | All-Inclusive Packages Customized Treatment Plans Short-term Packages Long-term Care Packages |

| By Payment Method | Out-of-Pocket Payments Insurance Coverage Financing Options |

| By Age Group | Children Adults Seniors |

| By Geographic Source | Asia-Pacific Europe North America Middle East |

| By Duration of Stay | Short-term (1-3 days) Medium-term (4-7 days) Long-term (8+ days) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Patient Experience | 120 | Medical Tourists, Patient Coordinators |

| Private Hospital Services | 90 | Hospital Administrators, Marketing Managers |

| Healthcare Professionals Insights | 70 | Doctors, Nurses, Medical Tourism Specialists |

| Travel Agencies and Medical Tourism Facilitators | 60 | Travel Agents, Medical Tourism Consultants |

| Regulatory and Policy Impact | 50 | Healthcare Policy Makers, Regulatory Officials |

The Thailand Medical Tourism and Private Hospitals Market is valued at approximately USD 3 billion, driven by high-quality healthcare services, competitive pricing, and a wide range of medical specialties, attracting millions of international patients annually.