Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7720

Pages:87

Published On:October 2025

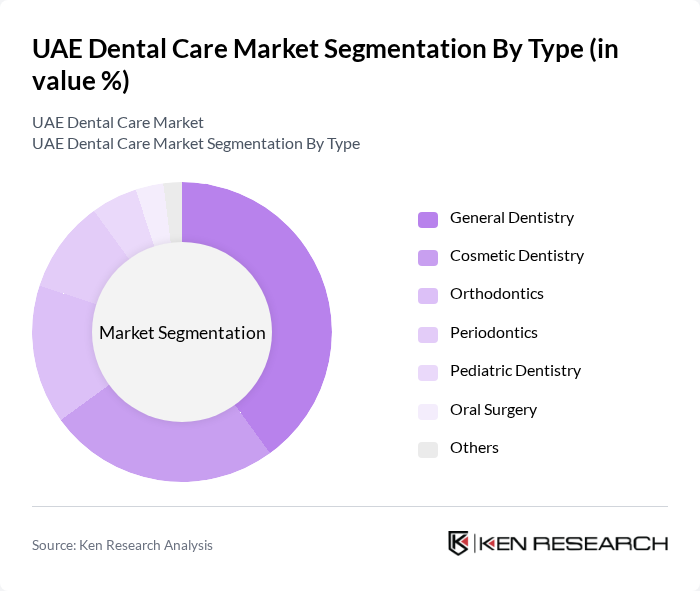

By Type:The dental care market can be segmented into various types, including General Dentistry, Cosmetic Dentistry, Orthodontics, Periodontics, Pediatric Dentistry, Oral Surgery, and Others. Among these, General Dentistry is the most dominant segment, as it encompasses a wide range of essential services that cater to the general population's oral health needs. The increasing focus on preventive care and regular check-ups drives the demand for general dental services, making it a critical component of the market.

By End-User:The market can be segmented based on end-users, including Individuals, Families, Corporates, and Government Institutions. The Individuals segment is the most significant, driven by the growing awareness of oral health and the increasing number of people seeking dental care for preventive and cosmetic purposes. This trend is further supported by the rise in disposable incomes, allowing more individuals to invest in their dental health.

The UAE Dental Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Dental Clinic, Dubai Dental Hospital, American Dental Clinic, Al Zahra Dental Clinic, Dr. Michael's Dental Clinic, Bright Smile Dental Clinic, Dental House, The Dental Studio, Al Futtaim Dental Clinic, Smile Dental Clinic, Nova Dental Clinic, Dental Care Center, The White Dental Clinic, Al Jazeera Dental Clinic, Dental Oasis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE dental care market appears promising, driven by ongoing technological advancements and a growing emphasis on preventive care. As the population becomes increasingly health-conscious, the demand for innovative dental solutions is expected to rise. Additionally, the government's commitment to enhancing healthcare infrastructure will likely facilitate better access to dental services, fostering a more competitive environment that encourages quality improvements and patient-centric care.

| Segment | Sub-Segments |

|---|---|

| By Type | General Dentistry Cosmetic Dentistry Orthodontics Periodontics Pediatric Dentistry Oral Surgery Others |

| By End-User | Individuals Families Corporates Government Institutions |

| By Distribution Channel | Dental Clinics Hospitals Online Platforms Retail Pharmacies |

| By Treatment Type | Preventive Treatments Restorative Treatments Surgical Treatments |

| By Age Group | Children Adolescents Adults Seniors |

| By Insurance Coverage | Insured Patients Uninsured Patients |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Practices | 150 | Dentists, Clinic Managers |

| Orthodontic Services | 100 | Orthodontists, Treatment Coordinators |

| Cosmetic Dentistry | 80 | Cosmetic Dentists, Marketing Managers |

| Pediatric Dentistry | 70 | Pediatric Dentists, Child Health Specialists |

| Dental Equipment Suppliers | 60 | Sales Representatives, Product Managers |

The UAE Dental Care Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased awareness of oral health, rising disposable incomes, and advancements in dental technology.