Region:Asia

Author(s):Geetanshi

Product Code:KRAD0010

Pages:91

Published On:August 2025

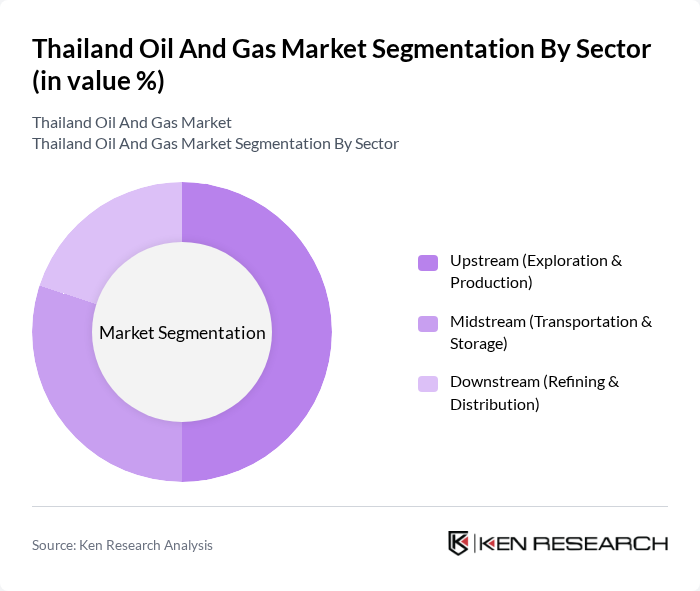

By Sector:The Thailand Oil and Gas Market is segmented into three main sectors: Upstream (Exploration & Production), Midstream (Transportation & Storage), and Downstream (Refining & Distribution). The upstream sector remains the most prominent, supported by ongoing exploration activities in the Gulf of Thailand and the strategic imperative of energy security. The midstream segment is focused on enhancing transportation and storage infrastructure to accommodate increased LNG imports and domestic distribution needs. The downstream sector is characterized by refinery upgrades and expanded distribution networks, serving both domestic and export markets .

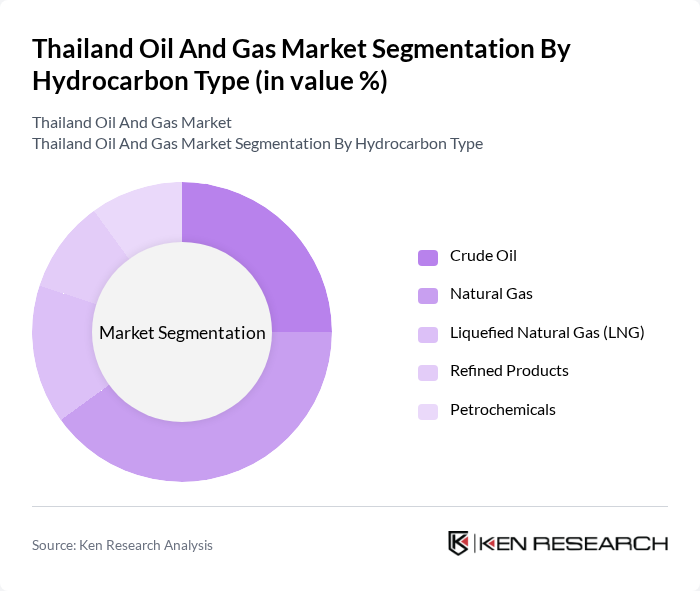

By Hydrocarbon Type:The market is further segmented by hydrocarbon type, including Crude Oil, Natural Gas, Liquefied Natural Gas (LNG), Refined Products, and Petrochemicals. Natural Gas is the leading segment, driven by the government's emphasis on cleaner energy and the rising demand for gas in power generation and transportation. Crude oil remains vital for refining and petrochemical feedstock, while LNG is increasingly important for energy diversification and security. Refined products and petrochemicals continue to support industrial and export activities .

The Thailand Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as PTT Public Company Limited, Chevron Thailand Exploration and Production, Ltd., PTTEP (PTT Exploration and Production Public Company Limited), Thai Oil Public Company Limited, Bangchak Corporation Public Company Limited, IRPC Public Company Limited, Shell Company of Thailand Limited, ExxonMobil Limited (Thailand), TotalEnergies EP Thailand, Hess Corporation (Thailand), CNOOC Thailand Limited, Mitsui Oil Exploration Co., Ltd. (MOECO), Eni Thailand B.V., ConocoPhillips Thailand, and MedcoEnergi Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand oil and gas market is poised for transformation as it adapts to evolving energy demands and regulatory landscapes. With a focus on cleaner energy sources and technological innovations, the sector is expected to enhance operational efficiencies and reduce environmental impacts. Strategic partnerships with international firms will likely drive investment in advanced exploration techniques. Additionally, the government's commitment to infrastructure development will support the growth of natural gas usage, positioning Thailand as a key player in the regional energy landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) |

| By Hydrocarbon Type | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Refined Products Petrochemicals |

| By End-User Industry | Power Generation Transportation Industrial Residential & Commercial |

| By Region | Gulf of Thailand (Offshore) Central Thailand (Onshore) Northeastern Thailand (Onshore) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Distribution Mode | Pipeline Tanker Rail Truck |

| By Pricing Strategy | Cost-Plus Pricing Market-Oriented Pricing Value-Based Pricing |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 60 | Exploration Managers, Production Engineers |

| Natural Gas Distribution | 50 | Distribution Managers, Regulatory Affairs Specialists |

| Refining Operations | 40 | Refinery Managers, Process Engineers |

| Environmental Compliance | 40 | Environmental Managers, Compliance Officers |

| Market Regulation Insights | 50 | Policy Analysts, Government Officials |

The Thailand Oil and Gas Market is valued at approximately USD 25 billion, reflecting a combination of increased energy demand, government initiatives for energy security, and ongoing investments in exploration and production activities.