Region:Asia

Author(s):Dev

Product Code:KRAB6079

Pages:91

Published On:October 2025

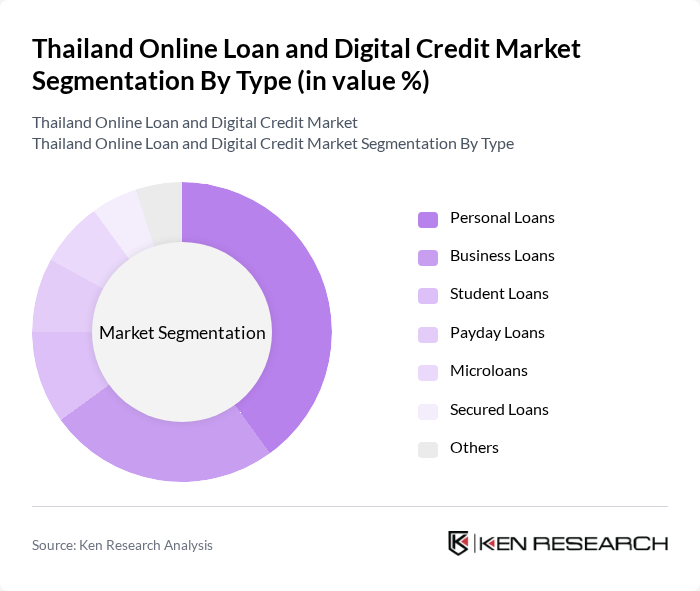

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, payday loans, microloans, secured loans, and others. Personal loans are currently the most popular choice among consumers due to their flexibility and ease of access. Business loans are also gaining traction as small and medium enterprises seek funding for growth. The demand for payday loans and microloans is increasing, particularly among lower-income individuals who require quick access to cash.

By End-User:The end-user segmentation includes individuals, small businesses, corporates, and non-profit organizations. Individuals represent the largest segment, driven by the need for personal financing solutions. Small businesses are increasingly turning to digital credit for operational funding, while corporates utilize loans for expansion and investment. Non-profit organizations also seek funding through digital channels to support their initiatives.

The Thailand Online Loan and Digital Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Krungsri Consumer, KTC (Krungthai Card Public Company Limited), Siam Commercial Bank, Bangkok Bank, TMBThanachart Bank, UOB Thailand, AEON Thana Sinsap (Thailand) Public Company Limited, Home Credit Thailand, Grab Financial Group, TrueMoney, Cash2u, Finnomena, WeLab Bank, Ascend Money, PayLater contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand online loan and digital credit market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As mobile-first solutions gain traction, lenders will increasingly leverage alternative data for credit assessments, enhancing approval rates. The rise of peer-to-peer lending platforms and BNPL services will further diversify the market, catering to various consumer needs. Additionally, ongoing regulatory developments will shape the competitive landscape, compelling lenders to innovate while ensuring compliance and consumer protection.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Payday Loans Microloans Secured Loans Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Loan Amount | Under 10,000 THB ,000 - 50,000 THB ,000 - 100,000 THB Over 100,000 THB |

| By Loan Duration | Short-term Loans Medium-term Loans Long-term Loans |

| By Distribution Channel | Online Platforms Mobile Applications Direct Lending Third-party Brokers |

| By Customer Segment | Salaried Individuals Self-employed Individuals Students Retirees |

| By Credit Score | Low Credit Score Medium Credit Score High Credit Score |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Online Loan Users | 150 | Individuals aged 18-45, recent borrowers |

| Small Business Owners | 100 | Entrepreneurs utilizing digital credit for business |

| Fintech Industry Experts | 50 | Analysts, consultants, and academics in digital finance |

| Regulatory Bodies | 30 | Officials from the Bank of Thailand and financial regulators |

| Online Lending Platform Executives | 40 | CEOs, CFOs, and product managers from fintech companies |

The Thailand Online Loan and Digital Credit Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the demand for quick credit solutions among consumers and businesses.