France Online Loan and Digital Credit Market Overview

- The France Online Loan and Digital Credit Market is valued at USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital banking solutions, a rise in consumer demand for quick and accessible credit options, and the expansion of fintech companies offering innovative lending solutions.

- Key cities such as Paris, Lyon, and Marseille dominate the market due to their high population density, economic activity, and the presence of numerous financial institutions and fintech startups. These urban centers serve as hubs for innovation and technology, facilitating the growth of online lending platforms and digital credit services.

- In 2023, the French government implemented regulations aimed at enhancing consumer protection in the online lending sector. This includes mandatory transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees, thereby promoting responsible lending practices and reducing the risk of over-indebtedness.

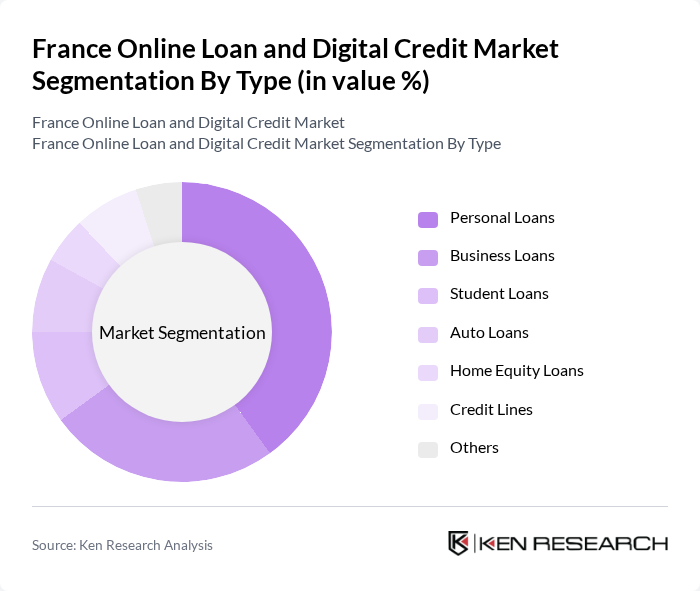

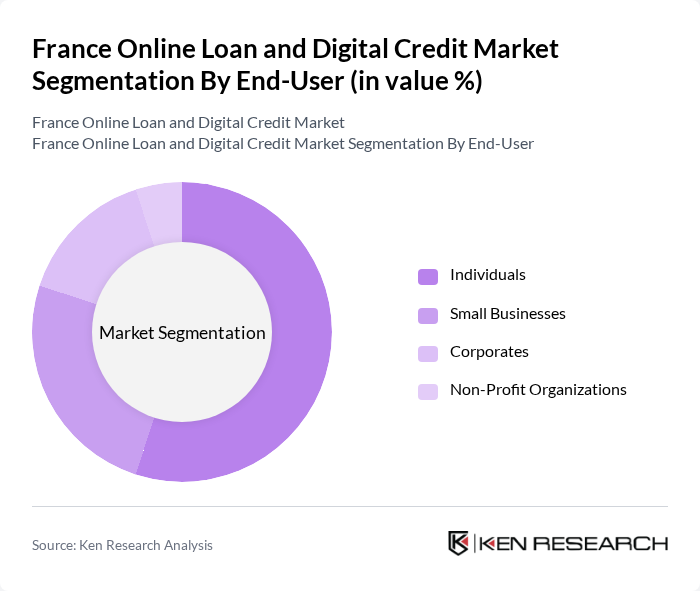

France Online Loan and Digital Credit Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Credit Lines, and Others. Personal Loans are currently the most dominant segment, driven by consumer preferences for unsecured credit options that offer flexibility in usage. Business Loans are also significant, as small and medium enterprises increasingly seek financing to support growth and operational needs.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals represent the largest segment, as personal loans are widely utilized for various purposes such as home improvements, debt consolidation, and unexpected expenses. Small Businesses also form a significant portion of the market, seeking loans for operational costs and expansion.

France Online Loan and Digital Credit Market Competitive Landscape

The France Online Loan and Digital Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Crédit Agricole, Cetelem, Younited Credit, Lendix, October, Pret d'Union, Hello Bank!, Boursorama Banque, ING Direct, Axa Banque, Orange Bank, Revolut, N26 contribute to innovation, geographic expansion, and service delivery in this space.

France Online Loan and Digital Credit Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital adoption rate in France reached 92% in the future, with over 60 million internet users actively engaging in online services. This surge in digital engagement has facilitated the growth of online loan platforms, allowing consumers to access credit conveniently. The French government’s initiatives to enhance digital infrastructure, including the rollout of 5G, are expected to further support this trend, making online lending more accessible and efficient for users across various demographics.

- Rising Demand for Quick Financing:In the future, the demand for quick financing solutions surged, with personal loans increasing by 15% year-on-year, totaling approximately €30 billion. This trend is driven by consumers seeking immediate financial relief for unexpected expenses. The convenience of online applications, which can be completed in under 10 minutes, has made digital credit an attractive option for many, particularly younger demographics who prioritize speed and efficiency in financial transactions.

- Expansion of E-commerce:The French e-commerce market is projected to reach €150 billion in the future, growing at a rate of 12% annually. This expansion has created a symbiotic relationship with online lending, as consumers increasingly seek financing options to support their purchases. Retailers are also integrating financing solutions at checkout, enhancing customer experience and driving sales, which in turn fuels the demand for digital credit products tailored to e-commerce transactions.

Market Challenges

- Regulatory Compliance Issues:The online loan market in France faces stringent regulatory compliance challenges, particularly with the Consumer Credit Directive, which mandates transparency and consumer protection. In the future, over 30% of online lenders reported difficulties in adapting to these regulations, leading to potential fines and operational disruptions. This regulatory landscape can hinder innovation and slow down the growth of new entrants in the digital credit space.

- Consumer Trust Deficits:Despite the growth of online lending, consumer trust remains a significant challenge, with 40% of potential borrowers expressing concerns about data security and fraud. The rise in cyberattacks targeting financial institutions has exacerbated these fears. Building consumer confidence is crucial for lenders, as trust directly impacts customer acquisition and retention in a market where personal data is paramount to operations and service delivery.

France Online Loan and Digital Credit Market Future Outlook

The future of the online loan and digital credit market in France appears promising, driven by technological advancements and evolving consumer preferences. As fintech innovations continue to emerge, lenders are likely to adopt more sophisticated credit assessment tools, enhancing the speed and accuracy of loan approvals. Additionally, the integration of sustainable financing options will cater to the growing demand for ethical lending practices, positioning the market for robust growth in the future.

Market Opportunities

- Growth in Fintech Innovations:The fintech sector in France is expected to attract over €5 billion in investments in the future, fostering innovations in digital credit solutions. This influx of capital will enable the development of advanced technologies, such as AI-driven credit scoring, which can streamline the lending process and enhance customer experience, ultimately expanding market reach and efficiency.

- Expansion into Underserved Markets:Approximately 20% of the French population remains underserved by traditional banking services. Targeting these demographics with tailored online loan products presents a significant opportunity for growth. By offering accessible financing options, lenders can tap into a new customer base, driving financial inclusion and increasing overall market penetration in the digital credit landscape.