Germany Online Loan and Digital Credit Market Overview

- The Germany Online Loan and Digital Credit Market is valued at USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital banking solutions, a rise in consumer demand for quick and accessible credit options, and the growing trend of online financial services. The market has seen a significant shift towards digital platforms, making loans more accessible to a broader audience.

- Key cities such as Berlin, Frankfurt, and Munich dominate the market due to their robust financial ecosystems, high population density, and a strong presence of fintech companies. These cities are hubs for innovation and technology, attracting both startups and established financial institutions, which enhances competition and service offerings in the online loan and digital credit space.

- In 2023, the German government implemented regulations aimed at enhancing consumer protection in the online lending sector. This includes stricter guidelines for transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees before taking out loans. Such regulations are designed to foster trust and stability in the digital credit market.

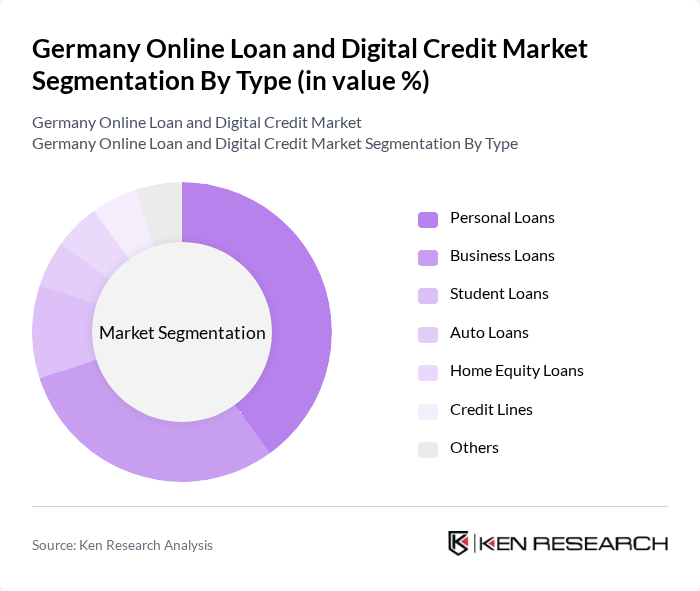

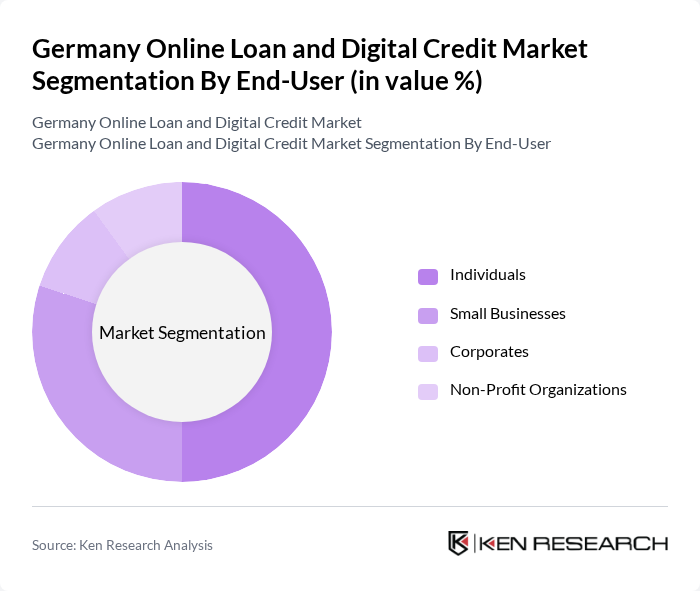

Germany Online Loan and Digital Credit Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Equity Loans, Credit Lines, and Others. Personal Loans are currently the most dominant segment, driven by consumer demand for flexible financing options for personal expenses, home improvements, and debt consolidation. Business Loans follow closely, as small and medium enterprises increasingly seek online solutions for quick funding to support their operations and growth.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals represent the largest segment, as they seek personal loans for various needs, including home renovations, education, and emergencies. Small Businesses also constitute a significant portion of the market, as they require quick access to funds for operational expenses and growth initiatives.

Germany Online Loan and Digital Credit Market Competitive Landscape

The Germany Online Loan and Digital Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Bank AG, Commerzbank AG, KfW Bank, ING-DiBa AG, Auxmoney GmbH, Smava GmbH, Lendico GmbH, Kreditech Holding SSL GmbH, N26 GmbH, Vivid Money GmbH, Solarisbank AG, Fidor Bank AG, Monzo Bank Ltd., Revolut Ltd., Zencap GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Germany Online Loan and Digital Credit Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The digital adoption rate in Germany reached 92% in the future, with over 70 million internet users actively engaging in online services. This surge in digital engagement has led to a significant increase in online loan applications, with a reported 30% rise in digital loan requests year-on-year. The growing reliance on smartphones and digital platforms facilitates easier access to financial services, driving the demand for online loans and digital credit solutions.

- Demand for Quick Loan Processing:In the future, the average loan processing time for online loans in Germany was reduced to just 24 hours, compared to traditional banks, which averaged 5-7 days. This rapid processing capability has attracted consumers seeking immediate financial solutions, particularly in emergencies. The convenience of online applications and instant approvals has resulted in a 40% increase in the number of loans disbursed digitally, highlighting the market's responsiveness to consumer needs.

- Rise of Fintech Solutions:The fintech sector in Germany has seen substantial growth, with over 1,000 fintech companies operating as of the future. These companies have collectively raised approximately €3 billion in funding, enabling them to innovate and offer competitive loan products. The integration of advanced technologies, such as AI and machine learning, has enhanced credit assessment processes, allowing for more personalized loan offerings and improved risk management, further driving market growth.

Market Challenges

- Regulatory Compliance Issues:The online loan market in Germany faces stringent regulatory frameworks, including the Consumer Credit Act and GDPR. Compliance costs for lenders can exceed €500,000 annually, impacting profitability. Additionally, the evolving nature of regulations requires continuous adaptation, which can hinder operational efficiency. Non-compliance risks can lead to significant fines, further complicating the market landscape for digital lenders.

- Consumer Trust and Security Concerns:Despite the growth of online lending, consumer trust remains a significant challenge. A survey indicated that 60% of potential borrowers express concerns about data security and fraud. The increasing number of cyberattacks in the financial sector, with reported incidents rising by 25% in the future, exacerbates these fears. Building consumer confidence through robust security measures and transparent practices is essential for market sustainability.

Germany Online Loan and Digital Credit Market Future Outlook

The future of the online loan and digital credit market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy continues to rise, more consumers are likely to embrace online lending solutions. Additionally, the integration of AI and machine learning will enhance credit scoring and risk assessment, making loans more accessible. However, maintaining compliance with regulatory standards and addressing consumer trust issues will be critical for sustained growth in this dynamic market.

Market Opportunities

- Expansion of Digital Payment Solutions:The digital payment market in Germany is projected to reach €100 billion in the future, creating opportunities for online lenders to integrate payment solutions. Collaborating with payment platforms can streamline loan disbursement and repayment processes, enhancing customer experience and driving loan uptake.

- Development of Personalized Loan Products:With consumer preferences shifting towards tailored financial solutions, lenders can leverage data analytics to create personalized loan products. This approach can increase customer satisfaction and retention, as evidenced by a 35% increase in customer loyalty for companies offering customized services in the future.