Region:Asia

Author(s):Dev

Product Code:KRAA1596

Pages:100

Published On:August 2025

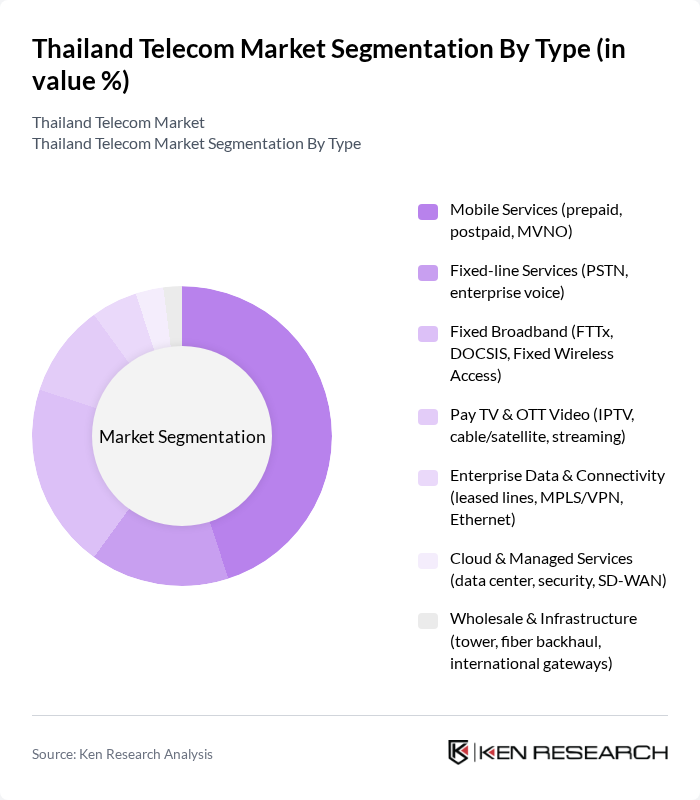

By Type:The Thailand Telecom Market can be segmented into various types, including Mobile Services, Fixed-line Services, Fixed Broadband, Pay TV & OTT Video, Enterprise Data & Connectivity, Cloud & Managed Services, and Wholesale & Infrastructure. Each of these segments caters to different consumer needs and preferences, with mobile services being the most dominant due to the widespread adoption of smartphones and mobile internet .

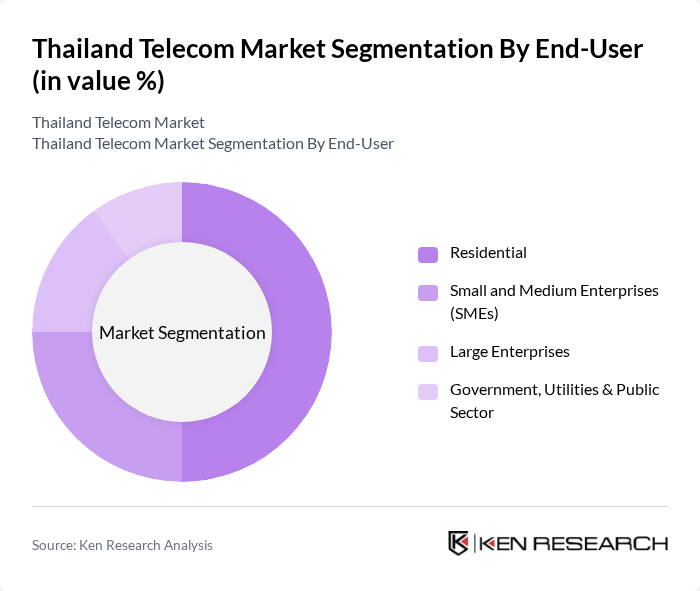

By End-User:The market can also be segmented by end-user categories, which include Residential, Small and Medium Enterprises (SMEs), Large Enterprises, and Government, Utilities & Public Sector. The residential segment is the largest due to the increasing number of households requiring internet and mobile services, while SMEs are rapidly adopting digital solutions to enhance their operations .

The Thailand Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Advanced Info Service Public Company Limited (AIS), True Corporation Public Company Limited (post-merger of True and dtac), Total Access Communication Public Company Limited (dtac) , National Telecom Public Company Limited (NT), Jasmine International Public Company Limited, Triple T Broadband Public Company Limited (3BB), AIS Fibre, TrueVisions, Symphony Communication Public Company Limited, CS LoxInfo Public Company Limited (INet/CSL), Interlink Telecom Public Company Limited, NT Mobile (formerly CAT/TOT mobile services under NT), Thaicom Public Company Limited, InTouch Holdings Public Company Limited, Advanced Wireless Network Company Limited (AWN, AIS subsidiary) contribute to innovation, geographic expansion, and service delivery in this space .

The Thailand telecom market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The ongoing rollout of 5G networks will facilitate the development of innovative applications, particularly in IoT and smart city initiatives. Additionally, the increasing focus on customer experience and digital services will reshape competitive dynamics, encouraging operators to enhance service offerings. As the market matures, strategic partnerships and collaborations will likely emerge, fostering a more integrated telecom ecosystem that meets the demands of a digitally connected society.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (prepaid, postpaid, MVNO) Fixed-line Services (PSTN, enterprise voice) Fixed Broadband (FTTx, DOCSIS, Fixed Wireless Access) Pay TV & OTT Video (IPTV, cable/satellite, streaming) Enterprise Data & Connectivity (leased lines, MPLS/VPN, Ethernet) Cloud & Managed Services (data center, security, SD-WAN) Wholesale & Infrastructure (tower, fiber backhaul, international gateways) |

| By End-User | Residential Small and Medium Enterprises (SMEs) Large Enterprises Government, Utilities & Public Sector |

| By Application | Voice Communication Mobile Broadband & Data Communication Video & Entertainment (Pay TV, OTT, gaming) Messaging & Digital Services (A2P/P2P SMS, VAS, mobile money) |

| By Distribution Channel | Direct Sales & Operator Stores Retail & Dealer Networks Online & App-based Channels |

| By Pricing Model | Subscription-based (postpaid) Pay-as-you-go (prepaid) Bundled & Converged Packages (quad-/triple-play) |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises & Strategic Accounts |

| By Policy Support | Universal Service & NBTC Programs Investment Incentives (BOI, tax incentives) Regulatory Support (spectrum, infrastructure sharing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 150 | Consumers aged 18-65, diverse income levels |

| Broadband Subscribers | 100 | Households with internet access, varying service plans |

| Corporate Telecom Clients | 90 | IT Managers, Procurement Officers from SMEs and large enterprises |

| Telecom Infrastructure Providers | 60 | Executives from network equipment and service companies |

| Regulatory Stakeholders | 40 | Policy Makers, Analysts from telecom regulatory bodies |

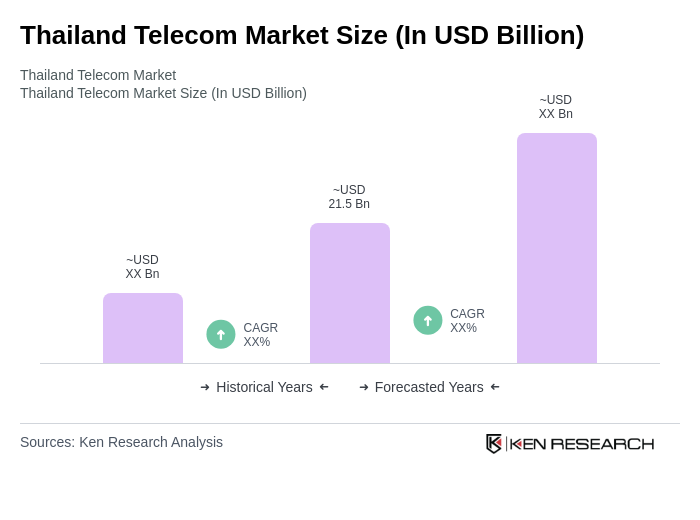

The Thailand Telecom Market is valued at approximately USD 21.5 billion, driven by increasing demand for mobile and internet services, smartphone penetration, and the expansion of 4G and 5G networks, enhancing connectivity and enabling new services.