Turkey Online Advertising and Programmatic Market Overview

- The Turkey Online Advertising and Programmatic Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and mobile devices, along with a shift in consumer behavior towards digital platforms for shopping and information. The rise of e-commerce and social media has further fueled the demand for targeted advertising solutions.

- Istanbul, Ankara, and Izmir are the dominant cities in the Turkey Online Advertising and Programmatic Market. Istanbul, as the largest city, serves as a commercial hub with a high concentration of businesses and digital agencies. Ankara, the capital, is home to many government and educational institutions, while Izmir's growing tech scene contributes to the market's expansion.

- In 2023, the Turkish government implemented regulations to enhance transparency in online advertising. This includes mandatory disclosures for digital ad placements and the establishment of a regulatory body to oversee compliance. These measures aim to protect consumer rights and ensure fair practices in the advertising industry.

Turkey Online Advertising and Programmatic Market Segmentation

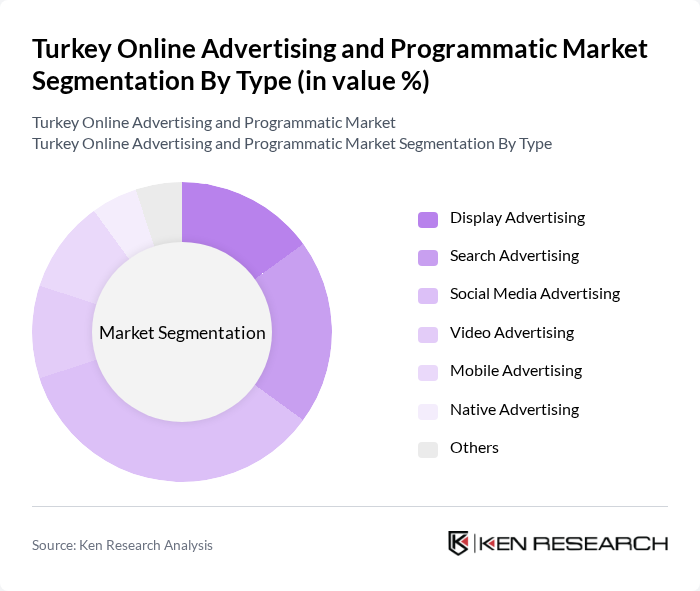

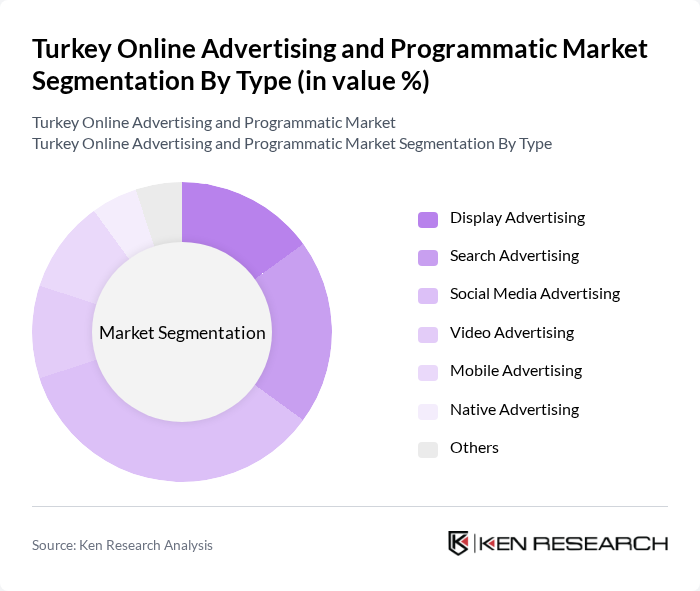

By Type:The market is segmented into various types of advertising, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Mobile Advertising, Native Advertising, and Others. Among these, Social Media Advertising has emerged as the leading segment due to the widespread use of platforms like Facebook, Instagram, and Twitter, which allow for targeted marketing and high engagement rates. The increasing number of users on these platforms has made them a preferred choice for advertisers looking to reach specific demographics effectively.

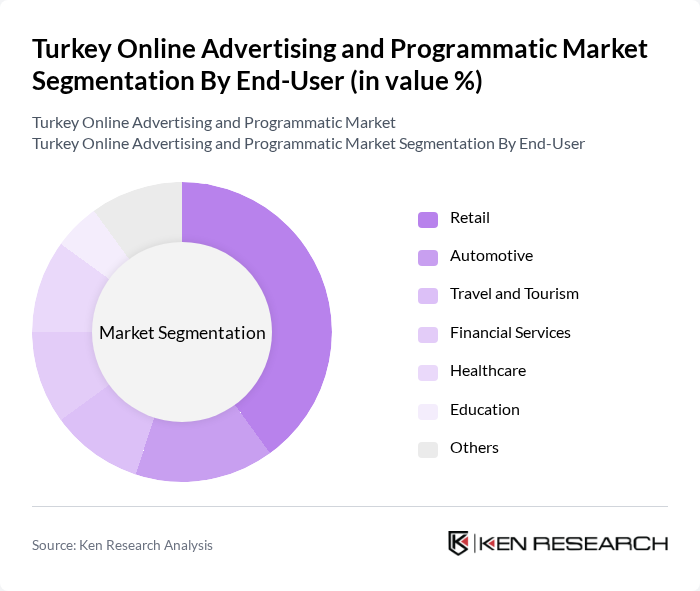

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. The Retail sector is the dominant end-user in the market, driven by the rapid growth of e-commerce and the need for businesses to reach consumers through digital channels. Retailers are increasingly investing in online advertising to enhance their visibility and drive sales, particularly during peak shopping seasons.

Turkey Online Advertising and Programmatic Market Competitive Landscape

The Turkey Online Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Facebook, Inc., Amazon Advertising, AdColony, Criteo S.A., Taboola, Outbrain, Yandex N.V., Adform, Sizmek, MediaMath, The Trade Desk, AppNexus, InMobi, Verizon Media contribute to innovation, geographic expansion, and service delivery in this space.

Turkey Online Advertising and Programmatic Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Turkey's internet penetration rate reached 82% in future, with approximately 70 million users accessing online platforms. This growth is driven by improved infrastructure and affordable data plans, which have increased accessibility. The Turkish Statistical Institute reported that the number of households with internet access rose by 5 million from 2022 to 2023, indicating a strong trend towards digital engagement. This expanding user base is a significant driver for online advertising growth.

- Rise of Mobile Advertising:In future, mobile advertising in Turkey is projected to account for 65% of total digital ad spending, amounting to approximately 4 billion USD. The increasing use of smartphones, with over 90% of internet users accessing the web via mobile devices, has made mobile platforms essential for advertisers. The Turkish mobile market is expected to grow by 15% annually, driven by enhanced mobile payment systems and app usage, further fueling mobile advertising investments.

- Growth of E-commerce:Turkey's e-commerce market is anticipated to reach 60 billion USD in future, reflecting a 20% increase from the previous year. This surge is attributed to changing consumer behaviors, with 80% of internet users engaging in online shopping. The rise of e-commerce platforms has created new advertising opportunities, as businesses increasingly allocate budgets to digital marketing strategies that target online shoppers, enhancing the overall online advertising landscape.

Market Challenges

- Regulatory Compliance Issues:The Turkish online advertising market faces significant challenges due to evolving regulatory frameworks. In future, compliance with data protection laws, such as the Personal Data Protection Law (KVKK), is critical, as non-compliance can result in fines up to 3 million TRY. Advertisers must navigate these regulations carefully to avoid legal repercussions, which can hinder their advertising strategies and overall market growth.

- Ad Fraud Concerns:Ad fraud remains a pressing issue in Turkey, with estimates suggesting that it costs advertisers approximately 1.5 billion TRY annually. The prevalence of click fraud and bot traffic undermines the effectiveness of digital campaigns, leading to wasted advertising budgets. As the market matures, addressing these fraud concerns through enhanced verification technologies and industry collaboration will be essential for maintaining advertiser trust and ensuring sustainable growth.

Turkey Online Advertising and Programmatic Market Future Outlook

The future of Turkey's online advertising and programmatic market appears promising, driven by technological advancements and evolving consumer preferences. As advertisers increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the growing emphasis on personalized content and user experience will likely shape advertising strategies. With a focus on sustainability and ethical advertising practices, the market is poised for innovation, creating new avenues for growth and engagement in the coming years.

Market Opportunities

- Expansion of Social Media Advertising:With over 60 million active social media users in Turkey, the potential for targeted advertising is immense. Brands can leverage social platforms to reach specific demographics, enhancing engagement and conversion rates. The increasing popularity of social commerce presents a unique opportunity for advertisers to integrate shopping experiences directly into social media, driving sales and brand loyalty.

- Growth in Video Advertising:Video advertising is projected to grow significantly, with an expected increase to 2 billion USD in future. The rise of platforms like YouTube and TikTok has transformed consumer engagement, making video content a vital component of advertising strategies. Advertisers can capitalize on this trend by creating compelling video campaigns that resonate with audiences, driving higher engagement and brand awareness.