Region:Asia

Author(s):Dev

Product Code:KRAB6523

Pages:80

Published On:October 2025

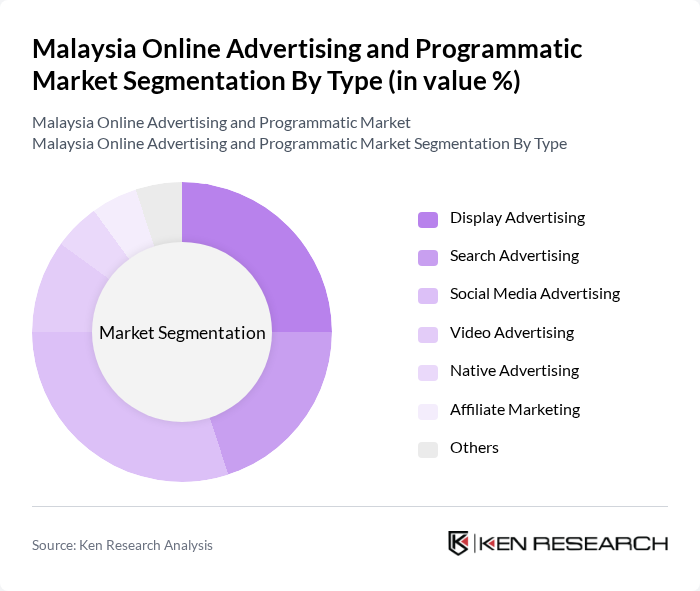

By Type:The online advertising market can be segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, and Others. Among these, Display Advertising and Social Media Advertising are particularly prominent due to their effectiveness in reaching targeted audiences and driving engagement. The increasing use of social media platforms for marketing has led to a significant rise in social media advertising, making it a leading segment in the market.

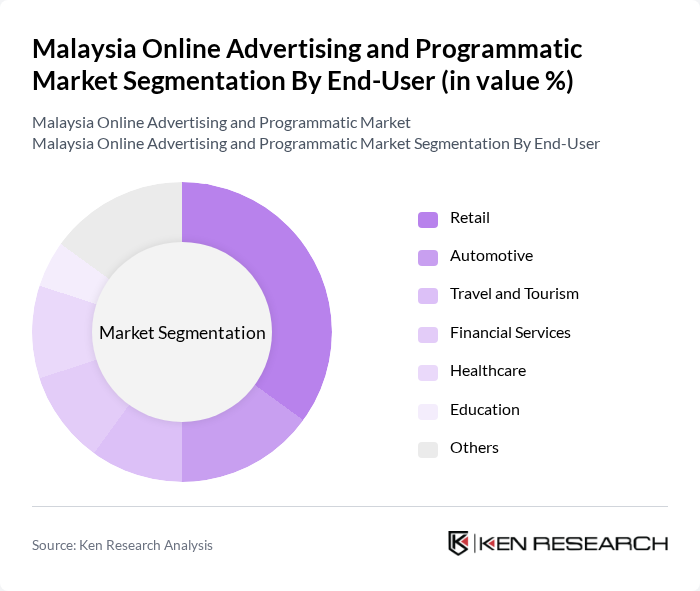

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. The Retail sector is the most significant contributor to the online advertising market, driven by the increasing trend of e-commerce and the need for businesses to establish a strong online presence. The growing competition in the retail space has led to higher investments in digital marketing strategies.

The Malaysia Online Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Media Prima Berhad, Astro Malaysia Holdings Berhad, GroupM Malaysia, Dentsu Malaysia, Omnicom Media Group Malaysia, Publicis Groupe Malaysia, Havas Media Malaysia, Naga DDB Tribal, AdAsia Holdings, iProspect Malaysia, Reprise Digital, VGI Global Media, The Media Shop, Xaxis Malaysia, AdColony contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's online advertising and programmatic market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt data-driven marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the rise of localized content will cater to diverse consumer preferences, fostering deeper engagement. With the government's support for digital initiatives, the market is poised for sustained growth, despite challenges such as ad fraud and regulatory compliance.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Others |

| By Advertising Format | Banner Ads Interstitial Ads Rich Media Ads Sponsored Content Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Engagement Sales Conversion Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 100 | Account Managers, Digital Strategists |

| Programmatic Ad Platforms | 80 | Product Managers, Data Analysts |

| Brand Advertisers | 70 | Marketing Directors, Brand Managers |

| Media Buying Firms | 60 | Media Buyers, Campaign Managers |

| Consumer Insights Specialists | 50 | Market Researchers, Consumer Behavior Analysts |

The Malaysia Online Advertising and Programmatic Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration and the adoption of digital marketing strategies across various sectors.