Region:Asia

Author(s):Geetanshi

Product Code:KRAB4028

Pages:97

Published On:October 2025

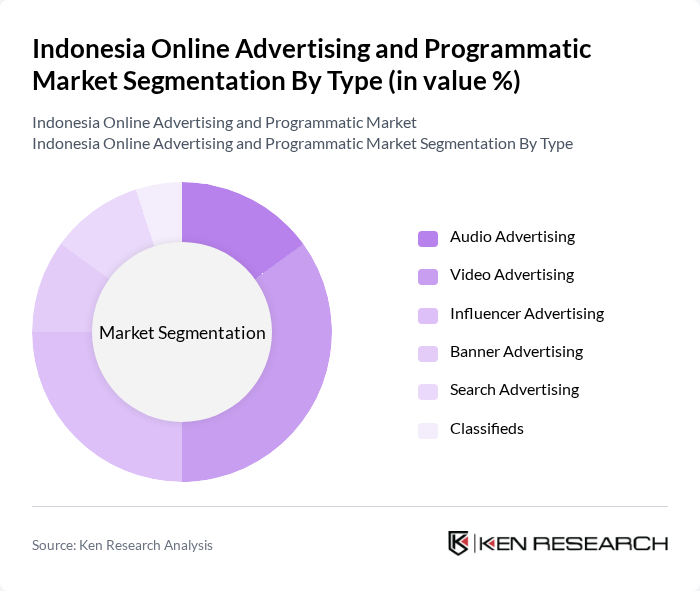

By Type:The market is segmented into various types of advertising, each catering to different consumer preferences and behaviors. Audio advertising has gained traction with the rise of podcasts and streaming services, while video advertising remains a dominant force due to its engaging nature and commands the largest share of digital ad spend. Influencer advertising leverages social media personalities to reach targeted audiences effectively. Banner advertising, search advertising, and classifieds also play significant roles in the overall market landscape, with retail media emerging as a fast-growing segment .

By End-User:The end-user segmentation highlights the diverse industries leveraging online advertising. Retail leads the way, driven by e-commerce growth and the rapid expansion of retail media. Automotive and travel and tourism sectors utilize digital platforms for promotions, while financial services, healthcare, education, FMCG, and information technology also significantly contribute to the market, each employing tailored advertising strategies to engage their respective audiences. Healthcare and pharma advertising are among the fastest-growing verticals, propelled by telemedicine adoption and rising health awareness .

The Indonesia Online Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Tokopedia, Bukalapak, Grab, Katalis Digital, Adskom, Dentsu Indonesia, VGI Global Media, Kompas Gramedia, MNC Group, C Channel Indonesia, IDN Media, Snapy, Kreavi, InMobi, Google Indonesia, Meta Indonesia, Xaxis Indonesia, ADA Asia, Mindshare Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's online advertising and programmatic market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more businesses are expected to embrace data-driven marketing strategies. Additionally, the integration of artificial intelligence in advertising will enhance targeting capabilities, making campaigns more effective. The increasing focus on sustainability in advertising practices will also shape the market, as brands seek to align with consumer values and preferences, fostering a more responsible advertising ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Audio Advertising Video Advertising Influencer Advertising Banner Advertising Search Advertising Classifieds |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education FMCG Information Technology Media and Entertainment Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Connected TV Platforms Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Campaigns Influencer Campaigns Others |

| By Advertising Format | Text Ads Image Ads Video Ads Interactive Ads Native Ads Audio Ads Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Java Other Islands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Advertising Strategies | 50 | Marketing Directors, Brand Managers |

| Programmatic Buying Insights | 60 | Media Buyers, Digital Advertising Specialists |

| Consumer Engagement Metrics | 45 | Data Analysts, Customer Experience Managers |

| Social Media Advertising Trends | 55 | Social Media Managers, Content Strategists |

| Mobile Advertising Effectiveness | 65 | Mobile Marketing Experts, App Developers |

The Indonesia Online Advertising and Programmatic Market is valued at approximately USD 8.1 billion, driven by increased internet penetration, mobile device usage, and a shift from traditional to digital advertising platforms.