Region:Europe

Author(s):Shubham

Product Code:KRAB1231

Pages:91

Published On:October 2025

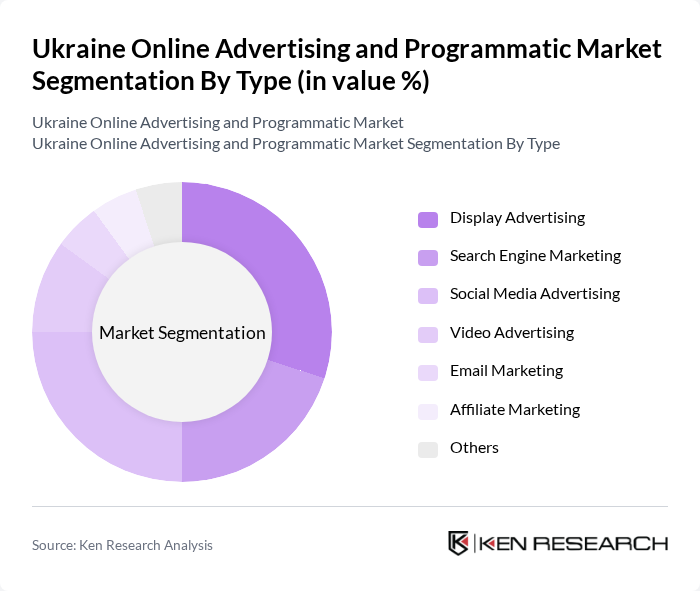

By Type:The online advertising market in Ukraine is segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Email Marketing, Affiliate Marketing, and Others. Among these, Display Advertising and Social Media Advertising are particularly prominent due to their effectiveness in reaching a broad audience and engaging users through visually appealing content. The increasing use of social media platforms for marketing purposes has led to a significant rise in investment in these segments.

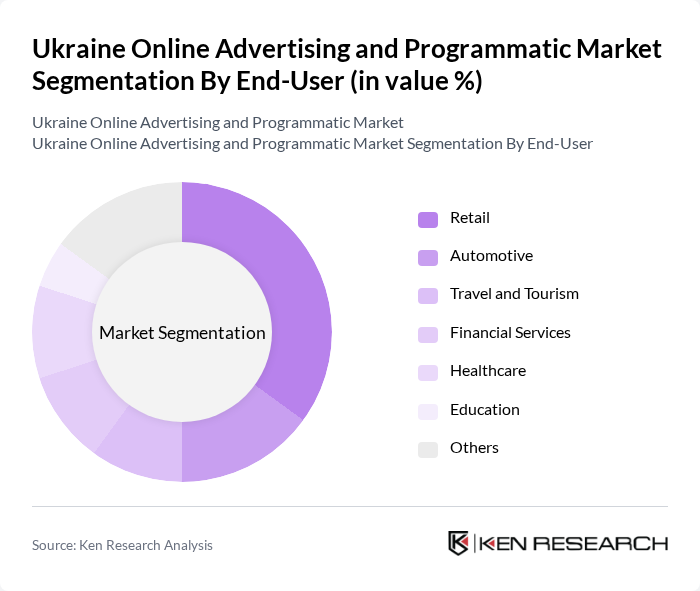

By End-User:The end-user segmentation of the online advertising market in Ukraine includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Education, and Others. The Retail sector is the most significant contributor, driven by the increasing trend of e-commerce and the need for businesses to reach consumers through targeted online advertising. The rise of online shopping has prompted retailers to invest heavily in digital marketing strategies to enhance visibility and drive sales.

The Ukraine Online Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adtelligent, PromoRepublic, ePochta, AdRiver, WebPromoExperts, Grape, MobiDev, Kasta, Allo, Promodo, Netpeak, OLX Ukraine, Dentsu Ukraine, Aimbulance, Ciklum contribute to innovation, geographic expansion, and service delivery in this space.

The future of Ukraine's online advertising and programmatic market appears promising, driven by technological advancements and changing consumer behaviors. As digital literacy improves, more businesses are expected to embrace data-driven marketing strategies. The integration of artificial intelligence in ad tech will enhance targeting capabilities, while the rise of video content will attract more advertisers. Furthermore, as the economy stabilizes, increased investments in digital infrastructure will support the growth of online advertising, creating a more dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Email Marketing Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Industry Vertical | E-commerce Telecommunications Consumer Electronics Food and Beverage Real Estate Entertainment Others |

| By Advertising Format | Native Advertising Sponsored Content Pay-Per-Click (PPC) Programmatic Ads Retargeting Ads Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion Engagement Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Others |

| By Geographic Focus | Central Ukraine Eastern Ukraine Western Ukraine Southern Ukraine Northern Ukraine Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Corporations Startups Non-Profit Organizations Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Marketing Agencies | 80 | Account Managers, Digital Strategists |

| Brand Advertisers | 70 | Marketing Directors, Brand Managers |

| Programmatic Ad Platforms | 40 | Product Managers, Sales Executives |

| Media Buying Firms | 50 | Media Buyers, Campaign Analysts |

| Industry Experts and Consultants | 40 | Market Analysts, Digital Advertising Consultants |

The Ukraine Online Advertising and Programmatic Market is valued at approximately USD 360 million, reflecting a significant growth trend driven by increased internet penetration, mobile device usage, and the rise of digital marketing strategies among businesses.