Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7163

Pages:89

Published On:December 2025

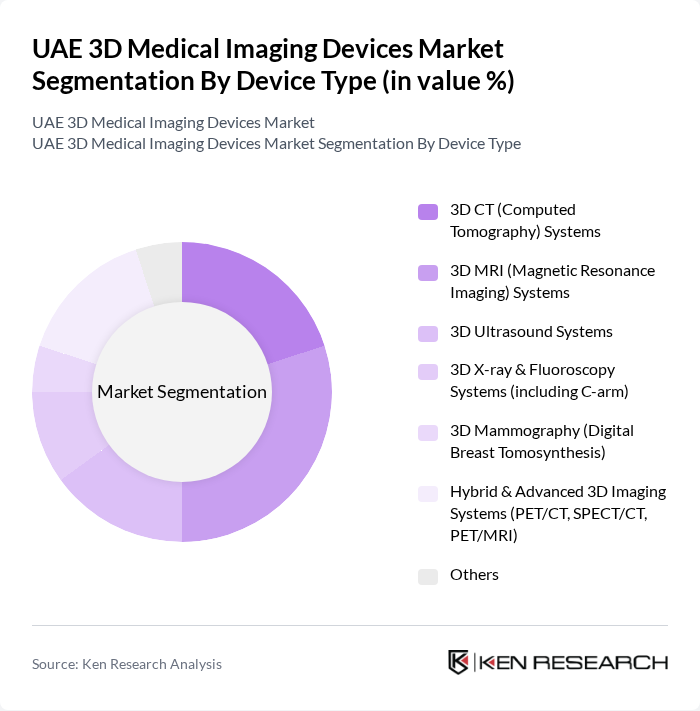

By Device Type:The market is segmented into various device types, including 3D CT (Computed Tomography) Systems, 3D MRI (Magnetic Resonance Imaging) Systems, 3D Ultrasound Systems, 3D X-ray & Fluoroscopy Systems (including C-arm), 3D Mammography (Digital Breast Tomosynthesis), Hybrid & Advanced 3D Imaging Systems (PET/CT, SPECT/CT, PET/MRI), and Others. While CT and X?ray devices together account for a substantial share of overall medical imaging usage in the UAE, high?end cross?sectional modalities such as MRI and hybrid PET/CT and SPECT/CT are increasingly used in oncology and neurology due to their superior soft?tissue contrast and functional imaging capabilities. In the 3D segment, demand is particularly strong for advanced CT and MRI systems used in cancer staging, neuroimaging, and cardiovascular assessment, supported by the rising burden of cancer and neurological disorders and the push towards precision diagnostics in leading UAE hospitals and diagnostic centers.

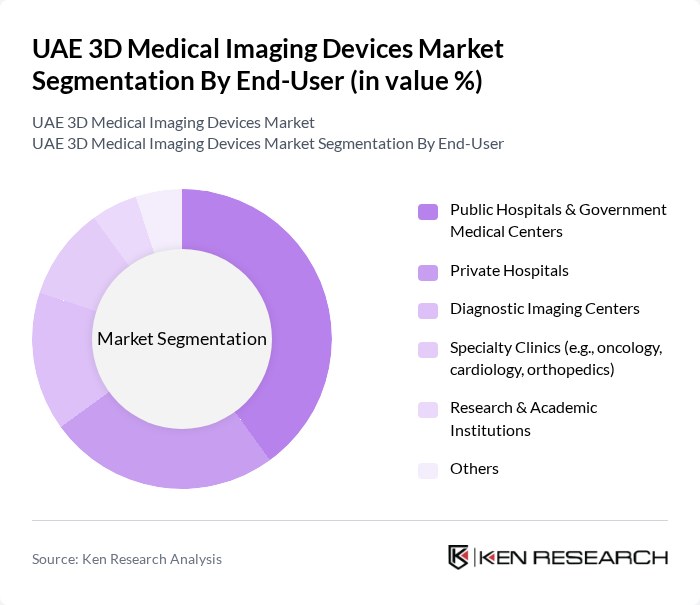

By End-User:The end-user segmentation includes Public Hospitals & Government Medical Centers, Private Hospitals, Diagnostic Imaging Centers, Specialty Clinics (e.g., oncology, cardiology, orthopedics), Research & Academic Institutions, and Others. Public Hospitals & Government Medical Centers dominate the market due to their extensive patient base, central role in managing complex and high?acuity cases, and government and emirate?level funding that facilitates the acquisition of advanced CT, MRI, and hybrid imaging technologies. Private hospitals and specialized diagnostic centers also represent a significant share, driven by medical tourism, expanding premium inpatient and outpatient services, and continued investments in digital and AI?enabled imaging platforms to enhance workflow efficiency and reporting accuracy.

The UAE 3D Medical Imaging Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V. (Philips Healthcare), Canon Medical Systems Corporation, Fujifilm Healthcare Corporation, Hitachi, Ltd. (Healthcare Business / Hitachi Medical Systems), Shimadzu Corporation, Agfa HealthCare NV, Carestream Health, Inc., Samsung Medison Co., Ltd., Mindray Medical International Limited (Shenzhen Mindray Bio?Medical Electronics Co., Ltd.), Esaote S.p.A., Hologic, Inc., 3D Systems Corporation, United Imaging Healthcare Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space, offering a broad portfolio across CT, MRI, ultrasound, X?ray, hybrid nuclear imaging, and increasingly AI?driven image processing and visualization solutions tailored to the UAE and wider Middle East market.

The future of the UAE 3D medical imaging devices market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in imaging solutions is expected to enhance diagnostic accuracy and efficiency. Additionally, the shift towards portable imaging devices will cater to the growing demand for accessible healthcare services. As the government continues to prioritize healthcare infrastructure, the market is poised for significant growth, fostering innovation and improved patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Device Type | D CT (Computed Tomography) Systems D MRI (Magnetic Resonance Imaging) Systems D Ultrasound Systems D X-ray & Fluoroscopy Systems (including C-arm) D Mammography (Digital Breast Tomosynthesis) Hybrid & Advanced 3D Imaging Systems (PET/CT, SPECT/CT, PET/MRI) Others |

| By End-User | Public Hospitals & Government Medical Centers Private Hospitals Diagnostic Imaging Centers Specialty Clinics (e.g., oncology, cardiology, orthopedics) Research & Academic Institutions Others |

| By Clinical Application | Oncology Cardiology & Vascular Imaging Neurology Orthopedics & Musculoskeletal Obstetrics & Gynecology Gastroenterology & Hepatology Others |

| By Technology / Component | D Imaging Hardware D Imaging Software (reconstruction, visualization, analytics) D Image Processing & Post?processing Workstations AI?enabled 3D Imaging & Decision Support Tools PACS / VNA & Cloud-based 3D Image Management Others |

| By Emirate / Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Distribution Channel | Direct Sales by OEMs Local Distributors / Channel Partners Group Purchasing Organizations & Tender-based Procurement Online / Digital Procurement Platforms Others |

| By Commercial Model | Capital Equipment Purchase Leasing & Managed Equipment Services Pay-per-use / Subscription & SaaS for 3D Imaging Software Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals and Clinics | 120 | Radiologists, Imaging Technologists |

| Medical Device Distributors | 80 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 60 | Health Administrators, Government Officials |

| Research Institutions | 50 | Medical Researchers, Academic Professors |

| Insurance Providers | 40 | Claims Analysts, Policy Underwriters |

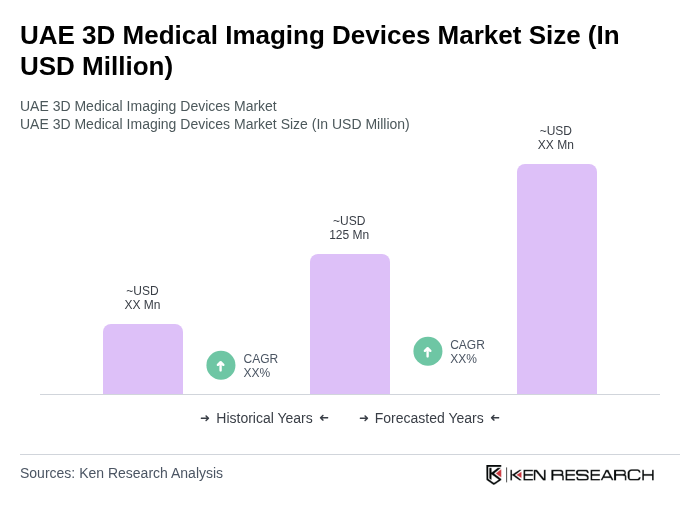

The UAE 3D Medical Imaging Devices Market is valued at approximately USD 125 million, driven by advancements in medical technology and increasing healthcare expenditure, particularly in cities like Dubai and Abu Dhabi.