Region:Middle East

Author(s):Shubham

Product Code:KRAA8956

Pages:92

Published On:November 2025

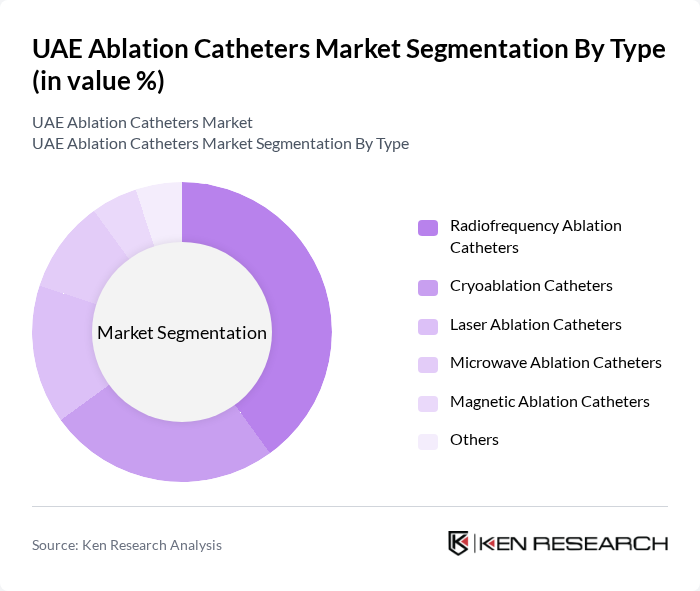

By Type:The market is segmented into various types of ablation catheters, including Radiofrequency Ablation Catheters, Cryoablation Catheters, Laser Ablation Catheters, Microwave Ablation Catheters, Magnetic Ablation Catheters, and Others. Each type serves specific medical needs and is utilized based on the condition being treated.

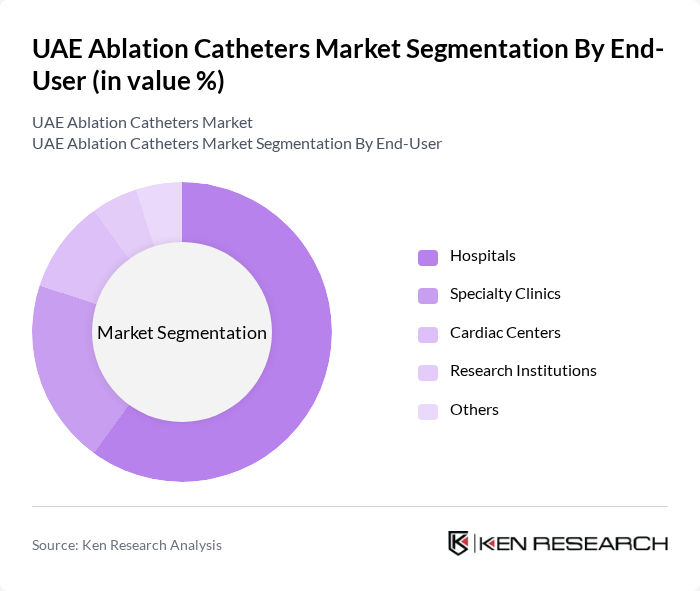

By End-User:The end-user segmentation includes Hospitals, Specialty Clinics, Cardiac Centers, Research Institutions, and Others. Each of these end-users plays a crucial role in the distribution and utilization of ablation catheters, with hospitals being the primary users due to their comprehensive healthcare services.

The UAE Ablation Catheters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson (Biosense Webster), Biotronik SE & Co. KG, Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers AG, MicroPort Scientific Corporation, Stereotaxis, Inc., Cook Medical LLC, Hologic, Inc., Terumo Corporation, Merit Medical Systems, Inc., AtriCure, Inc., AngioDynamics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE ablation catheters market appears promising, driven by ongoing advancements in medical technology and an increasing focus on patient-centered care. As healthcare providers continue to invest in innovative solutions, the integration of artificial intelligence and hybrid operating rooms is expected to enhance procedural efficiency. Additionally, the growing emphasis on outpatient procedures will likely lead to increased adoption of ablation technologies, ultimately improving patient outcomes and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Radiofrequency Ablation Catheters Cryoablation Catheters Laser Ablation Catheters Microwave Ablation Catheters Magnetic Ablation Catheters Others |

| By End-User | Hospitals Specialty Clinics Cardiac Centers Research Institutions Others |

| By Application | Cardiac Ablation (e.g., Atrial Fibrillation, Arrhythmias) Oncology/Tumor Ablation Pain Management Others |

| By Geography | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| By Distribution Channel | Direct Sales Distributors/Local Agents Online Sales Others |

| By Product Type | Disposable Catheters Reusable Catheters Others |

| By Technology | Electrophysiology Technology Imaging-Guided Technology Robotic-Assisted Ablation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments in Hospitals | 60 | Cardiologists, Electrophysiologists |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Procurement Managers | 45 | Procurement Officers, Supply Chain Managers |

| Clinical Research Organizations | 30 | Clinical Researchers, Data Analysts |

| Regulatory Bodies and Health Authorities | 20 | Regulatory Affairs Specialists, Policy Makers |

The UAE Ablation Catheters Market is valued at approximately USD 17 million, reflecting a significant growth driven by the rising prevalence of cardiovascular diseases and advancements in medical technology.