Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5839

Pages:81

Published On:December 2025

Technology Market.png)

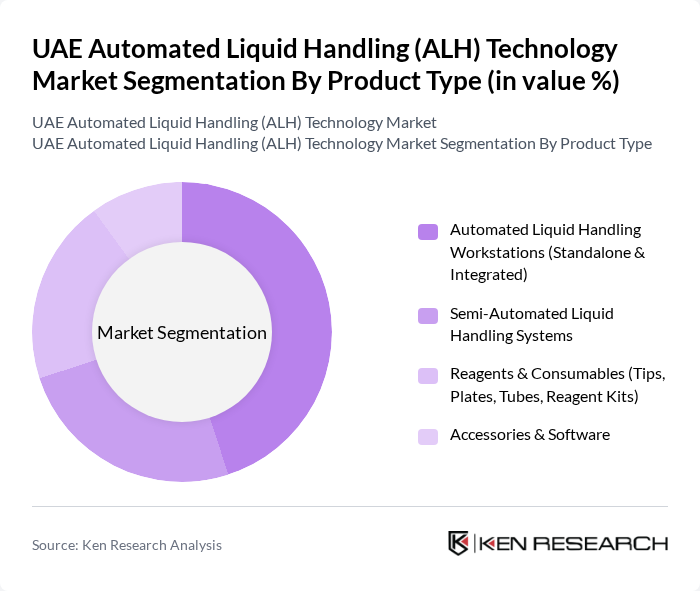

By Product Type:The product type segmentation includes various categories such as Automated Liquid Handling Workstations (Standalone & Integrated), Semi-Automated Liquid Handling Systems, Reagents & Consumables (Tips, Plates, Tubes, Reagent Kits), and Accessories & Software. Among these, Automated Liquid Handling Workstations are leading the market due to their versatility and efficiency in handling complex liquid transfer tasks. The demand for these workstations is driven by their ability to streamline laboratory workflows and reduce human error, making them essential in high-throughput environments.

By Liquid Handling Type:The liquid handling type segmentation encompasses Pipetting Workstations, Microplate Dispensers & Washers, Non-Contact Dispensing Systems, and Microfluidic-Based ALH Platforms. Pipetting Workstations dominate this segment due to their widespread application in various laboratory settings, including clinical diagnostics and research. Their ability to perform precise liquid transfers at high speeds makes them indispensable in laboratories focused on drug discovery and genomics.

The UAE Automated Liquid Handling (ALH) Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Beckman Coulter Life Sciences (a Danaher company), Eppendorf SE, Tecan Group Ltd., Agilent Technologies, Inc., Revvity, Inc. (formerly PerkinElmer, Inc.), Hamilton Company, Mettler-Toledo International Inc., Sartorius AG, Corning Incorporated, QIAGEN N.V., Roche Diagnostics International Ltd, Siemens Healthineers AG, Integra Biosciences AG, Analytik Jena GmbH+Co. KG (an Endress+Hauser company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Automated Liquid Handling Technology market appears promising, driven by continuous advancements in technology and increasing investments in healthcare infrastructure. As laboratories seek to enhance efficiency and accuracy, the integration of artificial intelligence and machine learning into ALH systems is expected to gain traction. Additionally, the growing emphasis on sustainability will likely influence the development of eco-friendly liquid handling solutions, aligning with global trends towards greener laboratory practices and responsible resource management.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Automated Liquid Handling Workstations (Standalone & Integrated) Semi-Automated Liquid Handling Systems Reagents & Consumables (Tips, Plates, Tubes, Reagent Kits) Accessories & Software |

| By Liquid Handling Type | Pipetting Workstations Microplate Dispensers & Washers Non-Contact Dispensing Systems Microfluidic-Based ALH Platforms |

| By Throughput Capacity | Low-Throughput Systems (< 10,000 samples/day) Medium-Throughput Systems (10,000–50,000 samples/day) High-Throughput Systems (> 50,000 samples/day) |

| By Application | Drug Discovery & Screening Genomics & Next-Generation Sequencing (NGS) Workflows Proteomics & Cell-Based Assays Clinical Diagnostics & Sample Preparation Forensic, Environmental, and Food Testing |

| By End-User | Pharmaceutical & Biopharmaceutical Companies Biotechnology Firms & Contract Research Organizations (CROs) Academic & Research Institutes Hospitals, Clinical & Reference Laboratories Government, Public Health & Regulatory Laboratories |

| By Region (Emirate) | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah, Fujairah & Umm Al Quwain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 50 | Laboratory Managers, Quality Control Supervisors |

| Research Institutions | 40 | Research Scientists, Lab Technicians |

| Pharmaceutical Companies | 45 | Production Managers, R&D Directors |

| Healthcare Providers | 50 | Healthcare Administrators, Procurement Officers |

| Educational Institutions | 40 | Academic Researchers, Lab Coordinators |

The UAE Automated Liquid Handling (ALH) Technology Market is valued at approximately USD 145 million, reflecting significant growth driven by advancements in laboratory automation and increasing demand for high-throughput screening in drug discovery and clinical diagnostics.