Region:Middle East

Author(s):Geetanshi

Product Code:KRAB9124

Pages:93

Published On:October 2025

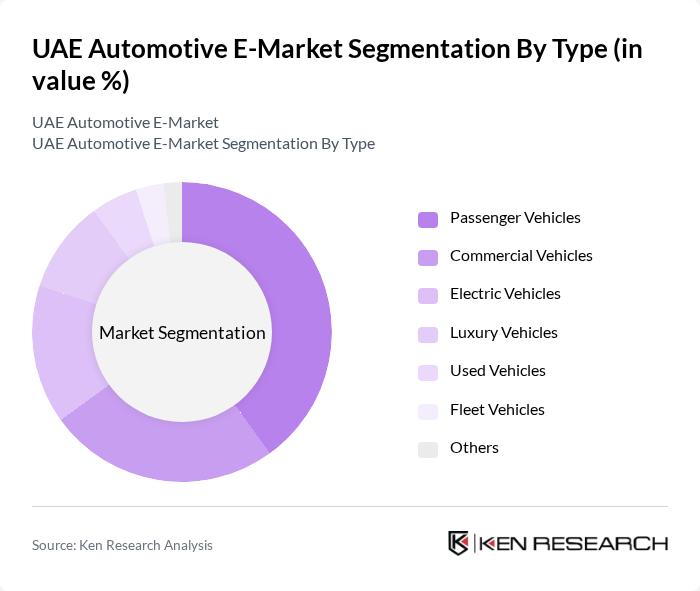

By Type:The segmentation by type includes various categories such as Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Luxury Vehicles, Used Vehicles, Fleet Vehicles, and Others. Each of these subsegments caters to different consumer needs and preferences, with the Passenger Vehicles segment being particularly dominant due to the high demand for personal transportation in urban areas. The increasing popularity of Electric Vehicles is also noteworthy, driven by environmental concerns and government incentives.

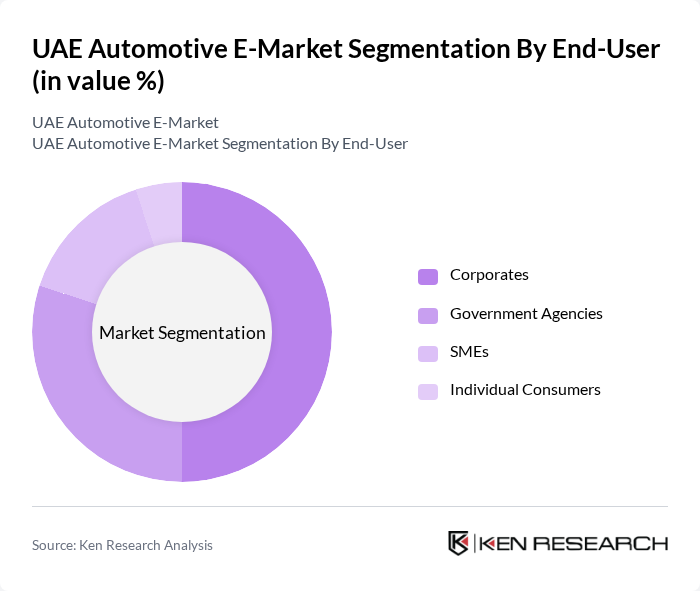

By End-User:The end-user segmentation includes Corporates, Government Agencies, SMEs, and Individual Consumers. Corporates are the leading segment, driven by the need for efficient transportation solutions for employees and logistics. Government Agencies also play a significant role, particularly in fleet leasing for public services. The increasing number of SMEs in the UAE is contributing to the growth of this segment as they seek cost-effective vehicle leasing options.

The UAE Automotive E-Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Automotive, Emirates Motors Company, Al Nabooda Automobiles, Al Tayer Motors, Arabian Automobiles, Al Ghandi Auto, Juma Al Majid Group, Al Mulla Group, Al Yousuf Motors, Al Mufeed Group, Al Maktoum Automobiles, Al Mufeed Leasing, Emirates Transport, National Car Rental, Budget Rent a Car contribute to innovation, geographic expansion, and service delivery in this space.

The UAE automotive e-market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As the demand for electric vehicles continues to rise, e-marketplaces will likely expand their offerings to include a wider range of EVs. Additionally, the integration of artificial intelligence in fleet management is expected to enhance operational efficiency, allowing businesses to optimize their logistics and reduce costs. These trends will shape the future landscape of the automotive e-market in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Vehicles Commercial Vehicles Electric Vehicles Luxury Vehicles Used Vehicles Fleet Vehicles Others |

| By End-User | Corporates Government Agencies SMEs Individual Consumers |

| By Sales Channel | Online Platforms Dealerships Auctions Direct Sales |

| By Distribution Mode | Direct Delivery Pickup Points Third-Party Logistics |

| By Price Range | Budget Vehicles Mid-Range Vehicles Premium Vehicles |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets |

| By Vehicle Condition | New Vehicles Certified Pre-Owned Vehicles Used Vehicles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Vehicle Sales | 150 | Online Dealership Managers, E-commerce Directors |

| Consumer Purchase Behavior | 200 | Recent Online Car Buyers, Automotive Enthusiasts |

| Automotive Financing Options | 100 | Financial Advisors, Loan Officers |

| Digital Marketing Strategies | 80 | Marketing Managers, Digital Strategists |

| After-Sales Services in E-commerce | 70 | Service Managers, Customer Support Leads |

The UAE Automotive E-Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital platforms for vehicle leasing and rising demand for fleet management solutions among businesses.