Region:Middle East

Author(s):Dev

Product Code:KRAD6384

Pages:82

Published On:December 2025

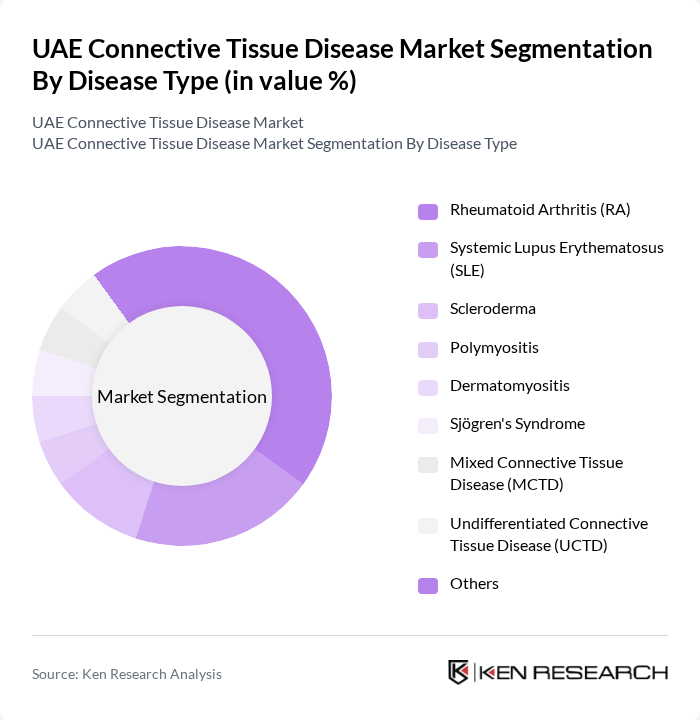

By Disease Type:The connective tissue disease market is segmented into various disease types, including Rheumatoid Arthritis (RA), Systemic Lupus Erythematosus (SLE), Scleroderma, Polymyositis, Dermatomyositis, Sjögren's Syndrome, Mixed Connective Tissue Disease (MCTD), Undifferentiated Connective Tissue Disease (UCTD), and Others. This structure is consistent with international clinical classifications that group autoimmune rheumatic and connective tissue disorders together. Among these, Rheumatoid Arthritis (RA) is the leading sub-segment due to its relatively higher prevalence globally and within the region, and the significant demand for effective treatment options including csDMARDs, biologics, and targeted synthetic agents. The increasing awareness, earlier diagnosis through improved imaging and serologic tests, and expanded access to advanced RA therapies have led to a surge in treatment uptake, making it a focal point in the market.

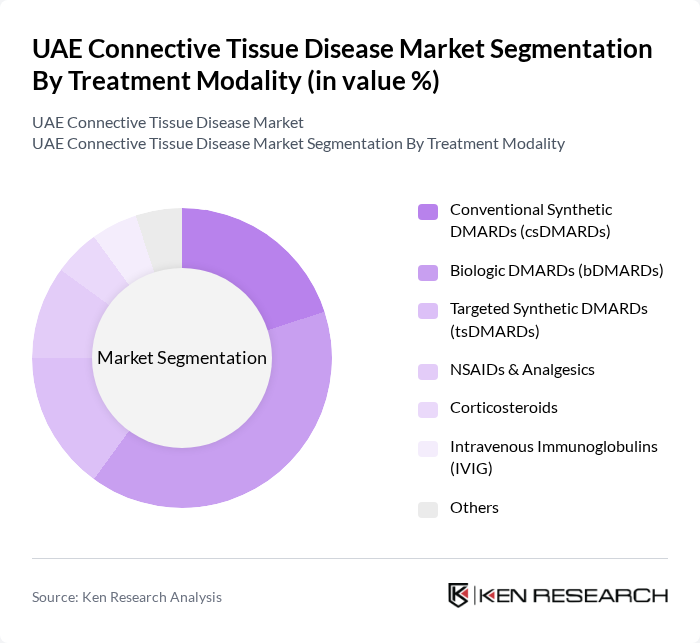

By Treatment Modality:The treatment modalities for connective tissue diseases include Conventional Synthetic DMARDs (csDMARDs), Biologic DMARDs (bDMARDs), Targeted Synthetic DMARDs (tsDMARDs), NSAIDs & Analgesics, Corticosteroids, Intravenous Immunoglobulins (IVIG), and Others. This segmentation reflects standard therapeutic classes used in autoimmune and connective tissue disease management in international and regional practice. Biologic DMARDs (bDMARDs) are the leading treatment modality in terms of value due to their effectiveness in managing moderate to severe cases of conditions such as RA, SLE, and other inflammatory connective tissue diseases, and their higher unit costs compared with conventional therapies. The increasing adoption of biologics and newer targeted synthetic DMARDs, driven by their targeted action, improved patient outcomes, availability of multiple agents (e.g., anti?TNF, IL?6, JAK inhibitors), and broader reimbursement coverage across GCC markets, has significantly influenced the market dynamics.

The UAE Connective Tissue Disease Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., F. Hoffmann-La Roche Ltd., AbbVie Inc., Novartis AG, Sanofi, Johnson & Johnson (Janssen), Amgen Inc., Bristol Myers Squibb, Eli Lilly and Company, UCB S.A., GSK plc, Boehringer Ingelheim, Takeda Pharmaceutical Company Limited, Biogen Inc., Sandoz Group AG contribute to innovation, geographic expansion, and service delivery in this space. These companies are prominent suppliers of biologic and targeted therapies for rheumatoid arthritis, lupus, and other autoimmune connective tissue diseases at the global level, and many of their key brands are registered and marketed across GCC countries, including the UAE.

The future of the UAE connective tissue disease market appears promising, driven by ongoing advancements in medical technology and increased healthcare investments. As the prevalence of these diseases continues to rise, healthcare providers are likely to adopt more personalized treatment approaches. Additionally, the integration of telemedicine and digital health solutions will enhance patient access to specialized care, ultimately improving health outcomes and fostering a more resilient healthcare system in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Disease Type | Rheumatoid Arthritis (RA) Systemic Lupus Erythematosus (SLE) Scleroderma Polymyositis Dermatomyositis Sjögren's Syndrome Mixed Connective Tissue Disease (MCTD) Undifferentiated Connective Tissue Disease (UCTD) Others |

| By Treatment Modality | Conventional Synthetic DMARDs (csDMARDs) Biologic DMARDs (bDMARDs) Targeted Synthetic DMARDs (tsDMARDs) NSAIDs & Analgesics Corticosteroids Intravenous Immunoglobulins (IVIG) Others |

| By Route of Administration | Oral Parenteral (IV/SC) Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Public Hospitals Private Hospitals Specialty & Rheumatology Clinics Research & Academic Institutes Others |

| By Patient Demographics | Age Group (Pediatric, Adult, Geriatric) Gender (Male, Female) Nationality (UAE Nationals, Expatriates) |

| By Emirate | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Umm Al Quwain, Ras Al Khaimah, Fujairah) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rheumatology Clinics | 45 | Rheumatologists, Clinic Managers |

| Patient Support Groups | 40 | Patients, Caregivers, Advocacy Group Leaders |

| Pharmaceutical Companies | 35 | Product Managers, Medical Affairs Directors |

| Healthcare Policy Makers | 30 | Health Economists, Policy Analysts |

| Insurance Providers | 42 | Underwriters, Claims Adjusters |

The UAE Connective Tissue Disease Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the rising prevalence of autoimmune diseases and increased healthcare expenditure in the region.