Region:Middle East

Author(s):Shubham

Product Code:KRAB8821

Pages:82

Published On:October 2025

By Type:The market is segmented into Full-Service Freight Forwarding, Niche Freight Forwarding, and Digital-Only Platforms. Full-Service Freight Forwarding is the most dominant segment, as it offers comprehensive solutions that cater to various logistics needs, making it a preferred choice for businesses seeking integrated services. Niche Freight Forwarding is gaining traction due to specialized services tailored for specific industries, while Digital-Only Platforms are emerging as a disruptive force, appealing to tech-savvy customers looking for streamlined processes.

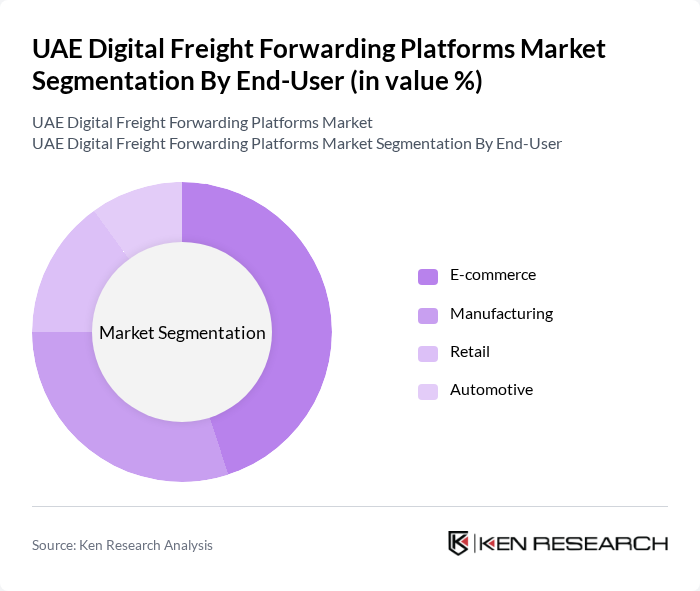

By End-User:The end-user segmentation includes E-commerce, Manufacturing, Retail, and Automotive. E-commerce is the leading segment, driven by the rapid growth of online shopping and the demand for efficient logistics solutions. Manufacturing follows closely, as companies seek reliable freight forwarding services to support their supply chains. Retail and Automotive sectors are also significant contributors, with increasing needs for timely deliveries and inventory management.

The UAE Digital Freight Forwarding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Logistics, DB Schenker, DHL Global Forwarding, Kuehne + Nagel, Expeditors International, Panalpina, CEVA Logistics, XPO Logistics, DSV Panalpina, Agility Logistics, Hellmann Worldwide Logistics, Toll Group, ZIM Integrated Shipping Services, Emirates Logistics, Freightos contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital freight forwarding market appears promising, driven by ongoing technological advancements and increasing demand for efficient logistics solutions. As businesses continue to embrace digital transformation, platforms that integrate AI and real-time tracking will likely gain a competitive advantage. Additionally, the expansion of e-commerce and cross-border trade will further stimulate market growth, creating opportunities for innovative solutions that enhance supply chain efficiency and transparency.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Freight Forwarding Niche Freight Forwarding Digital-Only Platforms |

| By End-User | E-commerce Manufacturing Retail Automotive |

| By Service Type | Air Freight Ocean Freight Land Freight |

| By Delivery Model | Door-to-Door Port-to-Port Terminal-to-Terminal |

| By Geographic Coverage | Domestic International |

| By Customer Size | Small and Medium Enterprises Large Enterprises |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Forwarding Platforms | 150 | CEOs, Founders, and Senior Executives |

| Logistics Service Providers | 100 | Operations Managers, Business Development Heads |

| End-User Companies | 120 | Supply Chain Managers, Procurement Officers |

| Technology Providers in Logistics | 80 | Product Managers, Technology Officers |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

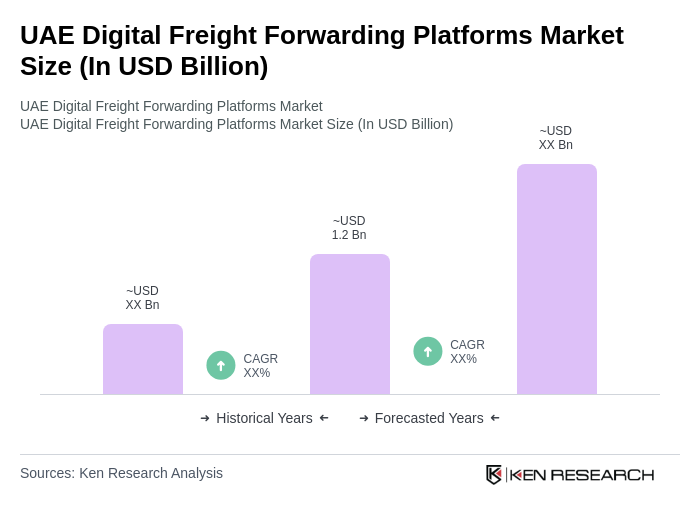

The UAE Digital Freight Forwarding Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies in logistics and the rise of e-commerce.