UAE Digital SME Credit Platforms Market Overview

- The UAE Digital SME Credit Platforms Market is valued at approximately USD 950 million, based on a five-year historical analysis. This market value reflects the rapid expansion of digital lending and credit solutions tailored for SMEs, driven by the increasing digitization of financial services, a surge in the number of SMEs, and the rising demand for alternative financing solutions. The sector is witnessing a significant shift toward online lending platforms, which offer faster and more accessible credit options for small and medium enterprises. The launch of new digital payment platforms in Dubai has further accelerated SME growth by simplifying transactions and reducing operational costs, supporting broader adoption of digital credit solutions .

- Dubai and Abu Dhabi are the dominant cities in the UAE Digital SME Credit Platforms Market due to their robust economic infrastructure, high concentration of SMEs, and supportive government policies. Dubai leads the fintech activity in the UAE, accounting for over 60% of market share, leveraging its advanced financial infrastructure and regulatory environment. Both cities have established themselves as financial hubs, attracting local and international investors, which further fuels the growth of digital credit platforms tailored for SMEs .

- In 2023, the UAE government implemented the "SME Credit Guarantee Scheme" under the UAE Ministry of Economy, designed to enhance access to finance for small and medium enterprises. This initiative provides guarantees to financial institutions for loans extended to SMEs, thereby reducing the risk associated with lending and encouraging banks to offer more favorable terms to these businesses. The scheme sets operational thresholds and compliance requirements for participating financial institutions, ensuring standardized lending practices and broader SME inclusion .

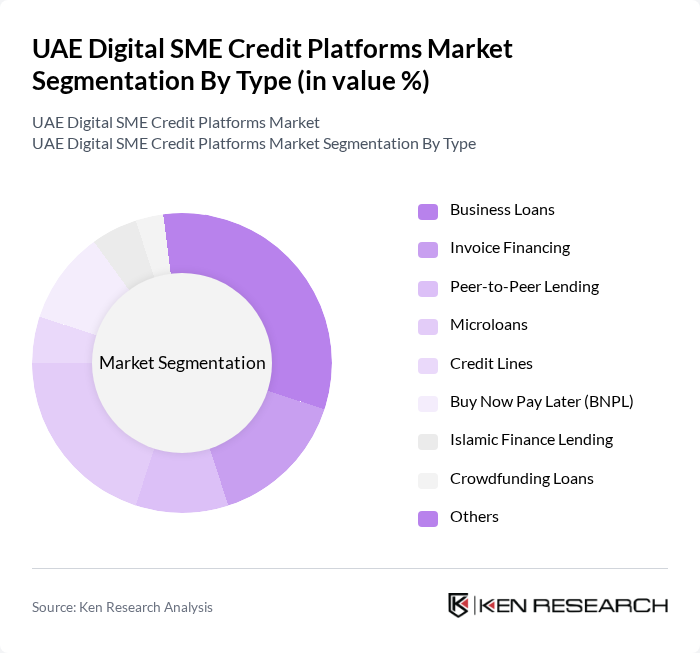

UAE Digital SME Credit Platforms Market Segmentation

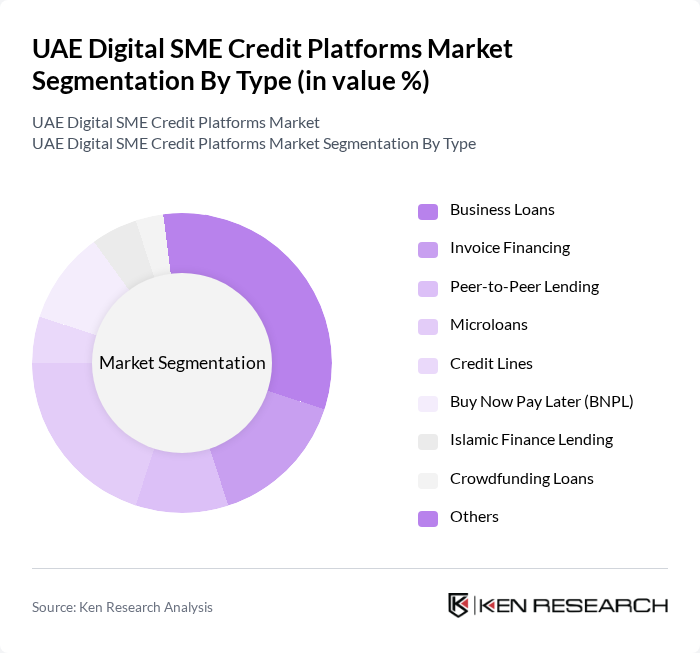

By Type:The market is segmented into Business Loans, Invoice Financing, Peer-to-Peer Lending, Microloans, Credit Lines, Buy Now Pay Later (BNPL), Islamic Finance Lending, Crowdfunding Loans, and Others. Business Loans and Invoice Financing remain the most popular choices among SMEs due to structured repayment terms and lower cost of capital. Peer-to-Peer Lending and Crowdfunding Loans are gaining traction among startups and micro-enterprises, while BNPL and Islamic Finance Lending are expanding in response to evolving consumer preferences and regulatory support for Sharia-compliant products. Microloans and Credit Lines cater to smaller enterprises with limited access to traditional banking services, reflecting the diverse financial needs of UAE SMEs .

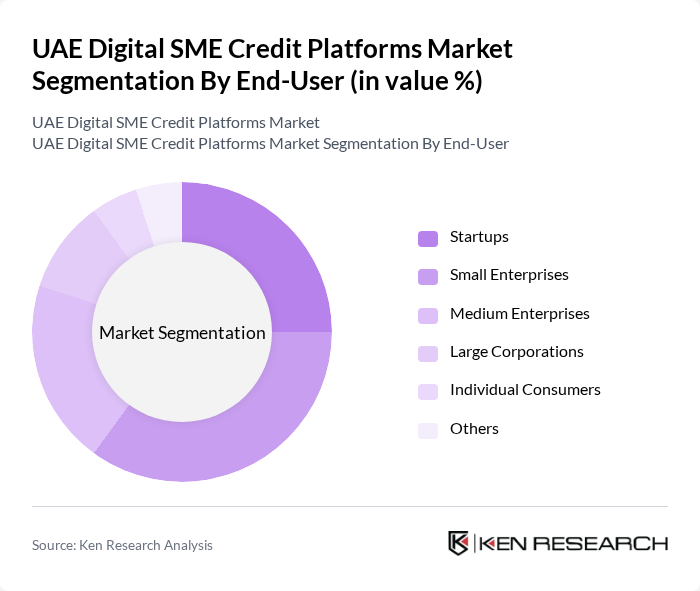

By End-User:The end-user segmentation includes Startups, Small Enterprises, Medium Enterprises, Large Corporations, Individual Consumers, and Others. Startups and Small Enterprises represent the largest share of borrowers, reflecting their need for flexible and accessible financing solutions. Medium Enterprises increasingly utilize digital credit platforms for growth capital, while Large Corporations leverage these platforms for specialized financing. Individual Consumers and Others represent niche segments, often accessing microloans or BNPL products for personal or business-related purposes .

UAE Digital SME Credit Platforms Market Competitive Landscape

The UAE Digital SME Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, Beehive, Tabby, Tamara, YallaCompare, FinTech Galaxy, RAKBANK, Noor Bank, Qarar, PayFort (Amazon Payment Services), LendingTree UAE, Aafaq Islamic Finance, Commercial Bank of Dubai, National Bank of Fujairah, Mashreq Bank, Dubai SME, EdfaPay contribute to innovation, geographic expansion, and service delivery in this space .

UAE Digital SME Credit Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Quick Financing Solutions:The UAE's SME sector, contributing approximately AED 100 billion to the economy, is increasingly seeking rapid financing options. In future, the demand for quick loans is projected to rise by 15%, driven by SMEs' need for immediate capital to manage cash flow and operational expenses. This trend is further supported by the UAE's growing entrepreneurial ecosystem, which saw a 20% increase in new business registrations in recent periods, highlighting the urgency for accessible credit solutions.

- Rise of Digital Banking and Fintech Innovations:The UAE's digital banking sector is expected to reach AED 30 billion in future, fueled by fintech innovations that streamline credit processes. With over 60% of the population using digital banking services, SMEs are increasingly adopting these platforms for their financing needs. The integration of advanced technologies, such as blockchain and AI, is enhancing the efficiency of credit assessments, making it easier for SMEs to secure loans quickly and effectively.

- Government Support for SME Growth:The UAE government has allocated AED 1 billion in future to support SME development through various initiatives, including funding programs and regulatory reforms. This support is crucial as SMEs represent 94% of the total number of companies in the UAE. Additionally, the introduction of the "SME Fund" aims to provide easier access to credit, fostering a conducive environment for growth and innovation within the sector, thereby driving demand for digital credit platforms.

Market Challenges

- High Competition Among Credit Platforms:The UAE digital SME credit market is characterized by intense competition, with over 50 active credit platforms vying for market share. This saturation leads to aggressive pricing strategies, which can undermine profitability. In future, the average loan processing time is expected to decrease to 24 hours, intensifying competition as platforms strive to offer faster services. This environment poses challenges for new entrants and established players alike in maintaining sustainable growth.

- Regulatory Compliance and Licensing Issues:Navigating the regulatory landscape in the UAE can be complex for digital credit platforms. In future, the Central Bank of the UAE is expected to introduce stricter compliance measures, requiring platforms to enhance their risk management frameworks. Non-compliance could result in penalties, impacting operational viability. Additionally, the licensing process can be lengthy, delaying market entry for new players and hindering innovation in the sector.

UAE Digital SME Credit Platforms Market Future Outlook

The future of the UAE digital SME credit market appears promising, driven by technological advancements and supportive government policies. As the adoption of mobile-first credit solutions increases, platforms are likely to enhance user experiences, making financing more accessible. Furthermore, the integration of alternative data for credit assessments will enable more SMEs to qualify for loans, fostering financial inclusion. The focus on sustainable financing options will also shape the market, aligning with global trends towards responsible lending practices.

Market Opportunities

- Integration of AI and Machine Learning for Credit Scoring:Leveraging AI and machine learning can significantly improve credit scoring accuracy, allowing platforms to assess risk more effectively. This technology can analyze vast datasets, including transaction histories and social media activity, to provide a more comprehensive view of an SME's creditworthiness, potentially increasing loan approvals by 30% in future.

- Partnerships with E-commerce Platforms:Collaborating with e-commerce platforms presents a lucrative opportunity for credit providers. As e-commerce sales in the UAE are projected to reach AED 20 billion in future, credit platforms can offer tailored financing solutions to online businesses, enhancing their growth potential. Such partnerships can drive customer acquisition and retention, creating a win-win scenario for both sectors.