Region:Middle East

Author(s):Rebecca

Product Code:KRAD7569

Pages:88

Published On:December 2025

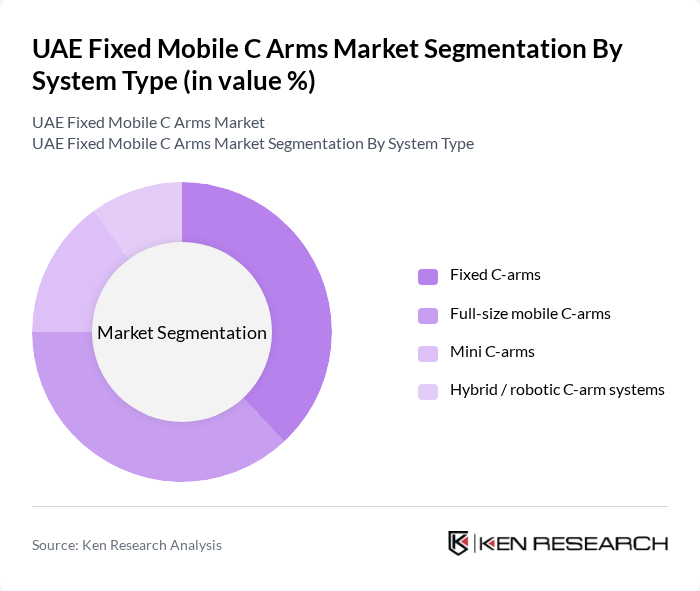

By System Type:The segmentation of the market by system type includes Fixed C-arms, Full-size mobile C-arms, Mini C-arms, and Hybrid/robotic C-arm systems. Each of these sub-segments caters to different surgical needs and preferences, with varying levels of mobility, field-of-view, and intraoperative imaging capabilities, particularly in orthopedics, cardiovascular, pain management, and neurosurgical procedures.

The Fixed C-arms segment is currently dominating the market due to their high image quality, stability, and suitability for complex procedures, especially in hybrid operating rooms and interventional suites. These systems are widely used in orthopedic, cardiovascular, and trauma surgeries, where precision is critical. The demand for Full-size mobile C-arms is also significant, as they offer flexibility, easier installation, and cost-efficiency for hospitals and ambulatory surgical centers handling high volumes of orthopedic, urology, and pain management cases. Mini C-arms are gaining traction in outpatient and extremity-focused settings, such as hand and foot surgeries, due to their compact design and lower radiation doses, while Hybrid/robotic systems are emerging as advanced solutions for complex image-guided surgeries, integrating navigation, 3D imaging, and operating room integration for high-acuity centers.

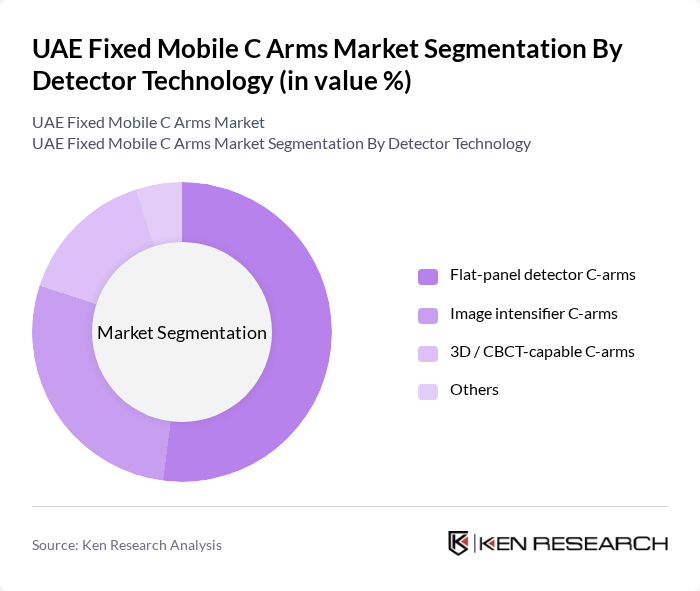

By Detector Technology:The market is segmented by detector technology into Flat-panel detector C-arms, Image intensifier C-arms, 3D/CBCT-capable C-arms, and Others. Each technology offers unique advantages in terms of image quality, radiation dose, workflow efficiency, and application versatility in intraoperative imaging.

Flat-panel detector C-arms are leading the market due to their superior spatial resolution, wider dynamic range, and lower radiation exposure compared to traditional image intensifier systems, which aligns with the global shift toward flat-panel technology in high-end surgical and interventional suites. The increasing adoption of 3D/CBCT-capable C-arms is also notable, as they provide volumetric imaging and improved anatomical visualization for complex orthopedic, spine, and neurosurgical procedures, supporting intraoperative decision-making and implant positioning. Image intensifier C-arms remain popular in various settings, particularly in cost-sensitive facilities and routine procedures, but their market share is gradually declining as newer flat-panel and 3D/CBCT technologies gain traction in tertiary and specialty centers.

The UAE Fixed Mobile C Arms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare (Royal Philips), Canon Medical Systems Corporation, Ziehm Imaging GmbH, Shimadzu Corporation, Hologic, Inc., Eurocolumbus Srl, Trivitron Healthcare Pvt. Ltd., Allengers Medical Systems Limited, Medtronic plc, Stryker Corporation, Orthoscan, Inc., Genoray Co., Ltd., Perlong Medical Equipment Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Fixed Mobile C Arms market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The government’s commitment to enhancing healthcare infrastructure, with a projected AED 12 billion allocated for the upcoming years, will likely facilitate the adoption of innovative imaging technologies. Additionally, the rising trend of medical tourism is expected to further boost demand for advanced imaging solutions, positioning the UAE as a regional healthcare hub.

| Segment | Sub-Segments |

|---|---|

| By System Type | Fixed C-arms Full-size mobile C-arms Mini C-arms Hybrid / robotic C-arm systems |

| By Detector Technology | Flat-panel detector C-arms Image intensifier C-arms D / CBCT-capable C-arms Others |

| By Application | Orthopedic and trauma surgery Cardiovascular and electrophysiology procedures Pain management and spinal interventions Gastroenterology, urology and general surgery |

| By End-User | Public hospitals and tertiary care centers Private hospitals and specialty clinics Day-care/ambulatory surgical centers Diagnostic imaging and catheterization labs |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Procurement Mode | Capital purchase Operating lease / rental Managed equipment services Refurbished systems |

| By Price Range | Premium (high-end flat-panel and hybrid systems) Mid-range (standard full-size mobile C-arms) Budget (basic and refurbished C-arms) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 100 | Radiology Heads, Imaging Technologists |

| Private Clinics and Diagnostic Centers | 80 | Clinic Owners, Medical Directors |

| Medical Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Procurement Officers | 70 | Procurement Managers, Supply Chain Directors |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Experts |

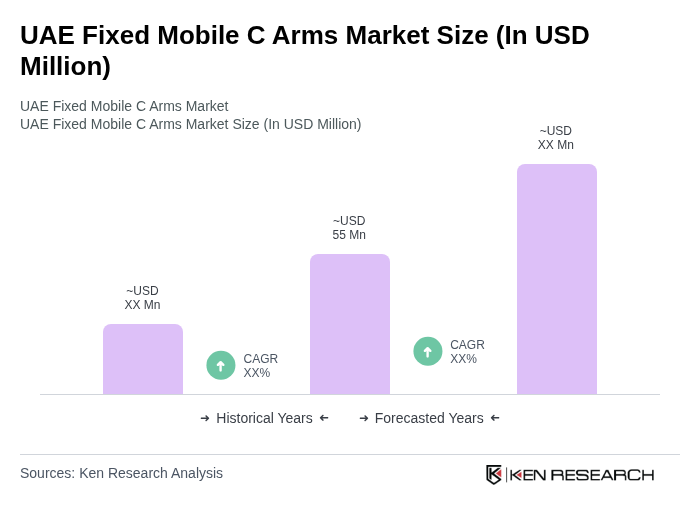

The UAE Fixed Mobile C Arms Market is valued at approximately USD 55 million, reflecting its significant share of the broader GCC Fixed Mobile C Arms Market, which totals around USD 230 million. This valuation is based on a five-year historical analysis.