Region:Middle East

Author(s):Shubham

Product Code:KRAC4295

Pages:97

Published On:October 2025

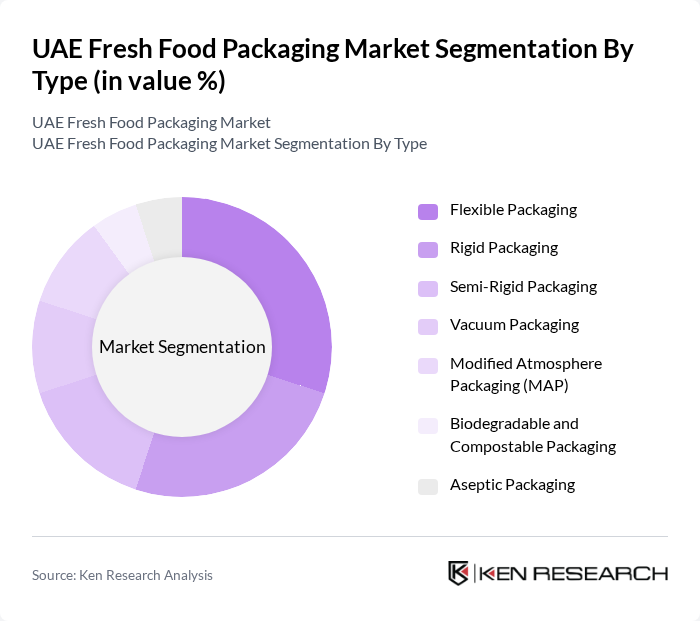

By Type:The segmentation of the market by type includes various packaging forms that cater to different consumer needs and preferences. The subsegments are as follows:

The flexible packaging segment is dominating the market due to its versatility, lightweight nature, and cost-effectiveness. Consumers increasingly prefer flexible packaging for its convenience and ability to preserve freshness. This segment is particularly popular for snacks, fruits, and vegetables, where maintaining product quality is crucial. The trend towards sustainability has also led to innovations in flexible packaging materials, further enhancing its appeal among environmentally conscious consumers. The adoption of recyclable and compostable flexible packaging is rising as regulatory and consumer pressure for sustainable solutions grows .

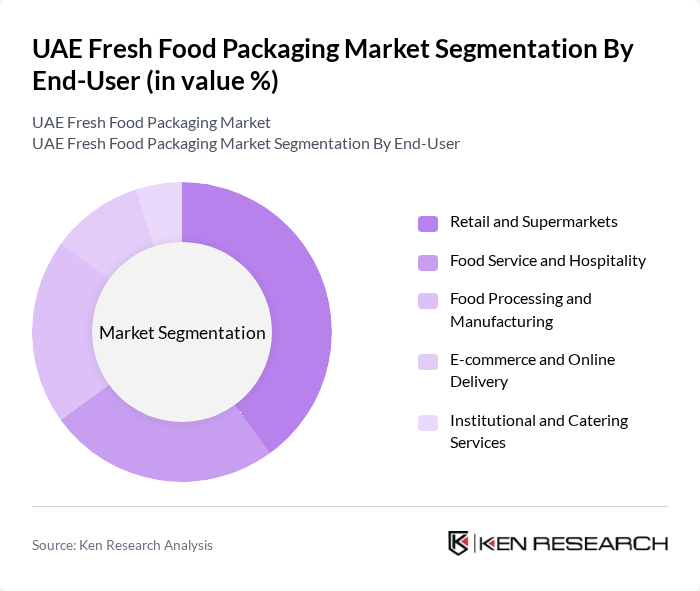

By End-User:The segmentation of the market by end-user includes various sectors that utilize fresh food packaging. The subsegments are as follows:

The retail and supermarkets segment is the leading end-user in the market, driven by the increasing demand for fresh food products among consumers. Supermarkets are focusing on enhancing their fresh food sections, leading to a higher requirement for effective packaging solutions that ensure product freshness and safety. The rise of health-conscious consumers has also contributed to the growth of this segment, as they seek high-quality, fresh food options. Growth in online grocery and food delivery services is further boosting demand for innovative, sustainable packaging formats .

The UAE Fresh Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Bayader International, Gulf East Paper and Plastic Industries LLC, National Plastic Factory, Emirates Packaging Materials Factory LLC, Al Mufeed Packaging Solutions, Al Khatib Packaging Industries, Ras Al Khaimah Plastic Factory, Al Jazeera Plastics Manufacturing, Huhtamaki Middle East, Sealed Air Corporation (Middle East Operations), Amcor Limited (UAE Division), Coveris Holdings (Middle East), Ecopac Packaging Solutions, Green Packaging UAE, Sustainable Packaging Industries LLC contribute to innovation, geographic expansion, and service delivery in this space.

The UAE fresh food packaging market is poised for significant transformation as sustainability and technology converge. In future, the integration of smart packaging technologies is expected to enhance consumer engagement and product traceability, aligning with the growing demand for transparency. Additionally, the expansion of e-commerce food delivery services will drive innovation in packaging solutions, catering to the need for convenience and safety. As these trends evolve, the market will likely witness a shift towards more customized and efficient packaging options that meet consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Semi-Rigid Packaging Vacuum Packaging Modified Atmosphere Packaging (MAP) Biodegradable and Compostable Packaging Aseptic Packaging |

| By End-User | Retail and Supermarkets Food Service and Hospitality Food Processing and Manufacturing E-commerce and Online Delivery Institutional and Catering Services |

| By Material | Plastic (LDPE, HDPE, PET, PP) Paper and Paperboard Glass Metal (Aluminum, Tin, Steel) Biodegradable Materials |

| By Application | Fruits and Vegetables Meat, Poultry, and Seafood Dairy and Dairy Products Bakery and Confectionery Products Prepared and Convenience Foods |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail and E-commerce Platforms Convenience Stores and Specialty Shops Direct Sales and Wholesale Food Service Distributors |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Format | Resealable Packaging Single-Use Packaging Multi-Pack and Bulk Packaging Portion-Controlled Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fresh Food Packaging | 120 | Store Managers, Category Buyers |

| Food Processing Companies | 80 | Production Managers, Quality Assurance Officers |

| Packaging Material Suppliers | 60 | Sales Representatives, Product Development Managers |

| Logistics and Distribution | 50 | Logistics Coordinators, Supply Chain Analysts |

| Consumer Insights on Packaging | 100 | End Consumers, Focus Group Participants |

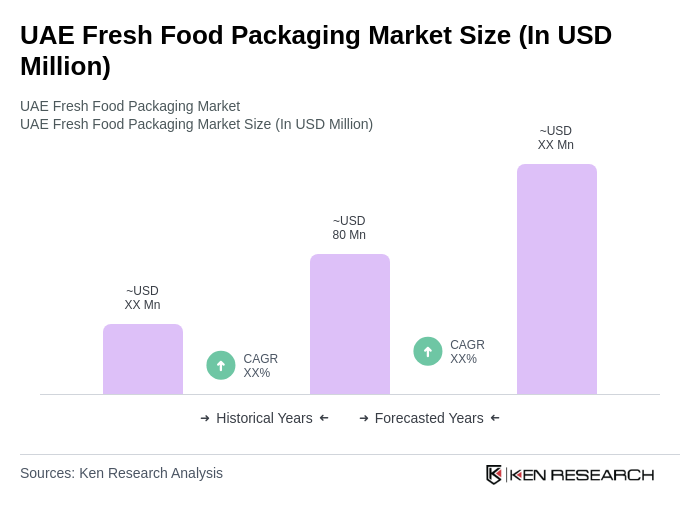

The UAE Fresh Food Packaging Market is valued at approximately USD 80 million, reflecting a significant growth driven by increasing demand for fresh food products and consumer awareness regarding food safety and sustainability.