Region:Middle East

Author(s):Dev

Product Code:KRAB7799

Pages:100

Published On:October 2025

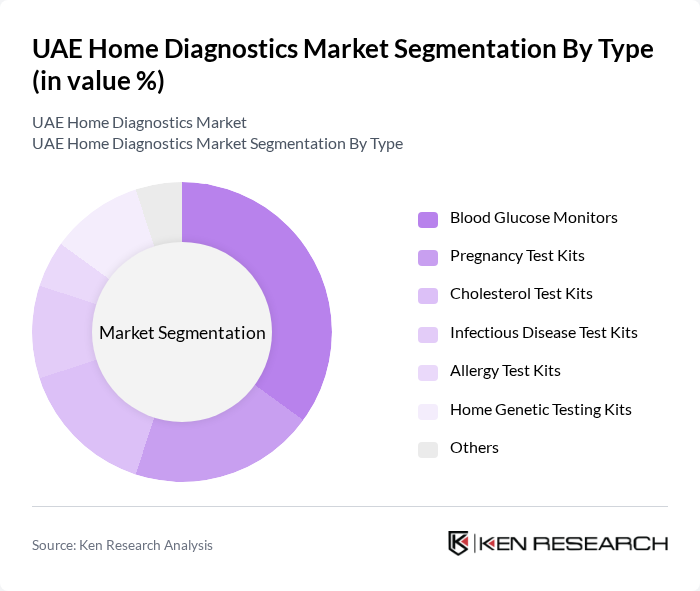

By Type:The market is segmented into various types of home diagnostic products, including Blood Glucose Monitors, Pregnancy Test Kits, Cholesterol Test Kits, Infectious Disease Test Kits, Allergy Test Kits, Home Genetic Testing Kits, and Others. Among these, Blood Glucose Monitors are leading the market due to the rising incidence of diabetes in the UAE, prompting consumers to monitor their blood sugar levels regularly. The convenience and accuracy of these devices have made them a preferred choice for many households.

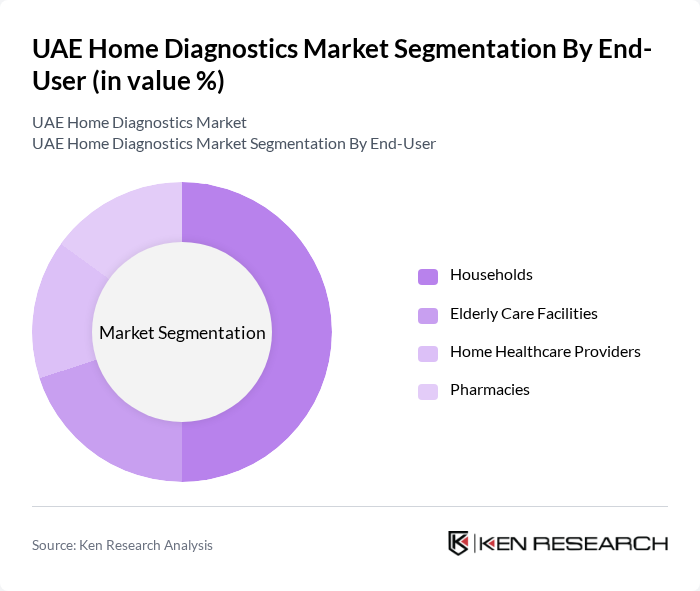

By End-User:The end-user segmentation includes Households, Elderly Care Facilities, Home Healthcare Providers, and Pharmacies. Households are the dominant segment, driven by the increasing trend of self-monitoring health and the convenience of using home diagnostic products. The growing awareness of health management among families has led to a significant rise in the adoption of these products in everyday life.

The UAE Home Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Johnson & Johnson, Becton, Dickinson and Company, Thermo Fisher Scientific, Quidel Corporation, Bio-Rad Laboratories, Medtronic, Abbott Point of Care, Hologic, Inc., Cepheid, OraSure Technologies, PerkinElmer, Inc., ACON Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE home diagnostics market appears promising, driven by ongoing technological advancements and increasing consumer demand for convenience. As telehealth services expand, more individuals will likely seek at-home testing solutions. Additionally, partnerships between diagnostic companies and healthcare providers are expected to enhance product visibility and accessibility. With a focus on personalized medicine and innovative diagnostic tools, the market is poised for significant growth, addressing the evolving healthcare needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Blood Glucose Monitors Pregnancy Test Kits Cholesterol Test Kits Infectious Disease Test Kits Allergy Test Kits Home Genetic Testing Kits Others |

| By End-User | Households Elderly Care Facilities Home Healthcare Providers Pharmacies |

| By Distribution Channel | Online Retail Pharmacies Supermarkets Direct Sales |

| By Application | Chronic Disease Management Preventive Health Monitoring Emergency Diagnostics Routine Health Check-ups |

| By Age Group | Children Adults Seniors |

| By Price Range | Low-End Products Mid-Range Products Premium Products |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Focused Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Diagnostic Device Users | 150 | Patients, Caregivers |

| Pharmacy Retailers | 100 | Pharmacy Managers, Sales Representatives |

| Healthcare Professionals | 80 | Doctors, Nurses, Health Advisors |

| Manufacturers of Home Diagnostics | 60 | Product Managers, Marketing Directors |

| Health Policy Makers | 50 | Government Officials, Health Administrators |

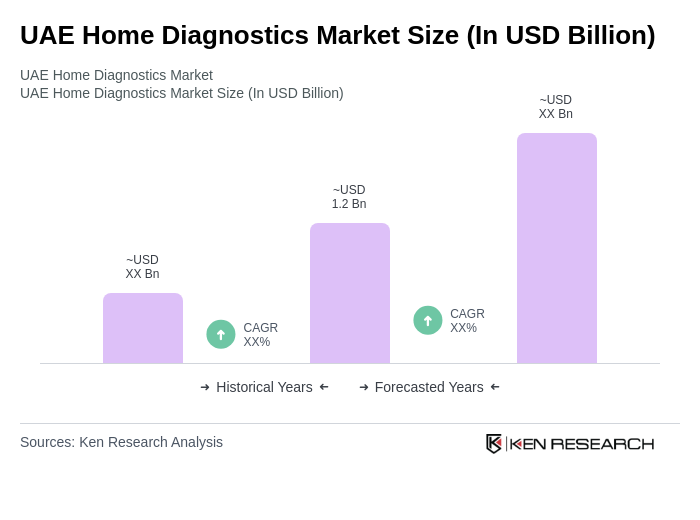

The UAE Home Diagnostics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases, an aging population, and heightened awareness of preventive healthcare among consumers.