Region:Middle East

Author(s):Shubham

Product Code:KRAB7122

Pages:86

Published On:October 2025

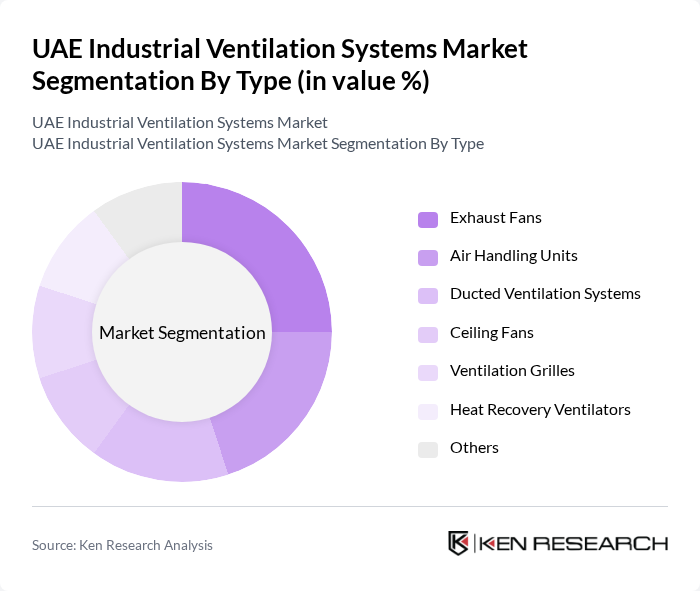

By Type:The market is segmented into various types of ventilation systems, including Exhaust Fans, Air Handling Units, Ducted Ventilation Systems, Ceiling Fans, Ventilation Grilles, Heat Recovery Ventilators, and Others. Each type serves specific applications and industries, contributing to the overall market dynamics.

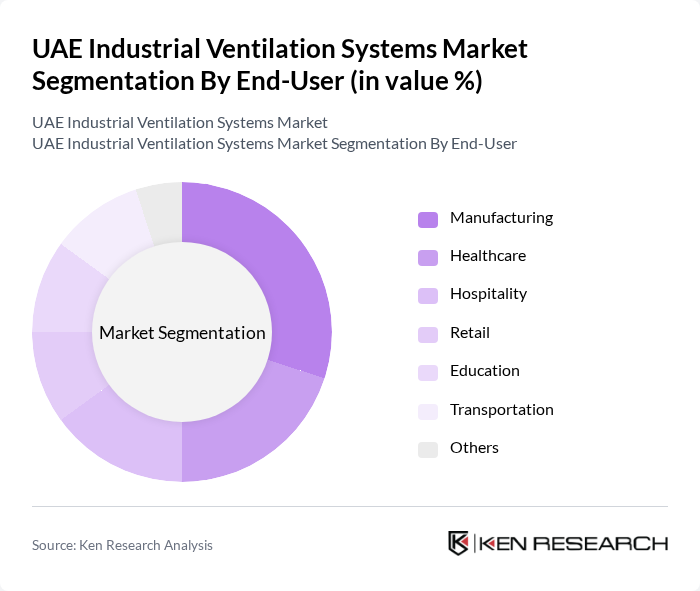

By End-User:The end-user segmentation includes Manufacturing, Healthcare, Hospitality, Retail, Education, Transportation, and Others. Each sector has unique requirements for ventilation systems, influencing the demand and growth of specific types.

The UAE Industrial Ventilation Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Systemair AB, Greenheck Fan Corporation, FläktGroup, Johnson Controls International plc, Trane Technologies plc, Daikin Industries, Ltd., Vent-Axia, Swegon AB, Mitsubishi Electric Corporation, Honeywell International Inc., Systemair Middle East, AAF International, Trox GmbH, Lindab International AB, K ventilation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE industrial ventilation systems market appears promising, driven by technological advancements and a growing focus on sustainability. As industries increasingly prioritize indoor air quality and energy efficiency, the adoption of smart ventilation systems integrated with IoT technology is expected to rise. Furthermore, the ongoing expansion of green building initiatives will likely create additional demand for innovative ventilation solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Exhaust Fans Air Handling Units Ducted Ventilation Systems Ceiling Fans Ventilation Grilles Heat Recovery Ventilators Others |

| By End-User | Manufacturing Healthcare Hospitality Retail Education Transportation Others |

| By Application | Industrial Facilities Commercial Buildings Residential Buildings Warehouses Laboratories Others |

| By Component | Fans Filters Ducts Controls Sensors Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Distribution Mode | Wholesale Retail Direct-to-Consumer Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Ventilation Systems | 100 | Plant Managers, Safety Officers |

| Oil & Gas Industry Ventilation Solutions | 80 | Operations Managers, Environmental Compliance Officers |

| Construction Site Ventilation Practices | 70 | Site Supervisors, Project Managers |

| Commercial Building Ventilation Systems | 90 | Facility Managers, Building Engineers |

| Healthcare Facility Ventilation Requirements | 60 | Healthcare Administrators, Infection Control Specialists |

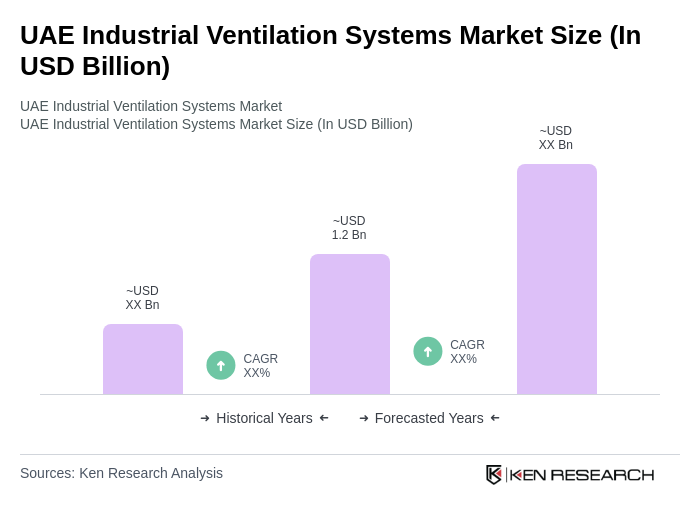

The UAE Industrial Ventilation Systems Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by industrialization, urbanization, and stringent air quality regulations in the region.