Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7707

Pages:91

Published On:October 2025

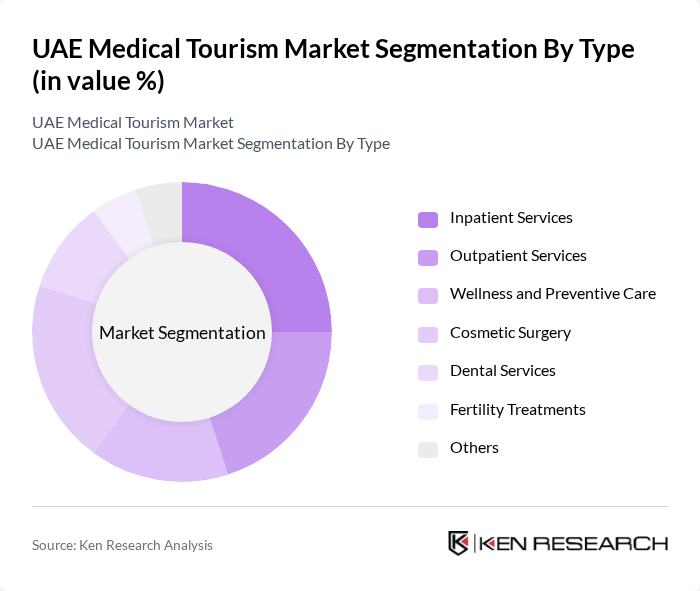

By Type:The market is segmented into various types of services, including Inpatient Services, Outpatient Services, Wellness and Preventive Care, Cosmetic Surgery, Dental Services, Fertility Treatments, and Others. Each of these segments caters to different patient needs and preferences, with specific trends influencing their growth. For instance, Cosmetic Surgery has seen a surge in demand due to the increasing popularity of aesthetic procedures among international patients.

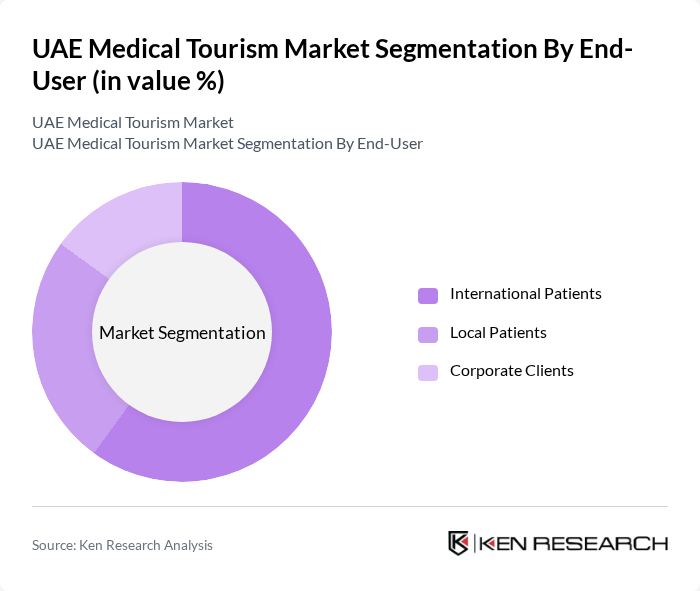

By End-User:The market is categorized into International Patients, Local Patients, and Corporate Clients. International Patients represent a significant portion of the market, driven by the UAE's reputation for high-quality healthcare services and advanced medical technology. Local Patients also contribute to the market, particularly in outpatient and wellness services, while Corporate Clients are increasingly seeking comprehensive health packages for their employees.

The UAE Medical Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mediclinic International, NMC Health, Cleveland Clinic Abu Dhabi, Dubai Healthcare City, HealthBay Polyclinic, American Hospital Dubai, Saudi German Hospital, Al Zahra Hospital, Burjeel Hospital, Aster DM Healthcare, Emirates Hospital, Mediclinic City Hospital, Rashid Hospital, Dubai Hospital, Zulekha Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The UAE medical tourism market is poised for significant growth, driven by advancements in healthcare technology and an increasing focus on patient-centric services. The integration of telemedicine and AI in healthcare is expected to enhance service delivery, making it more accessible for international patients. Additionally, the growing trend of wellness tourism will likely complement medical services, creating a holistic approach to health that appeals to a broader audience seeking comprehensive care solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Services Outpatient Services Wellness and Preventive Care Cosmetic Surgery Dental Services Fertility Treatments Others |

| By End-User | International Patients Local Patients Corporate Clients |

| By Service Provider | Private Hospitals Public Hospitals Specialty Clinics |

| By Destination | Dubai Abu Dhabi Sharjah Others |

| By Treatment Type | Cardiac Treatments Orthopedic Treatments Neurological Treatments Others |

| By Payment Method | Self-Payment Insurance Coverage Government Funding |

| By Age Group | Children Adults Seniors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Surgery Patients | 100 | International Patients, Medical Tourism Agents |

| Orthopedic Treatment Seekers | 80 | Patients, Healthcare Providers |

| Fertility Treatment Clients | 70 | Patients, Fertility Clinic Administrators |

| Cardiac Surgery Patients | 60 | Patients, Cardiologists, Medical Tourism Facilitators |

| General Health Check-up Clients | 90 | Patients, Health Insurance Representatives |

The UAE Medical Tourism Market is valued at approximately USD 3.5 billion, driven by advanced healthcare infrastructure and high-quality medical services. The market's growth is significantly influenced by the country's reputation for specialized treatments, particularly in cosmetic surgery and wellness services.