Region:Middle East

Author(s):Rebecca

Product Code:KRAD5041

Pages:94

Published On:December 2025

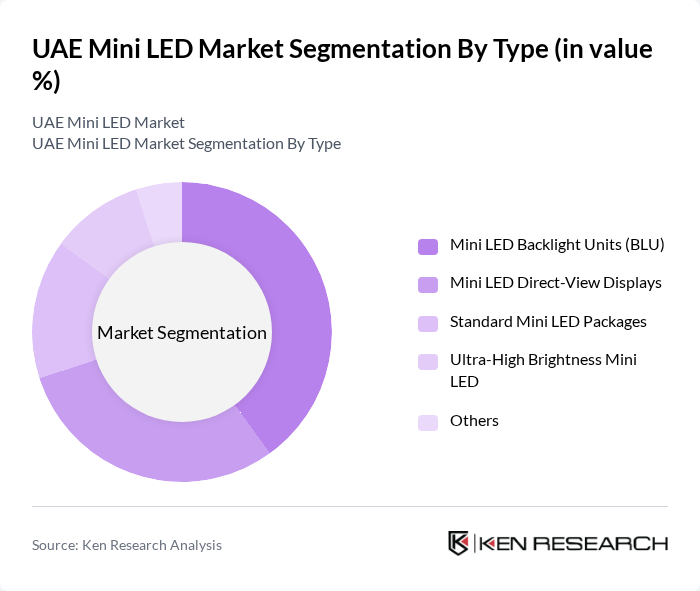

By Type:The Mini LED Market can be segmented into various types, including Mini LED Backlight Units (BLU), Mini LED Direct-View Displays, Standard Mini LED Packages, Ultra-High Brightness Mini LED, and Others. Each of these subsegments caters to different applications and consumer needs, with varying levels of market demand and technological advancements, broadly reflecting global mini LED segmentation where backlight and display applications dominate.

The Mini LED Backlight Units (BLU) segment is currently dominating the market due to their widespread application in televisions, gaming monitors, and professional IT displays, where enhanced brightness, high contrast, and precise local dimming are critical. The growing consumer preference for 4K and 8K high-definition displays in home entertainment systems and professional settings in the UAE, combined with the country’s high penetration of premium large-screen TVs and monitors, has led to increased adoption of BLU technology. Additionally, advancements in chip miniaturization, backlight driver ICs, and automated assembly have reduced cost per zone, making these units increasingly cost-effective and accelerating their market share versus conventional edge-lit LED solutions.

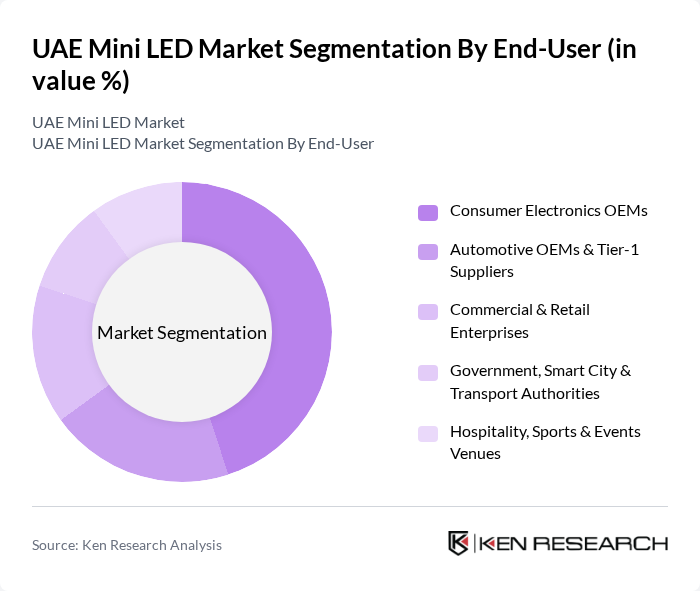

By End-User:The Mini LED Market is segmented by end-user into Consumer Electronics OEMs, Automotive OEMs & Tier-1 Suppliers, Commercial & Retail Enterprises, Government, Smart City & Transport Authorities, and Hospitality, Sports & Events Venues. Each end-user segment has unique requirements and applications for Mini LED technology, influencing market dynamics and growth potential, in line with the broader mini LED application mix across consumer, automotive, and signage.

The Consumer Electronics OEMs segment leads the market, driven by the increasing demand for high-quality displays in televisions, tablets, laptops, gaming monitors, and other consumer devices that increasingly adopt mini LED backlighting. The trend towards larger screens, higher refresh rates, HDR performance, and enhanced visual experiences has prompted manufacturers and their regional distributors in the UAE to prioritize Mini LED technology, which offers superior brightness, local dimming control, and color performance compared to conventional LED backlights. This segment's growth is further supported by consumer preferences for premium products, the rapid replacement cycle of TVs and IT displays in the UAE, and increased availability of mini LED-based flagship models from leading global brands in local retail and e-commerce channels.

The UAE Mini LED Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc. (Including LG Display Co., Ltd.), BOE Technology Group Co., Ltd., TCL Technology Group Corporation (TCL CSOT), AUO Corporation, Innolux Corporation, Konka Group Co., Ltd., Leyard Optoelectronic Co., Ltd., Absen Optoelectronic Co., Ltd., Unilumin Group Co., Ltd., Hisense Visual Technology Co., Ltd., Sony Group Corporation, Huawei Technologies Co., Ltd. (Display Ecosystem), Infiled Electronics (Shenzhen Infiled Electronics Co., Ltd.), Maxhub (Guangzhou Shiyuan Electronic Technology Company Limited) contribute to innovation, geographic expansion, and service delivery in this space, leveraging global capabilities in mini LED backlight modules, direct-view LED walls, and commercial display systems.

The UAE Mini LED market is poised for significant growth, driven by technological advancements and increasing consumer demand for high-quality displays. As the government continues to support smart city initiatives, the integration of Mini LED technology in various sectors, including automotive and consumer electronics, will likely accelerate. Furthermore, the rising focus on sustainability and energy efficiency will push manufacturers to innovate, creating a competitive landscape that fosters collaboration and investment in emerging technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Mini LED Backlight Units (BLU) Mini LED Direct-View Displays Standard Mini LED Packages Ultra-High Brightness Mini LED Others |

| By End-User | Consumer Electronics OEMs Automotive OEMs & Tier-1 Suppliers Commercial & Retail Enterprises Government, Smart City & Transport Authorities Hospitality, Sports & Events Venues |

| By Application | Televisions and Large-Screen TVs IT Monitors, Laptops and Tablets Automotive Instrument Clusters & Infotainment Displays Indoor & Outdoor Digital Signage / DOOH Control Rooms, Broadcast & Professional Displays |

| By Distribution Channel | Direct Sales to OEMs / System Integrators Value-Added Resellers and System Integrators Specialized AV & Display Distributors Online B2B Platforms Retail & E-commerce for Finished Devices |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others (Ras Al Khaimah, Fujairah, Umm Al Quwain) |

| By Technology | Mini LED Backlit LCD Mini LED with Quantum Dot Enhancement Direct-View Mini LED Others (Hybrid / Emerging Technologies) |

| By Market Segment | B2B (Projects, Institutional & Corporate) B2C (Consumer Devices) Others (Rental & Staging, System Integrators) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Executives |

| Automotive Display Manufacturers | 75 | Product Development Engineers, Procurement Managers |

| Commercial Display Solutions Providers | 60 | Business Development Managers, Technical Support Staff |

| Research Institutions Focused on Display Technologies | 45 | Research Scientists, Technology Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The UAE Mini LED Market is valued at approximately USD 1.1 billion, reflecting a strong demand for high-quality display technologies across consumer electronics, automotive, and commercial sectors, supported by a robust domestic consumer electronics base.