Region:Middle East

Author(s):Rebecca

Product Code:KRAD2929

Pages:80

Published On:November 2025

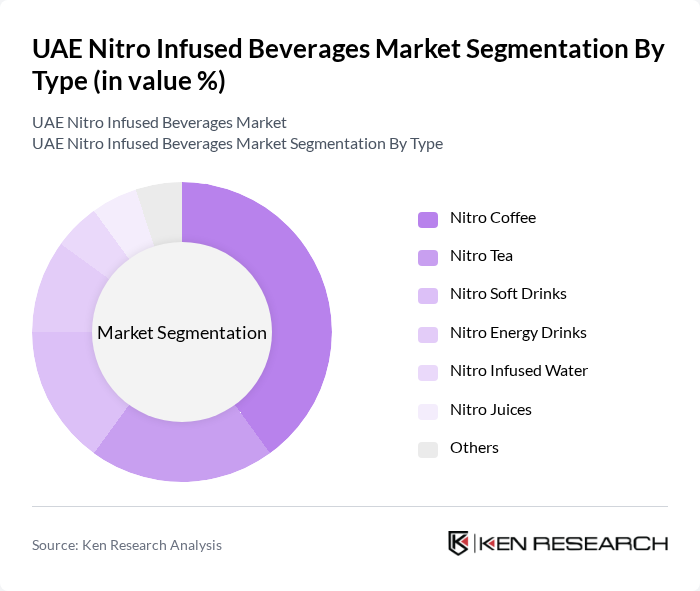

By Type:The market is segmented into Nitro Coffee, Nitro Tea, Nitro Soft Drinks, Nitro Energy Drinks, Nitro Infused Water, Nitro Juices, and Others. Nitro Coffee remains the leading sub-segment, propelled by the UAE’s vibrant café culture and consumer demand for premium, experiential beverages. Nitro Tea is gaining momentum as health-conscious consumers seek alternatives to sugary and carbonated drinks, while Nitro Soft Drinks and Nitro Energy Drinks are increasingly popular among younger demographics seeking novel and energizing options.

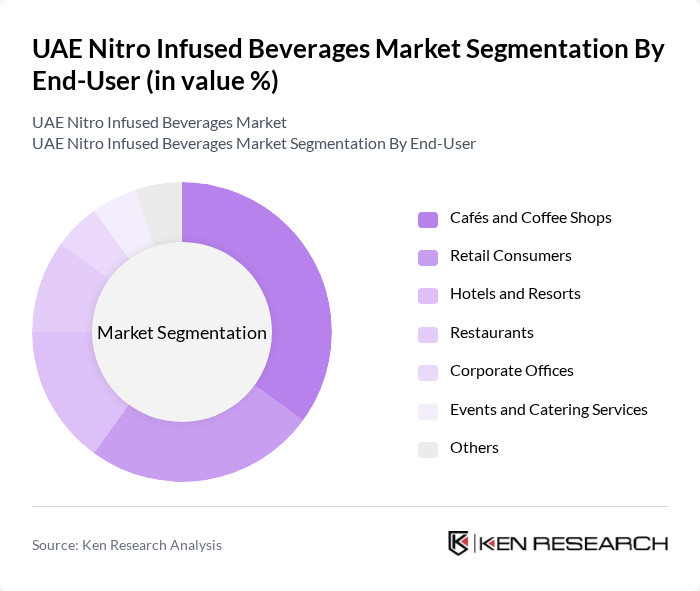

By End-User:End-user segmentation includes Retail Consumers, Cafés and Coffee Shops, Hotels and Resorts, Restaurants, Corporate Offices, Events and Catering Services, and Others. Cafés and Coffee Shops are the primary end-users, reflecting the UAE’s robust specialty coffee scene and consumer appetite for unique beverage experiences. Retail Consumers are also significant, with growing availability of nitro beverages in supermarkets and convenience stores. Hotels and Resorts are expanding their premium beverage offerings to cater to international guests and affluent residents.

The UAE Nitro Infused Beverages Market features a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Costa Coffee (Emirates Group), Dunkin' (UAE: Dunkin' UAE/Continental Foods), PepsiCo, Inc., The Coca-Cola Company, Monster Beverage Corporation, Red Bull GmbH, RAW Coffee Company (Dubai), Seven Fortunes Coffee Roasters (Dubai), Nescafé (Nestlé Middle East), RISE Brewing Co., Nitro Beverage Co., La Colombe Coffee Roasters, Chameleon Cold-Brew, and Califia Farms drive innovation, geographic expansion, and premium service delivery in this segment.

The future of the UAE nitro infused beverages market appears promising, driven by evolving consumer preferences and a growing focus on health and wellness. As the market matures, brands are likely to invest in innovative product development and marketing strategies to enhance consumer engagement. Additionally, the integration of technology in beverage preparation and distribution will streamline operations, making nitro beverages more accessible. This dynamic environment is expected to foster growth and attract new entrants, further diversifying the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitro Coffee Nitro Tea Nitro Soft Drinks Nitro Energy Drinks Nitro Infused Water Nitro Juices Others |

| By End-User | Retail Consumers Cafés and Coffee Shops Hotels and Resorts Restaurants Corporate Offices Events and Catering Services Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Convenience Stores Specialty Beverage Stores Direct Sales (B2B) Others |

| By Packaging Type | Cans Bottles Tetra Packs Kegs Others |

| By Flavor Profile | Classic Flavors (Coffee, Tea) Fruit Flavors Exotic Flavors Seasonal Flavors Custom Blends Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Nitro Beverages | 120 | Health-conscious Consumers, Beverage Enthusiasts |

| Retail Distribution Insights | 80 | Retail Managers, Beverage Category Buyers |

| Market Trends and Innovations | 60 | Product Developers, Marketing Executives |

| Impact of Health Trends on Beverage Choices | 50 | Nutritionists, Health Coaches |

| Consumer Awareness and Education | 60 | Marketing Analysts, Brand Managers |

The UAE Nitro Infused Beverages Market is valued at approximately USD 14 million, reflecting its position as a high-growth segment within the Middle East, driven by consumer demand for innovative and premium beverage options.