Region:Middle East

Author(s):Rebecca

Product Code:KRAD6301

Pages:89

Published On:December 2025

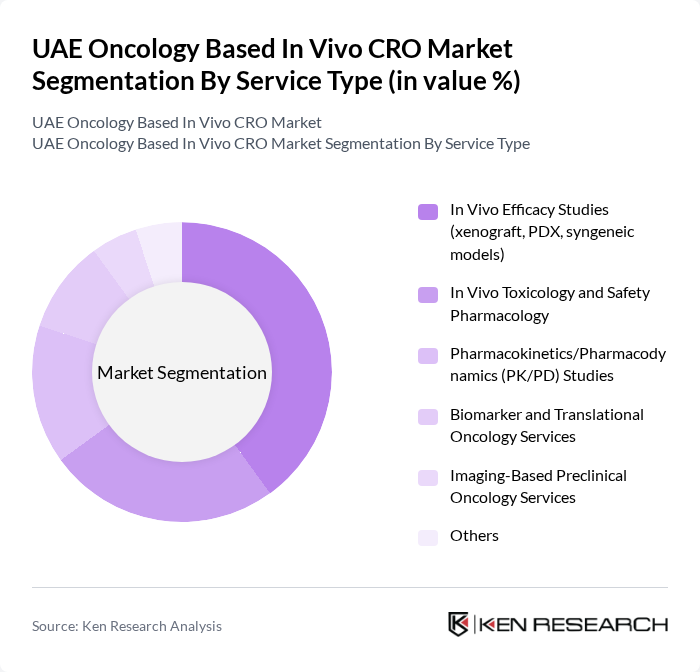

By Service Type:The service type segmentation includes various specialized services that cater to the needs of oncology research. The subsegments include In Vivo Efficacy Studies (xenograft, PDX, syngeneic models), In Vivo Toxicology and Safety Pharmacology, Pharmacokinetics/Pharmacodynamics (PK/PD) Studies, Biomarker and Translational Oncology Services, Imaging-Based Preclinical Oncology Services, and Others. In Vivo Efficacy Studies are particularly dominant in oncology-focused preclinical outsourcing, as global evidence shows that in vivo segments lead oncology-based preclinical CRO revenues due to the critical need for robust tumor model data to support candidate selection and regulatory submissions.

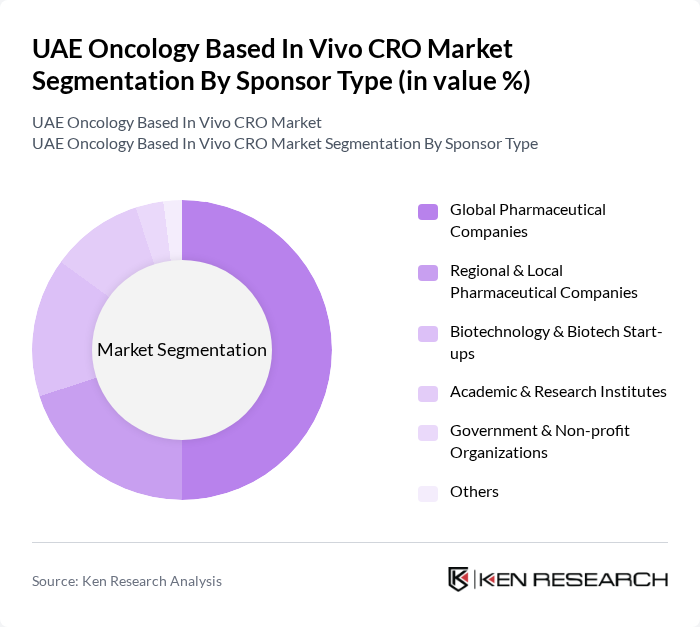

By Sponsor Type:The sponsor type segmentation encompasses various entities that fund and support oncology research. This includes Global Pharmaceutical Companies, Regional & Local Pharmaceutical Companies, Biotechnology & Biotech Start-ups, Academic & Research Institutes, Government & Non-profit Organizations, and Others. Global Pharmaceutical Companies are the leading sponsors in oncology-related CRO engagements, supported by their large oncology pipelines, strong financial resources, and active outsourcing strategies for both preclinical and clinical oncology programs. In the UAE, this is reinforced by the broader pharmaceutical CRO market, where multinational sponsors drive a significant share of clinical trial activity, particularly in oncology and CNS.

The UAE Oncology Based In Vivo CRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles River Laboratories International, Inc., Labcorp Drug Development (Laboratory Corporation of America Holdings), ICON plc, IQVIA Inc., PPD, Inc. (part of Thermo Fisher Scientific), Parexel International Corporation, Syneos Health, Wuxi AppTec Co., Ltd., Crown Bioscience Inc. (a JSR Life Sciences company), Eurofins Scientific SE, Toxikon Europe NV, UAE University – College of Medicine and Health Sciences (Oncology Research Units), Sheikh Shakhbout Medical City (SSMC) – Oncology Research Collaborations, Dubai Health (Dubai Academic Health Corporation) – Oncology Clinical Research Network, Mohammed Bin Rashid University of Medicine and Health Sciences (MBRU) – Cancer Research Center contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE oncology-based in vivo CRO market appears promising, driven by increasing collaboration between public and private sectors. The integration of artificial intelligence and machine learning into research processes is expected to enhance data analysis and patient outcomes. Furthermore, the emphasis on personalized medicine will likely lead to tailored treatment approaches, fostering innovation. As the market evolves, CROs that adapt to these trends will be well-positioned to capitalize on emerging opportunities and drive growth in the oncology sector.

| Segment | Sub-Segments |

|---|---|

| By Service Type | In Vivo Efficacy Studies (xenograft, PDX, syngeneic models) In Vivo Toxicology and Safety Pharmacology Pharmacokinetics/Pharmacodynamics (PK/PD) Studies Biomarker and Translational Oncology Services Imaging-Based Preclinical Oncology Services Others |

| By Sponsor Type | Global Pharmaceutical Companies Regional & Local Pharmaceutical Companies Biotechnology & Biotech Start-ups Academic & Research Institutes Government & Non-profit Organizations Others |

| By Indication (Cancer Type) | Solid Tumors Blood Cancers (hematologic malignancies) Immuno-oncology & Cell/Gene Therapy Programs Pediatric Oncology Others |

| By Study Phase | Exploratory / Discovery In Vivo Studies IND-enabling Preclinical Packages Early Clinical Support Studies (Phase I/II enabling) Late-stage Translational & Real-World Evidence Support Others |

| By Engagement Model | Full-Service, End-to-End Outsourcing Functional Service Provision (FSP) Strategic Partnerships/Alliances Project-Based Engagements Others |

| By Geographic Patient/Trial Source | UAE-only Programs GCC Multi-country Programs Wider MENA & International Programs Others |

| By Funding Source | Multinational Pharma & Biotech Sponsored UAE Government & Emirate-level Grants Sovereign Wealth Funds & Strategic Investment Arms Venture Capital & Private Equity Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trials | 100 | Clinical Research Coordinators, Oncologists |

| Regulatory Compliance in Oncology | 75 | Regulatory Affairs Managers, Compliance Officers |

| Oncology Research Funding | 60 | Research Grant Managers, Funding Agency Representatives |

| Patient Recruitment Strategies | 80 | Patient Advocacy Group Leaders, Clinical Trial Recruiters |

| Market Trends in Oncology Services | 90 | Healthcare Analysts, Oncology Service Providers |

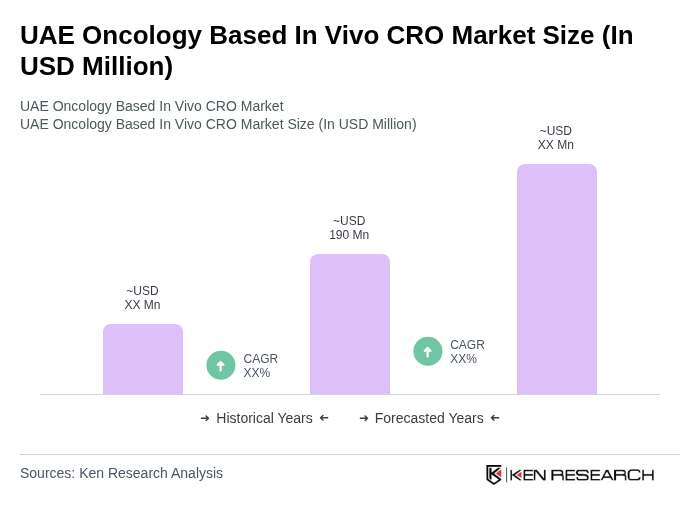

The UAE Oncology Based In Vivo CRO Market is valued at approximately USD 190 million, driven by the increasing prevalence of cancer, advancements in oncology research, and the demand for innovative therapies such as immuno-oncology and targeted biologics.