Region:Middle East

Author(s):Rebecca

Product Code:KRAD2730

Pages:87

Published On:November 2025

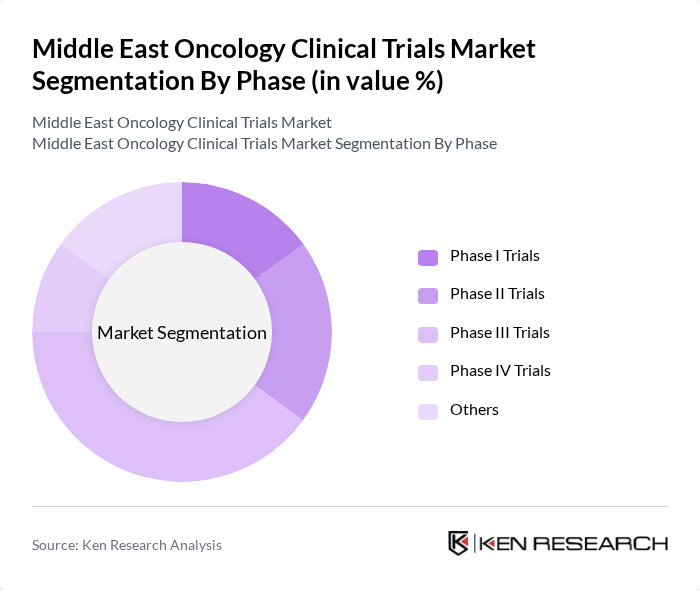

By Phase:The segmentation by phase includes Phase I Trials, Phase II Trials, Phase III Trials, Phase IV Trials, and Others. Phase III Trials account for the largest share of the market, reflecting their critical role in determining the efficacy and safety of new treatments before regulatory approval. The increasing number of oncology drugs advancing to this phase demonstrates the region’s growing investment in cancer research and the urgency to bring effective therapies to market. Early-phase trials are also expanding, driven by the adoption of novel targeted therapies and immuno-oncology agents .

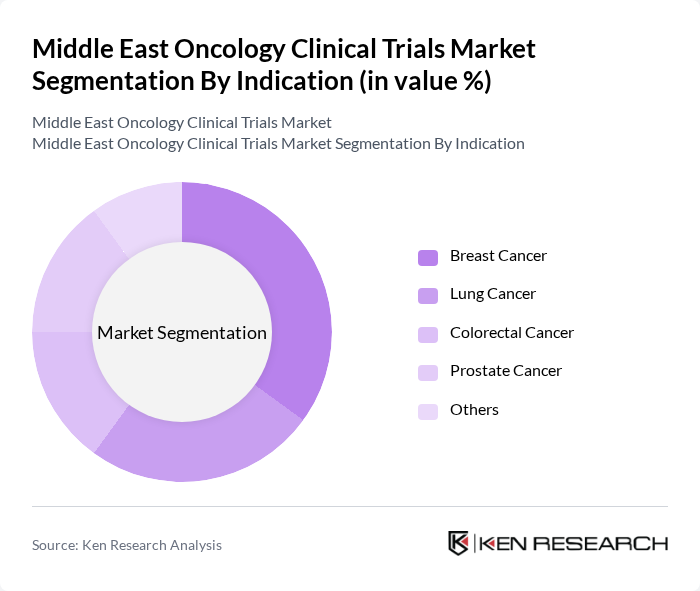

By Indication:The indication segmentation includes Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, and Others. Breast Cancer trials lead the market, driven by high incidence rates and the ongoing need for innovative treatment options. The focus on targeted therapies and immunotherapies for breast cancer has spurred significant investment and research, making it a priority in clinical trial agendas. Lung and colorectal cancer trials are also prominent, reflecting the disease burden and research focus in the region .

The Middle East Oncology Clinical Trials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis, Roche, Pfizer, AstraZeneca, Merck & Co., Sanofi, GSK, Eli Lilly, Amgen, Bayer, AbbVie, Takeda, Boehringer Ingelheim, Celgene (Bristol Myers Squibb), Bristol Myers Squibb, IQVIA, Parexel, ICON plc, Syneos Health, Medpace Holdings, Novotech, Gilead Sciences, Merck KGaA, Rakuten Medical, NanoPalm Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oncology clinical trials market in the Middle East appears promising, driven by advancements in technology and a growing emphasis on patient-centric approaches. The integration of artificial intelligence in trial design is expected to enhance efficiency and accuracy, while decentralized trials will improve patient access and participation. As regulatory bodies streamline approval processes, the region is likely to become a hub for innovative cancer research, attracting global investment and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Phase | Phase I Trials Phase II Trials Phase III Trials Phase IV Trials Others |

| By Indication | Breast Cancer Lung Cancer Colorectal Cancer Prostate Cancer Others |

| By Sponsor Type | Pharmaceutical Companies Biotechnology Firms Academic Institutions Government Organizations Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Patient Demographics | Age Group Gender Socioeconomic Status Others |

| By Study Design | Interventional Trials Observational Trials Expanded Access Trials Others |

| By Funding Source | Public Funding Private Funding Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinical Trial Coordinators | 75 | Clinical Research Associates, Trial Managers |

| Oncologists in Major Hospitals | 65 | Medical Oncologists, Surgical Oncologists |

| Pharmaceutical Companies' R&D Heads | 55 | R&D Directors, Clinical Development Managers |

| Patient Advocacy Group Leaders | 45 | Advocacy Directors, Patient Engagement Managers |

| Regulatory Affairs Specialists | 60 | Regulatory Managers, Compliance Officers |

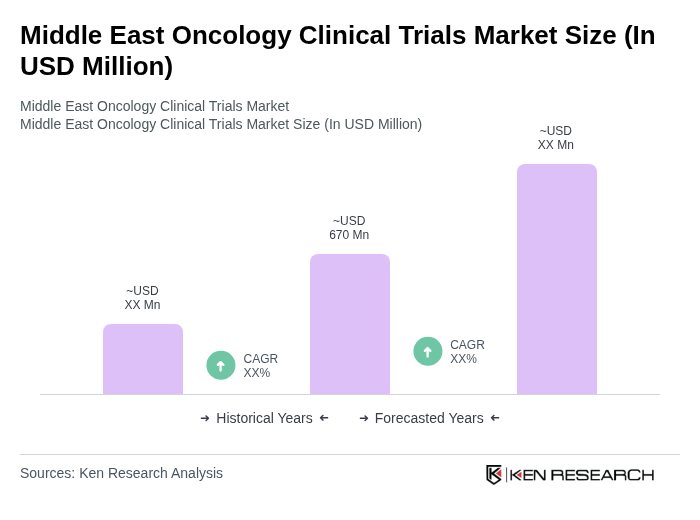

The Middle East Oncology Clinical Trials Market is valued at approximately USD 670 million, reflecting significant growth driven by the rising prevalence of cancer, advancements in medical technologies, and a focus on personalized medicine.