UAE Online Loan and FinTech Platforms Market Overview

- The UAE Online Loan and FinTech Platforms Market is valued at approximately AED 10 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in consumer demand for quick and accessible loan options, and the proliferation of mobile banking applications. The market has seen a significant shift towards online platforms, which offer convenience and efficiency to borrowers.

- Dubai and Abu Dhabi are the dominant cities in the UAE Online Loan and FinTech Platforms Market due to their status as financial hubs with advanced infrastructure, a high concentration of tech-savvy consumers, and supportive government policies. The presence of numerous financial institutions and startups in these cities fosters a competitive environment that drives innovation and service delivery in the fintech sector.

- In 2023, the UAE government implemented a regulatory framework aimed at enhancing consumer protection in the fintech sector. This framework includes guidelines for transparency in loan terms and conditions, ensuring that borrowers are fully informed about interest rates and fees. The initiative is designed to build trust in digital lending platforms and promote responsible borrowing practices among consumers.

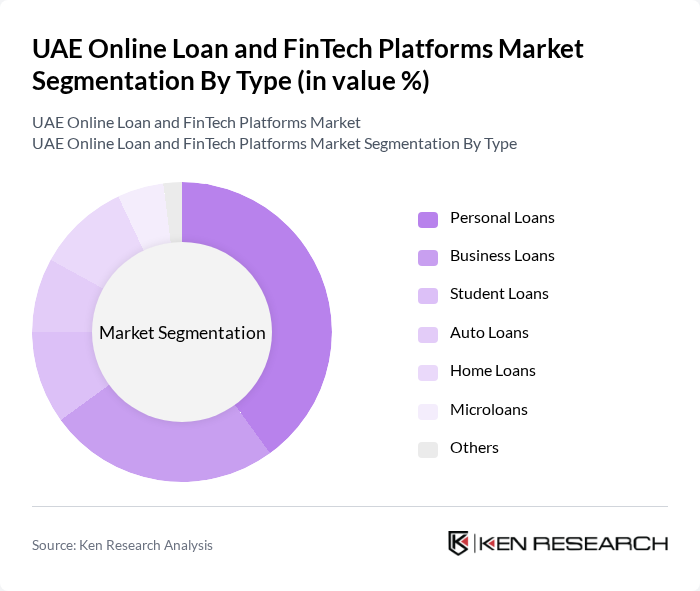

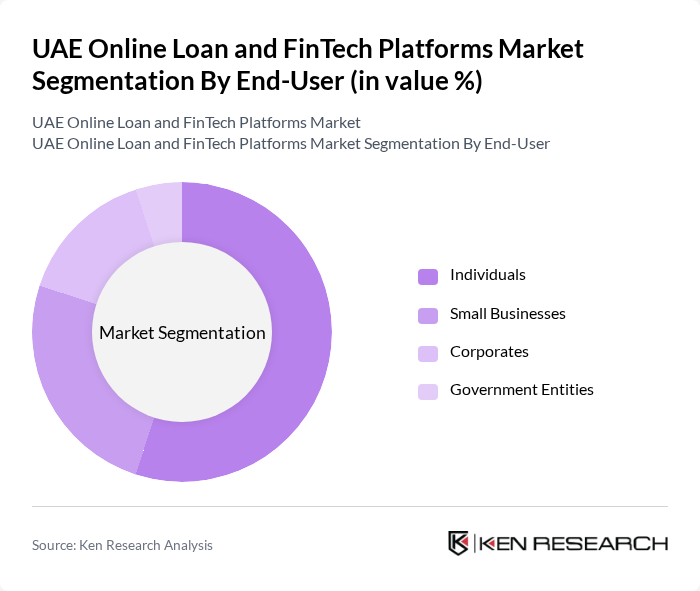

UAE Online Loan and FinTech Platforms Market Segmentation

By Type:The market is segmented into various types of loans, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Loans, Microloans, and Others. Among these, Personal Loans are the most popular, driven by consumer demand for quick access to funds for personal expenses. Business Loans are also significant, as small and medium enterprises seek financing for growth and operational needs.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Government Entities. Individuals dominate the market, as they are the primary consumers of personal loans for various needs, including education, home improvement, and emergencies. Small businesses also represent a significant portion, seeking loans for operational costs and expansion.

UAE Online Loan and FinTech Platforms Market Competitive Landscape

The UAE Online Loan and FinTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank, Fawry, PayFort, Souqalmal, Beehive, YAP, Tamweel, RAK Bank, Qarar, Zand, NymCard, Fintech Galaxy, Lendo contribute to innovation, geographic expansion, and service delivery in this space.

UAE Online Loan and FinTech Platforms Market Industry Analysis

Growth Drivers

- Increasing Digital Adoption:The UAE has witnessed a significant surge in digital adoption, with internet penetration reaching 99% in future, according to the Telecommunications Regulatory Authority. This digital landscape facilitates the growth of online loan platforms, as consumers increasingly prefer digital solutions for financial services. The rise of smartphone usage, projected to exceed 90% of the population, further supports this trend, enabling seamless access to FinTech services and enhancing user engagement in the online loan sector.

- Rising Demand for Quick Loans:The demand for quick loans in the UAE has escalated, with the Central Bank reporting a 30% increase in personal loan applications in future. This trend is driven by consumers seeking immediate financial solutions for emergencies and unexpected expenses. The convenience of online platforms allows for faster processing times, with many loans being approved within 24 hours, catering to the urgent needs of borrowers and fostering a competitive market environment.

- Enhanced Regulatory Framework:The UAE government has implemented a robust regulatory framework for FinTech companies, with the Financial Services Regulatory Authority issuing 150 licenses to FinTech firms by the end of future. This regulatory clarity fosters a secure environment for both consumers and businesses, encouraging investment in online loan platforms. Enhanced consumer protection laws and anti-money laundering regulations further bolster trust in the sector, promoting growth and innovation in financial services.

Market Challenges

- High Competition:The online loan market in the UAE is characterized by intense competition, with over 50 active FinTech platforms vying for market share. This saturation leads to aggressive marketing strategies and pricing wars, which can erode profit margins. As new entrants continue to emerge, established players must innovate and differentiate their offerings to maintain a competitive edge, posing a significant challenge to profitability in the sector.

- Consumer Trust Issues:Despite the growth of online loan platforms, consumer trust remains a critical challenge. A survey by the UAE Central Bank indicated that 40% of potential borrowers express concerns about data security and fraud. This skepticism can hinder the adoption of digital financial services, as consumers may prefer traditional banking methods. Building trust through transparency, robust security measures, and effective customer service is essential for overcoming this barrier.

UAE Online Loan and FinTech Platforms Market Future Outlook

The future of the UAE online loan and FinTech platforms market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy continues to rise, more consumers are likely to embrace online financial services. Additionally, the integration of artificial intelligence and machine learning in loan processing is expected to enhance efficiency and customer experience. Strategic partnerships between FinTech firms and traditional banks may also emerge, creating a more comprehensive financial ecosystem that meets diverse consumer needs.

Market Opportunities

- Expansion of Financial Inclusion:The UAE government aims to increase financial inclusion, targeting a 90% inclusion rate by future. This initiative presents a significant opportunity for online loan platforms to reach underserved populations, including expatriates and low-income individuals. By offering tailored financial products, these platforms can tap into a growing customer base, driving revenue and fostering economic growth.

- Technological Innovations:The rapid advancement of technology, particularly in blockchain and AI, offers substantial opportunities for the FinTech sector. By leveraging these technologies, online loan platforms can enhance security, streamline operations, and improve customer service. The adoption of innovative solutions can lead to more personalized loan offerings, attracting a broader audience and increasing market share in a competitive landscape.