Region:Middle East

Author(s):Dev

Product Code:KRAB8209

Pages:100

Published On:October 2025

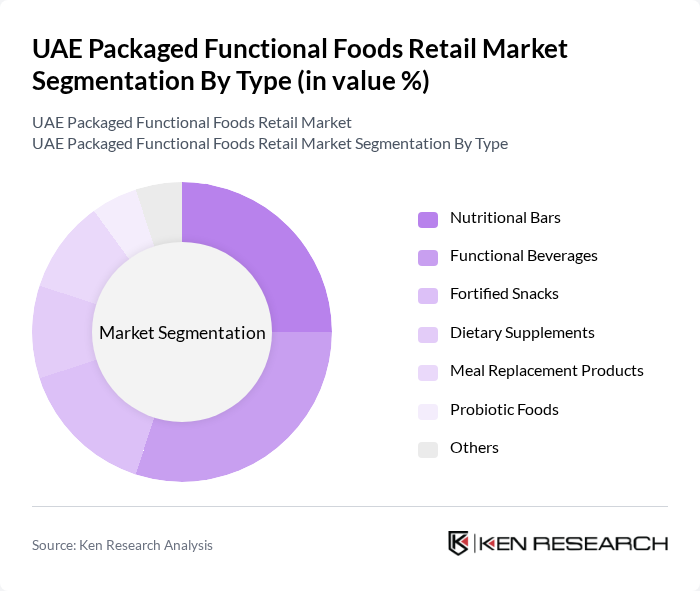

By Type:The market is segmented into various types of packaged functional foods, including nutritional bars, functional beverages, fortified snacks, dietary supplements, meal replacement products, probiotic foods, and others. Each of these subsegments caters to specific consumer needs and preferences, reflecting the diverse landscape of health-oriented food products.

The functional beverages segment is currently dominating the market due to the increasing consumer preference for convenient and on-the-go health solutions. This category includes energy drinks, sports drinks, and fortified juices that appeal to health-conscious individuals seeking hydration and nutritional benefits. The trend towards functional beverages is further fueled by innovative product formulations and marketing strategies that highlight health benefits, making them a popular choice among consumers.

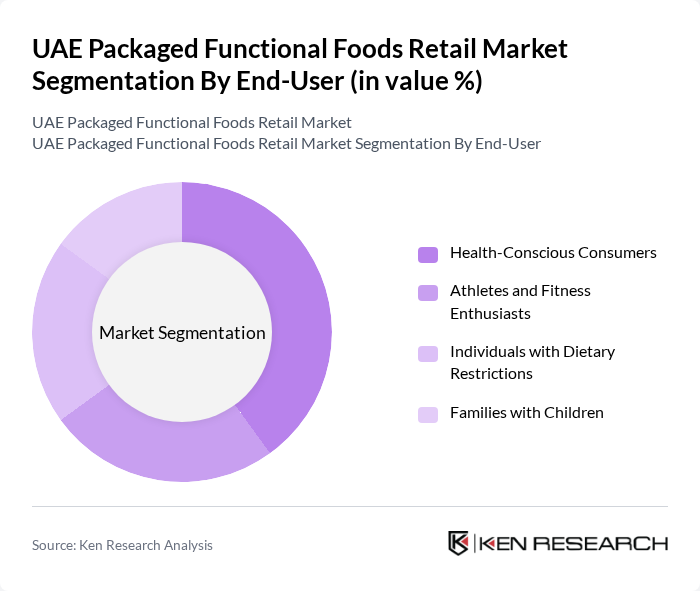

By End-User:The market is segmented based on end-users, including health-conscious consumers, athletes and fitness enthusiasts, individuals with dietary restrictions, and families with children. Each group has distinct preferences and requirements, influencing their purchasing decisions in the packaged functional foods market.

The health-conscious consumers segment is leading the market, driven by a growing awareness of nutrition and wellness. This demographic actively seeks products that offer health benefits, such as low-calorie options, high protein content, and functional ingredients. The increasing prevalence of lifestyle-related health issues has further propelled this segment, as consumers prioritize their health and well-being through dietary choices.

The UAE Packaged Functional Foods Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Herbalife Nutrition Ltd., General Mills, Inc., The Kellogg Company, Unilever PLC, PepsiCo, Inc., GNC Holdings, Inc., Amway Corporation, Glanbia PLC, The Hain Celestial Group, Inc., Nature's Way Products, LLC, Orgain, Inc., Garden of Life, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The UAE packaged functional foods market is poised for dynamic growth, driven by evolving consumer preferences towards health and wellness. Innovations in product formulations, particularly in plant-based and personalized nutrition, are expected to gain traction. Additionally, the increasing integration of technology in retail, such as AI-driven recommendations, will enhance consumer engagement. As the market adapts to these trends, companies that prioritize sustainability and transparency in their offerings will likely capture a larger share of the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Nutritional Bars Functional Beverages Fortified Snacks Dietary Supplements Meal Replacement Products Probiotic Foods Others |

| By End-User | Health-Conscious Consumers Athletes and Fitness Enthusiasts Individuals with Dietary Restrictions Families with Children |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Pharmacies |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Rigid Packaging Flexible Packaging Bulk Packaging |

| By Ingredient Type | Organic Ingredients Non-GMO Ingredients Gluten-Free Ingredients |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaged Functional Beverages | 150 | Product Managers, Marketing Directors |

| Health Supplements Retail | 100 | Store Owners, Nutritionists |

| Functional Snacks Market | 120 | Category Managers, Consumer Insights Analysts |

| Online Retail of Functional Foods | 80 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Functional Foods | 200 | Health-Conscious Consumers, Fitness Enthusiasts |

The UAE Packaged Functional Foods Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a preference for convenient food options among consumers.