Region:Middle East

Author(s):Rebecca

Product Code:KRAB8348

Pages:80

Published On:October 2025

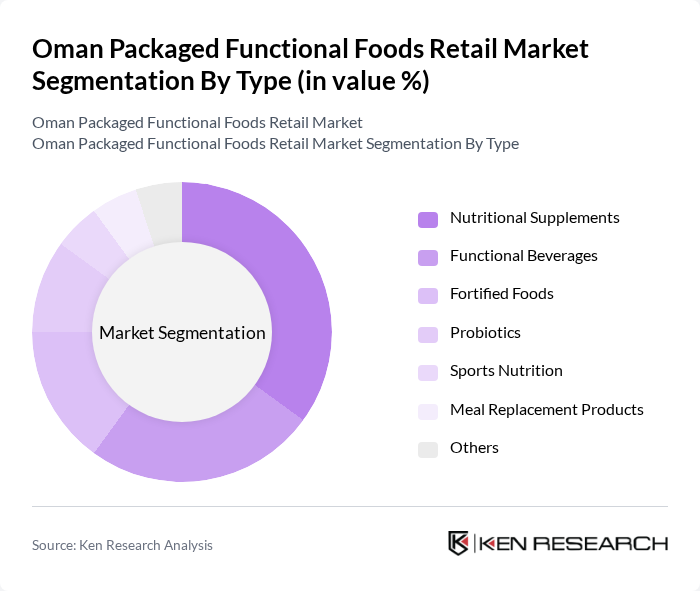

By Type:The market is segmented into various types of packaged functional foods, including nutritional supplements, functional beverages, fortified foods, probiotics, sports nutrition, meal replacement products, and others. Among these, nutritional supplements are currently leading the market due to their increasing popularity among health-conscious consumers seeking to enhance their dietary intake. The growing trend of preventive healthcare and the rising awareness of the benefits of vitamins and minerals are driving this segment's growth.

By End-User:The end-user segmentation includes health-conscious consumers, athletes and fitness enthusiasts, the elderly population, and children and adolescents. Health-conscious consumers dominate this segment, driven by a growing awareness of nutrition and wellness. This demographic is increasingly seeking products that support their health goals, leading to a surge in demand for functional foods tailored to their specific needs.

The Oman Packaged Functional Foods Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Oman Refreshment Company, Dhofar Beverages Company, Muscat Gases Company, Oman Food Investment Holding Company, Al Jazeera International Catering Company, Oman National Dairy Products Company, Al Muna Group, Al Fawaz Group, Al Mufeedah Group, Al Makhazen Group, Al Mufeedah Trading Company, Al Harthy Group, Al Shanfari Group, Al Muna Foodstuff Trading contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman packaged functional foods market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, manufacturers are likely to innovate with new product offerings that cater to specific dietary needs. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement. The anticipated growth in e-commerce will further facilitate market expansion, allowing brands to reach a broader audience and adapt to changing consumer behaviors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Nutritional Supplements Functional Beverages Fortified Foods Probiotics Sports Nutrition Meal Replacement Products Others |

| By End-User | Health-Conscious Consumers Athletes and Fitness Enthusiasts Elderly Population Children and Adolescents |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Pharmacies |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bottles Pouches Tubs Sachets |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients |

| By Consumer Demographics | Age Group Gender Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaged Functional Foods Retailers | 150 | Store Managers, Category Buyers |

| Health and Wellness Product Distributors | 100 | Distribution Managers, Sales Executives |

| Consumer Preferences in Functional Foods | 200 | Health-conscious Consumers, Fitness Enthusiasts |

| Market Trends in Dietary Supplements | 80 | Nutritionists, Health Coaches |

| Retail Sales Data Analysis | 120 | Market Analysts, Retail Strategists |

The Oman Packaged Functional Foods Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health awareness, rising disposable incomes, and a shift towards convenience foods among consumers.