Region:Middle East

Author(s):Dev

Product Code:KRAD1819

Pages:83

Published On:November 2025

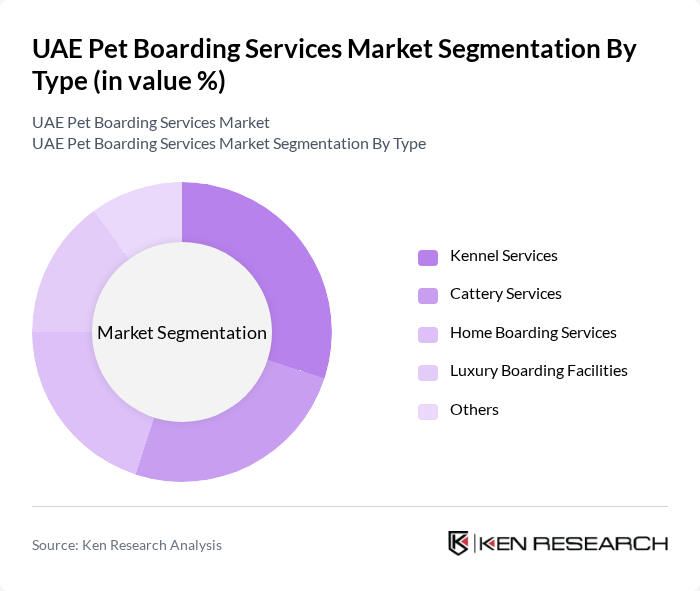

By Type:The segmentation by type includes various services offered in the pet boarding industry. The subsegments are Kennel Services, Cattery Services, Home Boarding Services, Luxury Boarding Facilities, and Others. Each of these services caters to different needs and preferences of pet owners, with varying levels of care and amenities provided. Kennel Services are primarily focused on dogs and offer structured environments, while Cattery Services cater to cats with specialized care. Home Boarding Services provide a more personalized experience in a home setting, and Luxury Boarding Facilities deliver premium amenities such as private suites and spa treatments. The “Others” category includes daycare and short-term boarding options.

The Kennel Services subsegment is currently dominating the market due to the high number of dog owners in the UAE. This service offers a structured environment for dogs, providing them with necessary care and socialization. The increasing trend of pet ownership, particularly among families, has led to a rise in demand for kennel services, as pet owners seek reliable options for their pets when they are away. Additionally, the growth of pet-friendly tourism and the introduction of advanced amenities in boarding facilities have further boosted this segment.

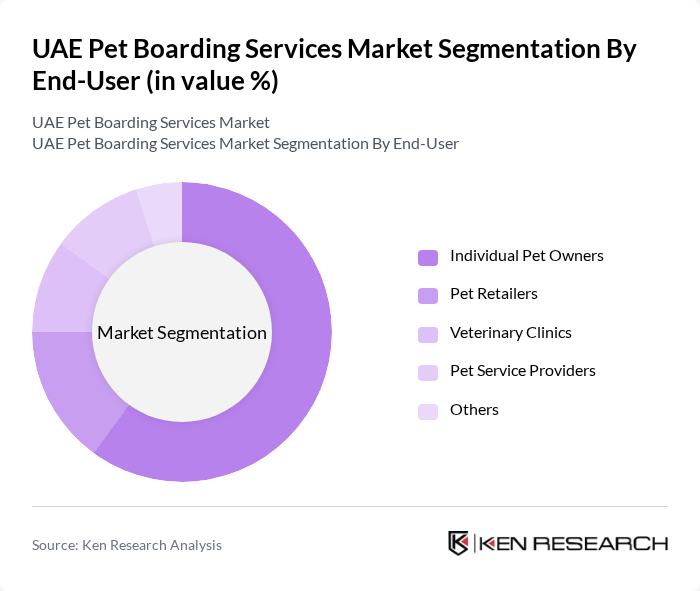

By End-User:The segmentation by end-user includes Individual Pet Owners, Pet Retailers, Veterinary Clinics, Pet Service Providers, and Others. Each end-user category plays a crucial role in the demand for pet boarding services, with individual pet owners being the primary consumers. Veterinary clinics and pet retailers increasingly collaborate with boarding facilities to offer integrated care solutions, while service providers focus on specialized and luxury offerings.

Individual Pet Owners represent the largest end-user segment, driven by the increasing number of households owning pets. This demographic prioritizes the well-being of their pets and often seeks professional boarding services when traveling or during emergencies. The growing trend of pet humanization and rising disposable incomes have led to higher spending on pet care, making individual pet owners the key drivers of demand in the pet boarding services market.

The UAE Pet Boarding Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as My Second Home, Posh Paws Dubai, Dubai Kennels & Cattery (DKC), Pet Station Kennels & Cattery, Urban Tails Pet Resort, The Pet Shop Dubai, Woof Pet Services, Petzone, Petsville, Furry Friends Dubai, Pet Boutique Dubai, Happy Paws Dubai, Pet Avenue, The Dog House Dubai, Catopia Dubai contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE pet boarding services market appears promising, driven by increasing pet ownership and rising disposable incomes. As consumers become more discerning, the demand for high-quality, specialized services is expected to grow. Innovations in technology, such as online booking systems and enhanced customer engagement through apps, will likely reshape service delivery. Additionally, the trend towards eco-friendly practices in pet care will attract environmentally conscious consumers, further expanding market opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Kennel Services Cattery Services Home Boarding Services Luxury Boarding Facilities Others |

| By End-User | Individual Pet Owners Pet Retailers Veterinary Clinics Pet Service Providers Others |

| By Pet Type | Dogs Cats Small Mammals Birds Others |

| By Service Duration | Short-term Boarding Long-term Boarding Daycare Services Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Pricing Model | Premium Pricing Mid-range Pricing Budget Pricing Others |

| By Customer Segment | Families Singles Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Boarding Facilities | 60 | Facility Owners, Operations Managers |

| Pet Owners | 120 | Pet Owners, Pet Care Enthusiasts |

| Veterinary Clinics | 50 | Veterinarians, Clinic Managers |

| Pet Grooming Services | 40 | Grooming Service Owners, Pet Stylists |

| Pet Supply Retailers | 40 | Retail Managers, Product Buyers |

The UAE Pet Boarding Services Market is valued at approximately USD 30 million, driven by increasing pet ownership, urbanization, and a trend of pet humanization, where pets are treated as family members.