Region:Middle East

Author(s):Shubham

Product Code:KRAD5337

Pages:99

Published On:December 2025

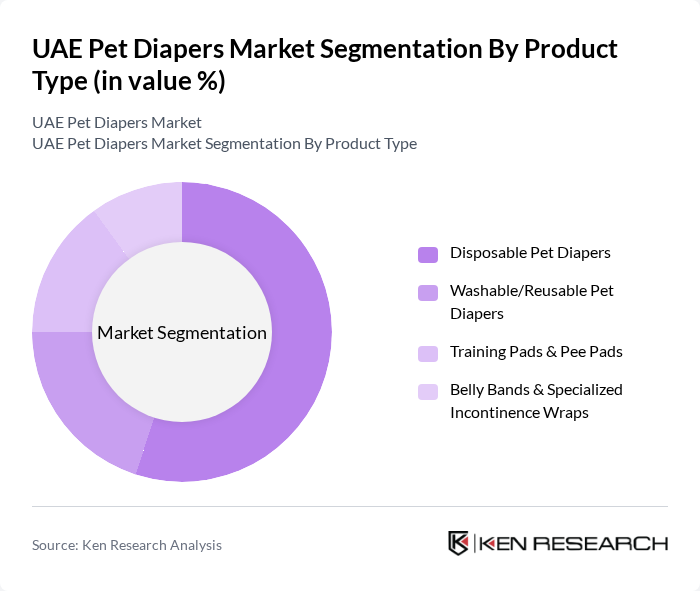

By Product Type:The product type segmentation includes Disposable Pet Diapers, Washable/Reusable Pet Diapers, Training Pads & Pee Pads, and Belly Bands & Specialized Incontinence Wraps. Disposable Pet Diapers dominate the market due to their convenience and ease of use, appealing to busy pet owners and aligning with global patterns where disposables hold the largest share of pet diaper revenues. Washable/Reusable Pet Diapers are gaining traction among environmentally conscious consumers as sustainable, lower-waste alternatives, supported by increasing interest in reusable formats in the broader pet diapers market. Training Pads & Pee Pads are essential for house training puppies and managing indoor elimination, a key global use case cited for pet diapers and absorbent pads, particularly in apartments and high-rise living. Belly Bands & Specialized Incontinence Wraps cater to specific needs, such as male dogs with incontinence issues, senior pets, and post-surgical recovery, reflecting the broader industry focus on urinary incontinence and age-related conditions as primary drivers.

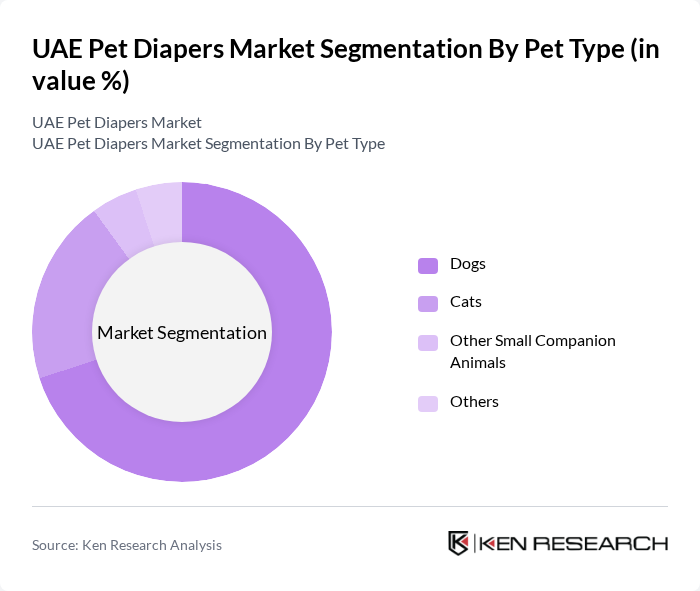

By Pet Type:The pet type segmentation includes Dogs, Cats, Other Small Companion Animals, and Others. Dogs represent the largest segment due to their popularity as pets in the UAE and globally, driving higher demand for diapers, training pads, and incontinence solutions, which is consistent with global pet diapers and dog diaper market analyses that highlight canines as the primary users. Cats follow closely, with a growing number of cat owners seeking convenient solutions for their pets, particularly for elderly, post-surgical, or special-needs animals where diapers and pads support hygiene and indoor cleanliness. Other small companion animals, such as rabbits and guinea pigs, are also gaining attention, although they represent a smaller market share and tend to use more specialized or niche hygiene products within the broader companion animal care category. The "Others" category includes exotic pets, which have niche demand and typically rely on customized hygiene and enclosure-management solutions rather than mass-market diaper formats.

The UAE Pet Diapers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petzone (Pet Line Trading LLC), Dubai Pet Food (The Pet Shop LLC), Royal Canin (UAE Operations), Mars Petcare – Pedigree & Whiskas (UAE Operations), Pet Sky General Trading LLC, Eurovets Veterinary Suppliers LLC, Pet Corner Trading LLC, Amazon (Amazon.ae – Pet Supplies Private Labels & Imports), Noon (Noon.com – Pet Supplies Private Labels & Imports), Carrefour UAE (Majid Al Futtaim Retail – Private Label & Branded Pet Diapers), Spinneys & Waitrose UAE (Pet Care Category), Lulu Hypermarket UAE (Lulu Group International – Pet Diaper Assortment), Petzone Veterinary Clinic & Retail Network (In-house & Partner Brands), Pets Plus LLC, Petworld UAE contribute to innovation, geographic expansion, and service delivery in this space.

The UAE pet diapers market is poised for continued growth, driven by increasing pet ownership and heightened awareness of pet hygiene. Innovations in product technology and a shift towards premium offerings are expected to shape consumer preferences. Additionally, the rise of e-commerce will facilitate easier access to a variety of products. As sustainability becomes a priority, brands focusing on eco-friendly materials will likely capture a growing segment of environmentally conscious consumers, enhancing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Disposable Pet Diapers Washable/Reusable Pet Diapers Training Pads & Pee Pads Belly Bands & Specialized Incontinence Wraps |

| By Pet Type | Dogs Cats Other Small Companion Animals Others |

| By Application | Urinary Incontinence Females in Heat / Menstruation House Training & Puppy Training Post-surgery and Travel Use |

| By End-User | Household Pet Owners Veterinary Clinics & Hospitals Pet Grooming Salons & Day-care/Boarding Facilities Animal Shelters & Rescues |

| By Distribution Channel | Online Retail & Marketplaces (e-commerce) Supermarkets/Hypermarkets Pet Specialty Stores & Vet Clinics Other Offline Retail (convenience, co-ops, etc.) |

| By Material Type | Conventional Synthetic Materials Cotton & Natural Fiber-based Biodegradable & Eco-friendly Materials Hybrid & Others |

| By Size | Extra Small / Toy Breeds Small Medium Large & Extra Large |

| By Brand Positioning | Premium & Imported Brands Mid-range Mass-market Brands Value/Budget & Private Label Brands |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owners Survey | 150 | Dog and cat owners across various demographics |

| Retailer Insights | 120 | Pet store managers and e-commerce platform representatives |

| Veterinary Perspectives | 80 | Veterinarians and pet care specialists |

| Manufacturers Feedback | 60 | Product managers and marketing heads from pet diaper manufacturers |

| Market Analysts Review | 40 | Industry analysts and market researchers specializing in pet products |

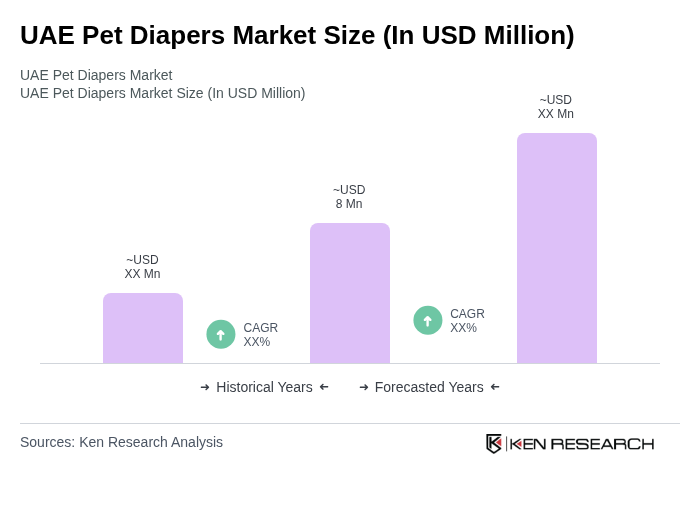

The UAE Pet Diapers Market is valued at approximately USD 8 million, reflecting a growing trend in pet ownership and hygiene awareness among pet owners in the region.