Region:Middle East

Author(s):Rebecca

Product Code:KRAD6126

Pages:95

Published On:December 2025

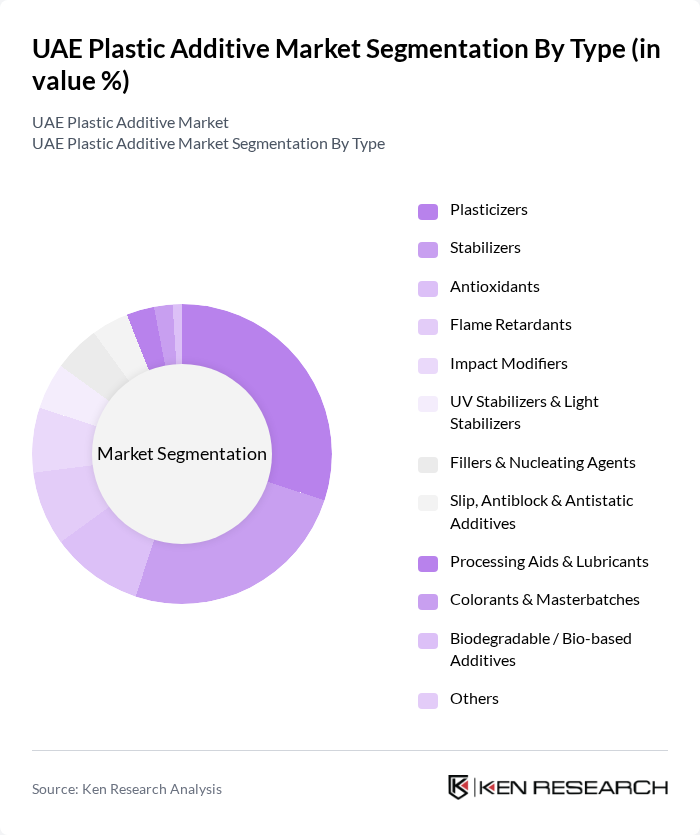

By Type:The plastic additive market is segmented into various types, including plasticizers, stabilizers, antioxidants, flame retardants, impact modifiers, UV stabilizers & light stabilizers, fillers & nucleating agents, slip, antiblock & antistatic additives, processing aids & lubricants, colorants & masterbatches, biodegradable/bio-based additives, and others. Among these, plasticizers and stabilizers are the most significant contributors to market growth, with plasticizers identified as holding the largest share in the UAE due to the extensive use of PVC in infrastructure, construction, and building applications. Plasticizers enhance the flexibility and workability of plastics, making them essential in applications like flexible PVC pipes, cables, profiles, and packaging. Stabilizers, particularly heat and light stabilizers, improve the durability and longevity of plastic products under harsh climatic conditions, which is crucial in sectors such as automotive, building components, electrical cabling, and outdoor applications.

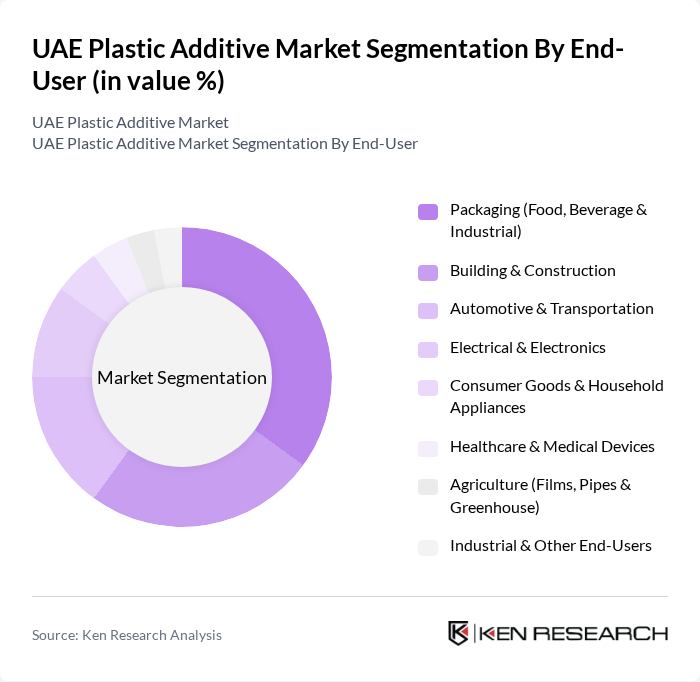

By End-User:The end-user segments of the plastic additive market include packaging (food, beverage & industrial), building & construction, automotive & transportation, electrical & electronics, consumer goods & household appliances, healthcare & medical devices, agriculture (films, pipes & greenhouse), and industrial & other end-users. The packaging sector is the largest consumer of plastic additives in the UAE, driven by strong growth in food and beverage processing, e-commerce, retail, and tourism, which increases the need for high-performance, safe, and moisture- and heat-resistant packaging solutions. The construction industry also significantly contributes to the market, as additives are essential for enhancing the weatherability, mechanical performance, and service life of pipes, cables, profiles, insulation, and other polymer-based construction materials used in large-scale infrastructure and real estate projects.

The UAE Plastic Additive Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Evonik Industries AG, DuPont de Nemours, Inc., SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V., Addchem FZC (UAE), Astra Polymers Compounding Co. Ltd., Polytech Plastics Industries LLC (UAE), Green Oasis General Trading LLC (UAE), PolyOne Corporation (Avient Corporation), INEOS Group, Arkema S.A., Huntsman Corporation, Mitsubishi Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UAE plastic additive market is poised for significant transformation, driven by technological advancements and a strong push towards sustainability. As industries increasingly adopt eco-friendly practices, the demand for innovative additives that enhance performance while minimizing environmental impact will rise. Additionally, the integration of smart technologies in manufacturing processes is expected to streamline production and improve product quality, positioning the UAE as a leader in the regional plastic additive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasticizers Stabilizers Antioxidants Flame Retardants Impact Modifiers UV Stabilizers & Light Stabilizers Fillers & Nucleating Agents Slip, Antiblock & Antistatic Additives Processing Aids & Lubricants Colorants & Masterbatches Biodegradable / Bio-based Additives Others |

| By End-User | Packaging (Food, Beverage & Industrial) Building & Construction Automotive & Transportation Electrical & Electronics Consumer Goods & Household Appliances Healthcare & Medical Devices Agriculture (Films, Pipes & Greenhouse) Industrial & Other End-Users |

| By Application / Processing Method | Extrusion (Films, Sheets & Pipes) Injection Molding Blow Molding Thermoforming Rotational Molding D Printing & Additive Manufacturing Compounding & Masterbatch Production Others |

| By Polymer Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polyethylene Terephthalate (PET) Polystyrene (PS & EPS) Engineering Plastics (PC, PA, PBT, etc.) Bioplastics & Compostable Plastics Others |

| By Product Form | Masterbatches Liquid Additives Powders Pastes & Dispersions Compounded Pellets / Granules Others |

| By Distribution Channel | Direct Sales to Converters & Compounders Specialized Chemical Distributors Resin Producers’ Captive Supply Online / E-marketplaces Traders & Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others (Free Zones & Industrial Clusters) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Additives | 45 | Product Managers, Quality Assurance Specialists |

| Automotive Plastic Additives | 40 | Procurement Managers, R&D Engineers |

| Construction Material Additives | 35 | Project Managers, Material Engineers |

| Consumer Goods Plastic Additives | 40 | Marketing Managers, Product Development Leads |

| Regulatory Compliance in Plastics | 30 | Compliance Officers, Environmental Managers |

The UAE Plastic Additive Market is valued at approximately USD 240 million, reflecting a robust growth trajectory driven by increasing demand across sectors such as packaging, automotive, and construction, alongside significant investments in infrastructure and sustainability initiatives.