Region:Middle East

Author(s):Shubham

Product Code:KRAC4354

Pages:92

Published On:October 2025

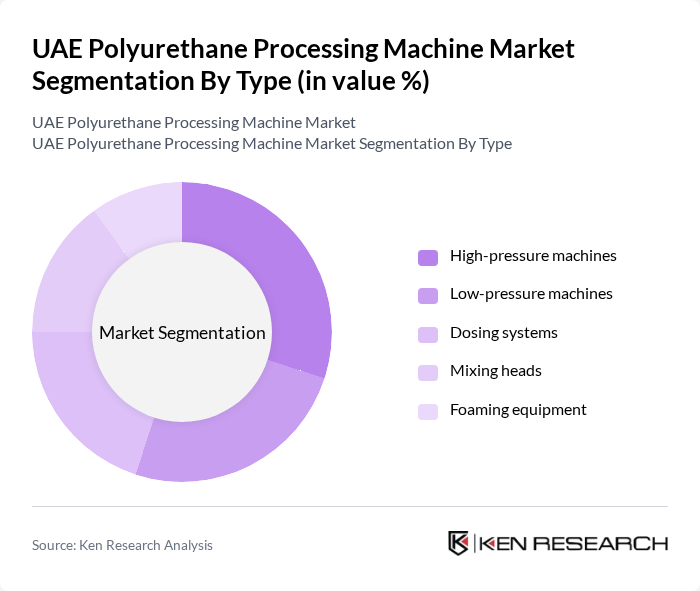

By Type:The market is segmented into various types of polyurethane processing machines, including high-pressure machines, low-pressure machines, dosing systems, mixing heads, and foaming equipment. Each of these sub-segments plays a crucial role in the production process, catering to different manufacturing needs and applications.

The high-pressure machines segment is currently dominating the market due to their efficiency and ability to produce high-quality polyurethane products. These machines are widely used in industries such as automotive and construction, where precision, speed, and consistent quality are critical. The rising demand for lightweight, durable, and energy-efficient materials in these sectors has led to a surge in the adoption of high-pressure processing technologies. Manufacturers are increasingly investing in automation and smart manufacturing solutions to enhance productivity and reduce operational costs, further driving the market leadership of high-pressure machines.

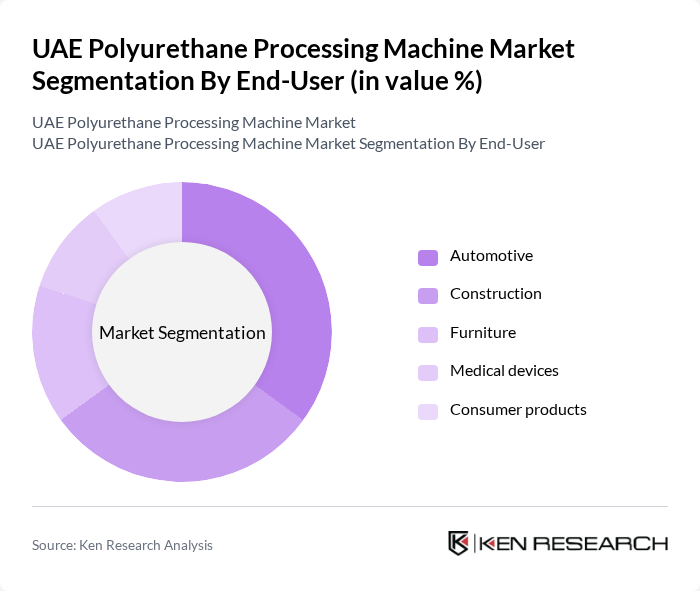

By End-User:The end-user segmentation includes automotive, construction, furniture, medical devices, and consumer products. Each of these sectors utilizes polyurethane processing machines for various applications, reflecting the material's versatility and performance.

The automotive sector is the leading end-user of polyurethane processing machines, driven by the industry's need for lightweight, durable, and energy-efficient materials. The increasing production of vehicles and the adoption of polyurethane foam for seating, insulation, and interior components have boosted demand in this segment. The construction sector follows closely, leveraging polyurethane for insulation, structural components, and energy-saving solutions in both residential and commercial projects. Furniture, medical devices, and consumer products also represent significant application areas, benefiting from polyurethane's versatility and performance characteristics.

The UAE Polyurethane Processing Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, Covestro AG, Dow Inc., Wanhua Chemical Group Co., Ltd., Graco Inc., Hennecke GmbH, CANNON Group, RAMPF Holding GmbH & Co. KG, Sika AG, Inoac Corporation, Kuka AG, PPG Industries, Inc., Axxon Group, Recticel NV/SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE polyurethane processing machine market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As the construction and automotive sectors continue to expand, the demand for innovative and efficient processing solutions will rise. Companies are likely to invest in automation and smart manufacturing technologies, enhancing productivity. Furthermore, the shift towards eco-friendly materials will create new opportunities for bio-based polyurethane products, aligning with global sustainability trends and local regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | High-pressure machines Low-pressure machines Dosing systems Mixing heads Foaming equipment |

| By End-User | Automotive Construction Furniture Medical devices Consumer products |

| By Application | Rigid insulation foams Flexible foams Coatings Adhesives and sealants Elastomers |

| By Distribution Channel | Direct sales to manufacturers Authorized distributors Equipment rental services Online B2B platforms System integrators |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Price Range | Entry-level machines (USD 50K-150K) Mid-range machines (USD 150K-500K) Premium machines (USD 500K+) |

| By Technology | Conventional technology Advanced automation and IoT-enabled Hybrid and modular systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polyurethane Applications | 60 | Production Managers, Quality Control Supervisors |

| Construction Material Suppliers | 50 | Sales Directors, Product Development Managers |

| Furniture Manufacturing Sector | 40 | Operations Managers, Design Engineers |

| Adhesives and Sealants Producers | 40 | Procurement Managers, R&D Specialists |

| Insulation Material Manufacturers | 50 | Technical Managers, Supply Chain Coordinators |

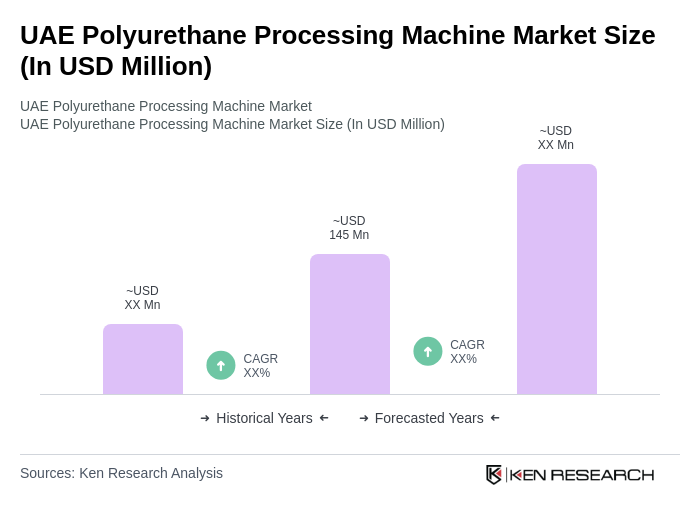

The UAE Polyurethane Processing Machine market is valued at approximately USD 145 million, driven by increasing demand across industries such as automotive, construction, and furniture manufacturing, reflecting a robust growth trajectory in recent years.