Region:Middle East

Author(s):Rebecca

Product Code:KRAA9421

Pages:100

Published On:November 2025

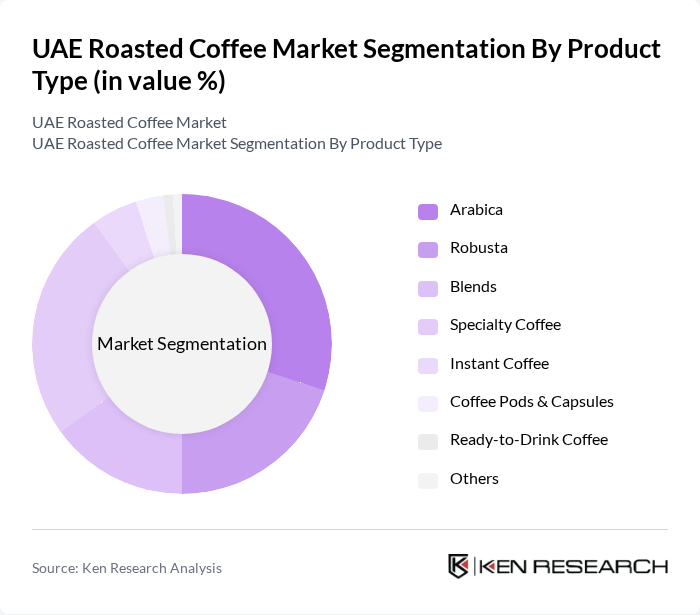

By Product Type:The product type segmentation includes categories such as Arabica, Robusta, Blends, Specialty Coffee, Instant Coffee, Coffee Pods & Capsules, Ready-to-Drink Coffee, and Others. Each subsegment caters to distinct consumer preferences and market demands. Arabica coffee is favored for its smooth, mild flavor and aromatic qualities, while Robusta appeals to those seeking a stronger taste and higher caffeine content. Specialty coffee has gained significant traction due to the increasing interest in single-origin beans, artisanal roasting, and unique brewing methods. Coffee pods and capsules are rapidly growing, driven by at-home consumption and convenience.

By End-User:The end-user segmentation encompasses categories including Households, Cafés & Coffee Shops, Restaurants & Hotels (HoReCa), Offices & Institutions, and Others. Households represent a significant portion of the market, driven by the increasing trend of home brewing, investment in coffee machines, and capsule systems. Cafés and coffee shops are crucial, catering to the growing demand for specialty coffee experiences, while HoReCa and offices reflect the broader adoption of premium coffee in hospitality and workplace environments.

The UAE Roasted Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Dairy (Coffee Division), Coffee Planet, RAW Coffee Company, The Espresso Lab, Café Bateel, % Arabica, Nespresso (Nestlé Middle East), Lavazza Middle East, Starbucks UAE (Alshaya Group), Costa Coffee UAE (Emirates Leisure Retail), The Coffee Club UAE, Seven Fortunes Coffee Roasters, Boon Coffee, Gold Box Roastery, Mokha 1450 Coffee Boutique contribute to innovation, geographic expansion, and service delivery in this space.

The UAE roasted coffee market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. As the demand for specialty and organic coffee rises, brands that prioritize quality and sustainability will likely thrive. Additionally, the integration of technology in coffee brewing and the expansion of e-commerce platforms will enhance accessibility and convenience for consumers. The market is expected to adapt to these trends, fostering a vibrant coffee culture that attracts both local and international consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Arabica Robusta Blends Specialty Coffee Instant Coffee Coffee Pods & Capsules Ready-to-Drink Coffee Others |

| By End-User | Households Cafés & Coffee Shops Restaurants & Hotels (HoReCa) Offices & Institutions Others |

| By Packaging Type | Bags Cans Pods & Capsules Sachets Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Cafés & Direct-to-Consumer Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Flavor Profile | Fruity Nutty Chocolatey Spicy Floral Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 120 | Café Owners, Baristas, Retail Managers |

| Wholesale Coffee Distributors | 85 | Distribution Managers, Sales Executives |

| Consumer Coffee Preferences | 150 | Regular Coffee Drinkers, Specialty Coffee Enthusiasts |

| Online Coffee Retailers | 65 | E-commerce Managers, Marketing Directors |

| Local Coffee Roasters | 55 | Roasting Experts, Business Owners |

The UAE Roasted Coffee Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increasing coffee consumption, a rising café culture, and the demand for specialty coffee products among consumers.