UAE Smartwatch & Wearables Retail Market Overview

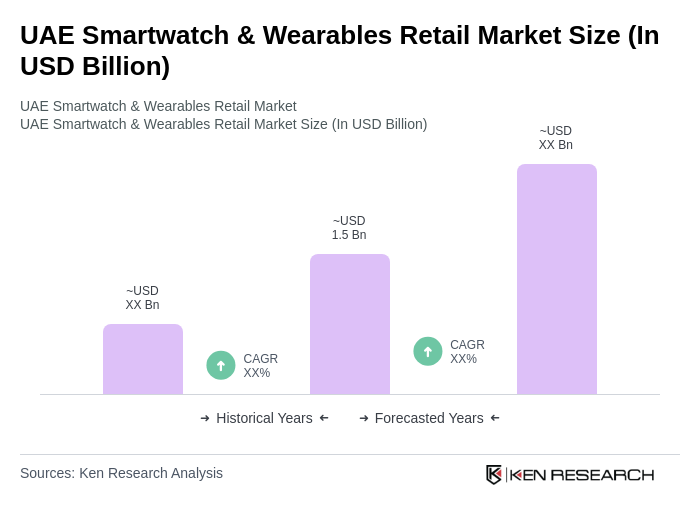

- The UAE Smartwatch & Wearables Retail Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, technological advancements in wearable devices, and the rising demand for fitness tracking solutions. The market has seen a surge in adoption due to the integration of smart features in wearables, enhancing user experience and functionality.

- Dubai and Abu Dhabi are the dominant cities in the UAE Smartwatch & Wearables Retail Market, attributed to their status as major economic hubs with high disposable incomes and a tech-savvy population. The presence of numerous retail outlets and e-commerce platforms in these cities further facilitates the accessibility and popularity of smartwatches and wearables among consumers.

- In 2023, the UAE government implemented regulations to promote the use of wearable health technology. This initiative includes guidelines for manufacturers to ensure data privacy and security, encouraging the development of innovative health monitoring devices. The regulation aims to enhance consumer trust and drive the adoption of wearables in healthcare settings.

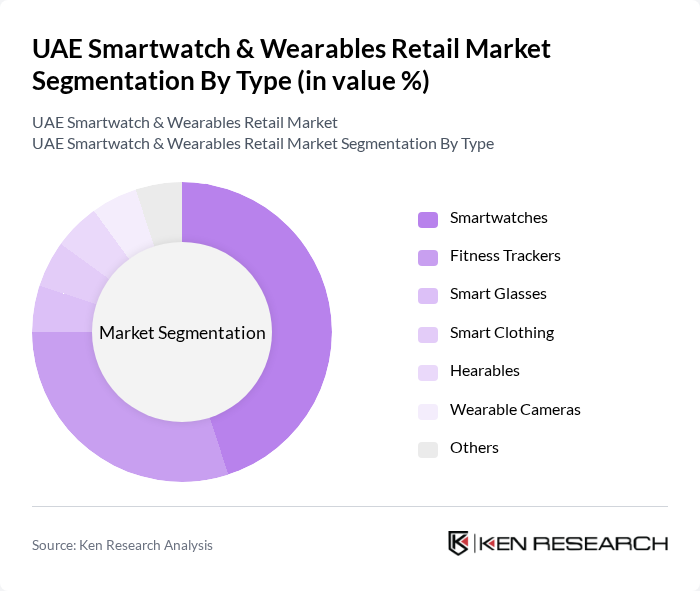

UAE Smartwatch & Wearables Retail Market Segmentation

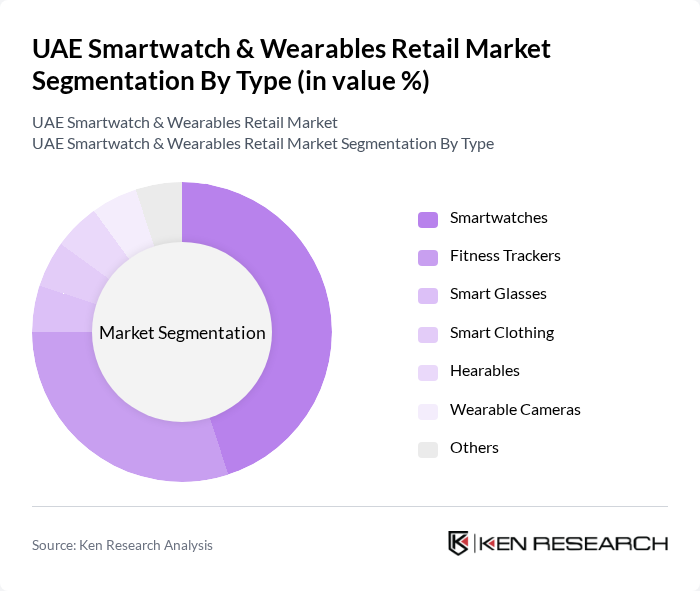

By Type:The market is segmented into various types of wearables, including smartwatches, fitness trackers, smart glasses, smart clothing, hearables, wearable cameras, and others. Among these, smartwatches dominate the market due to their multifunctionality, combining fitness tracking, communication, and entertainment features. Fitness trackers also hold a significant share, driven by the growing trend of health and fitness awareness among consumers. The increasing integration of advanced technologies such as GPS and heart rate monitoring in these devices further enhances their appeal.

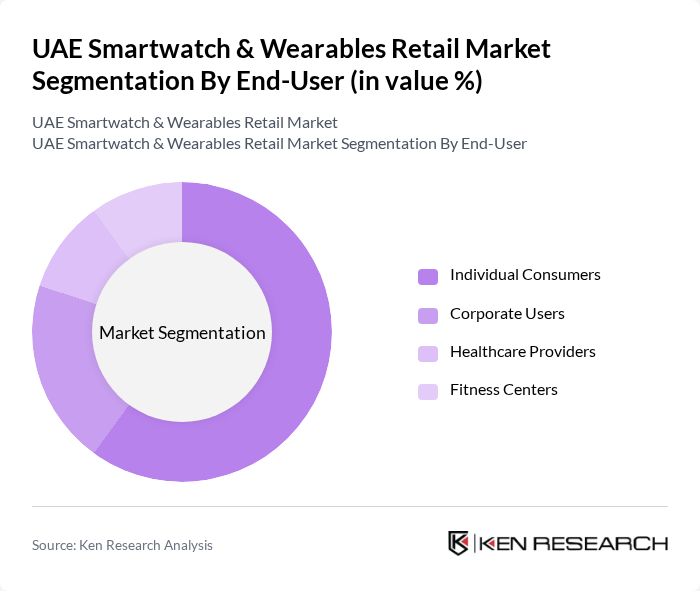

By End-User:The end-user segmentation includes individual consumers, corporate users, healthcare providers, and fitness centers. Individual consumers represent the largest segment, driven by the increasing popularity of fitness and health tracking among the general public. Corporate users are also emerging as a significant segment, utilizing wearables for employee wellness programs. Healthcare providers are increasingly adopting wearables for patient monitoring, while fitness centers leverage these devices to enhance member engagement and track fitness progress.

UAE Smartwatch & Wearables Retail Market Competitive Landscape

The UAE Smartwatch & Wearables Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit, Inc., Huawei Technologies Co., Ltd., Xiaomi Corporation, Fossil Group, Inc., Suunto Ltd., Amazfit, Withings, TicWatch, Honor, Skagen Designs, Inc., Misfit Wearables Corp., Polar Electro Oy contribute to innovation, geographic expansion, and service delivery in this space.

UAE Smartwatch & Wearables Retail Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The UAE has seen a significant rise in health awareness, with 70% of the population actively seeking ways to improve their health. This trend is supported by the UAE government’s initiatives, such as the National Health Strategy, which aims to enhance public health. The increasing prevalence of lifestyle diseases, with diabetes affecting approximately 18% of adults, further drives the demand for health-monitoring wearables, making them essential for proactive health management.

- Technological Advancements:The UAE's smartwatch and wearables market is bolstered by rapid technological advancements, with over 55% of consumers expressing interest in devices that offer advanced features like ECG monitoring and blood oxygen tracking. The introduction of 5G technology is expected to enhance connectivity and functionality, allowing wearables to integrate seamlessly with other smart devices. This technological evolution is crucial as it meets the growing consumer demand for innovative and multifunctional wearable technology.

- Rising Disposable Income:The UAE's GDP per capita is projected to reach approximately $45,000, indicating a robust economic environment. This increase in disposable income allows consumers to invest in premium wearable technology, with sales of high-end smartwatches expected to rise by 16% annually. As consumers prioritize health and fitness, the willingness to spend on advanced wearables that offer comprehensive health tracking features is significantly increasing, driving market growth.

Market Challenges

- High Competition:The UAE smartwatch and wearables market is characterized by intense competition, with over 35 brands vying for market share. Major players like Apple, Samsung, and Fitbit dominate, making it challenging for new entrants to establish themselves. This competitive landscape leads to aggressive pricing strategies, which can erode profit margins. Companies must innovate continuously to differentiate their products and maintain a competitive edge in this saturated market.

- Consumer Price Sensitivity:Despite rising disposable incomes, a significant portion of the UAE population remains price-sensitive, particularly among younger consumers. Approximately 45% of potential buyers cite price as a primary barrier to purchasing smartwatches. This sensitivity necessitates that brands offer competitive pricing or value-added features to attract budget-conscious consumers. As a result, companies must balance quality and affordability to capture a broader audience in the market.

UAE Smartwatch & Wearables Retail Market Future Outlook

The future of the UAE smartwatch and wearables market appears promising, driven by ongoing technological innovations and a growing emphasis on health and fitness. As consumers increasingly prioritize health monitoring, the integration of wearables with telehealth services is expected to gain traction. Additionally, the rise of fashionable wearables will likely attract a broader demographic, enhancing market penetration. Companies that adapt to these trends and focus on user experience will be well-positioned for success in this evolving landscape.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in the UAE, projected to reach $30 billion, presents a significant opportunity for smartwatch and wearables sales. Brands can leverage online platforms to reach a wider audience, offering convenience and competitive pricing. Enhanced digital marketing strategies can further boost visibility and sales, capitalizing on the increasing trend of online shopping among consumers.

- Collaborations with Fitness Centers:Partnerships with fitness centers and health clubs can create synergies that enhance brand visibility and consumer engagement. With over 1,200 fitness centers in the UAE, brands can offer exclusive promotions or bundled services that integrate wearables with fitness programs. This strategy not only drives sales but also fosters a community around health and fitness, encouraging long-term customer loyalty.