Region:Middle East

Author(s):Rebecca

Product Code:KRAB4753

Pages:97

Published On:October 2025

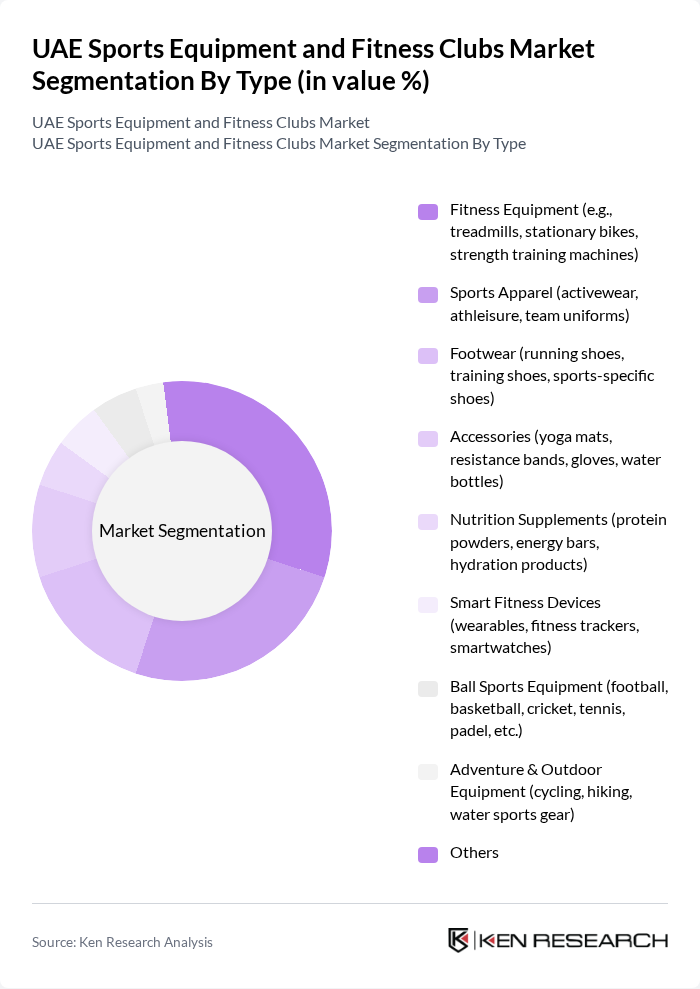

By Type:The market is segmented into various types of products and services that cater to the fitness and sports needs of consumers. The key subsegments include Fitness Equipment, Sports Apparel, Footwear, Accessories, Nutrition Supplements, Smart Fitness Devices, Ball Sports Equipment, Adventure & Outdoor Equipment, and Others. Each of these subsegments plays a crucial role in meeting the diverse demands of fitness enthusiasts and athletes. Fitness Equipment and Sports Apparel remain the largest segments, driven by consumer demand for home gyms, athleisure, and technologically advanced gear. Smart Fitness Devices and Nutrition Supplements are experiencing rapid growth due to digital health trends and increased focus on performance optimization .

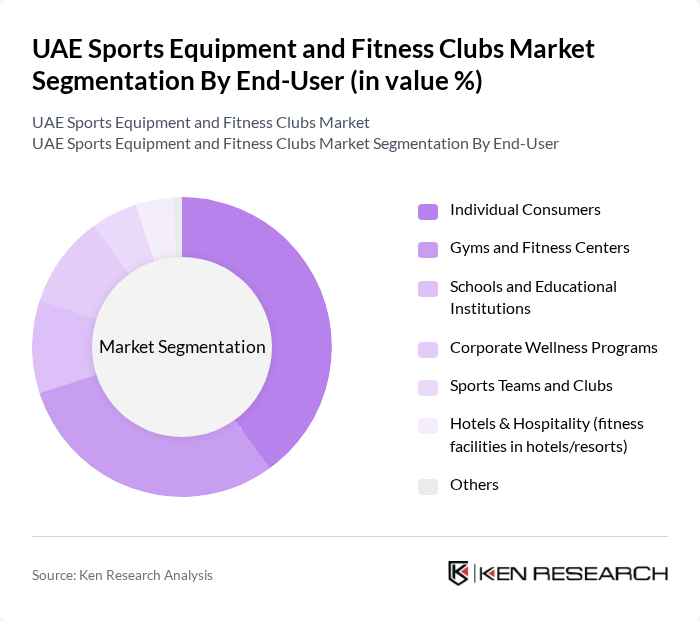

By End-User:The market is also segmented based on the end-users of sports equipment and fitness services. Key subsegments include Individual Consumers, Gyms and Fitness Centers, Schools and Educational Institutions, Corporate Wellness Programs, Sports Teams and Clubs, Hotels & Hospitality, and Others. This segmentation helps in understanding the diverse needs and preferences of different user groups. Individual Consumers and Gyms/Fitness Centers are the largest end-user segments, reflecting the popularity of personal fitness and the proliferation of commercial gyms. Corporate Wellness Programs and Hotels & Hospitality are emerging segments, supported by rising employer health initiatives and tourism sector investments .

The UAE Sports Equipment and Fitness Clubs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fitness First Middle East, Gold's Gym UAE, GymNation, Snap Fitness UAE, The Warehouse Gym, Technogym S.p.A., Life Fitness (Brunswick Corporation), Precor Incorporated, Decathlon S.A., Adidas AG, Nike, Inc., Under Armour, Inc., Puma SE, Reebok International Ltd., Sun & Sand Sports (Gulf Marketing Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE sports equipment and fitness clubs market appears promising, driven by ongoing health initiatives and technological advancements. The integration of digital platforms for fitness services is expected to enhance consumer engagement, while the demand for personalized fitness solutions will likely grow. Additionally, the increasing focus on sustainability will push manufacturers to innovate eco-friendly products, aligning with global trends and consumer preferences, thereby fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment (e.g., treadmills, stationary bikes, strength training machines) Sports Apparel (activewear, athleisure, team uniforms) Footwear (running shoes, training shoes, sports-specific shoes) Accessories (yoga mats, resistance bands, gloves, water bottles) Nutrition Supplements (protein powders, energy bars, hydration products) Smart Fitness Devices (wearables, fitness trackers, smartwatches) Ball Sports Equipment (football, basketball, cricket, tennis, padel, etc.) Adventure & Outdoor Equipment (cycling, hiking, water sports gear) Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Corporate Wellness Programs Sports Teams and Clubs Hotels & Hospitality (fitness facilities in hotels/resorts) Others |

| By Sales Channel | Online Retail (e-commerce platforms, brand websites) Brick-and-Mortar Stores (specialty sports stores, department stores) Wholesale Distributors Direct Sales (brand-owned outlets, pop-up stores) Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Type | International Brands Local Brands (e.g., Sun & Sand Sports, Al Boom Sports) Private Labels Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Others |

| By Application | Home Use Commercial Use Professional Sports Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Club Membership Insights | 100 | Gym Members, Personal Trainers |

| Sports Equipment Retail Analysis | 60 | Retail Managers, Sales Representatives |

| Consumer Fitness Trends | 80 | Fitness Enthusiasts, Health Coaches |

| Corporate Wellness Programs | 50 | HR Managers, Wellness Coordinators |

| Emerging Fitness Technologies | 40 | Tech Developers, Fitness Innovators |

The UAE Sports Equipment and Fitness Clubs Market is valued at approximately USD 1.6 billion. This valuation reflects a five-year historical analysis of revenues, driven by increasing health consciousness, rising disposable incomes, and government initiatives promoting fitness activities.