Region:Europe

Author(s):Geetanshi

Product Code:KRAA5043

Pages:94

Published On:September 2025

By Type:The market can be segmented into various types of products and services, including fitness equipment, sports apparel, accessories, nutrition supplements, fitness technology, home gym equipment, and others. Each of these segments caters to different consumer needs and preferences, with fitness equipment and sports apparel being particularly popular among fitness enthusiasts.

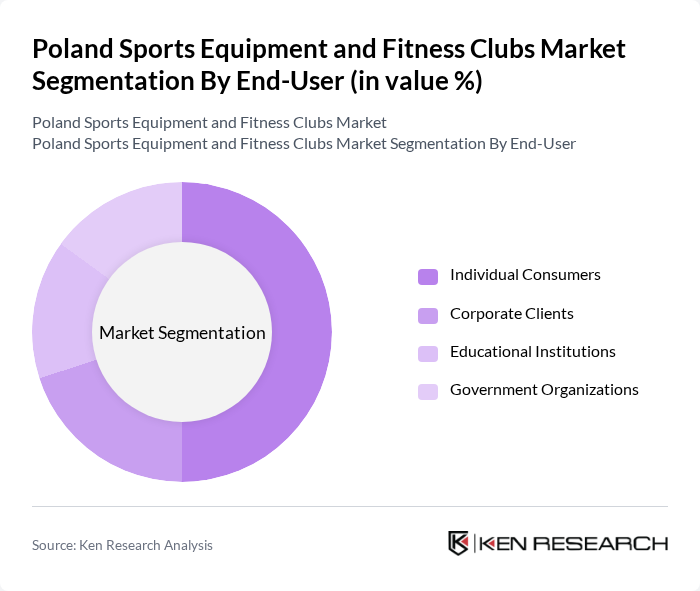

By End-User:The end-user segmentation includes individual consumers, corporate clients, educational institutions, and government organizations. Each segment has unique requirements and purchasing behaviors, with individual consumers being the largest segment due to the growing trend of personal fitness and wellness.

The Poland Sports Equipment and Fitness Clubs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon S.A., Adidas AG, Nike, Inc., Reebok International Ltd., Under Armour, Inc., Fitness World A/S, Gold's Gym International, Inc., Planet Fitness, Inc., 4F S.A., Trec Nutrition, Life Fitness, Inc., Technogym S.p.A., Hammer Strength, Kettler GmbH, Body-Solid, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland sports equipment and fitness clubs market appears promising, driven by ongoing health trends and technological advancements. As consumers increasingly seek personalized fitness experiences, the integration of digital platforms and wearable technology will likely enhance engagement. Additionally, the expansion of fitness services into rural areas presents a significant opportunity for growth, allowing businesses to tap into previously underserved markets and cater to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Accessories Nutrition Supplements Fitness Technology Home Gym Equipment Others |

| By End-User | Individual Consumers Corporate Clients Educational Institutions Government Organizations |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Fitness Clubs Wholesale Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands |

| By Usage Frequency | Daily Users Weekly Users Occasional Users |

| By Fitness Goals | Weight Loss Muscle Gain Endurance Training General Fitness |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Club Owners | 100 | Owners, General Managers |

| Equipment Retailers | 80 | Sales Managers, Product Buyers |

| Fitness Enthusiasts | 150 | Regular Gym Goers, Home Fitness Users |

| Health and Fitness Trainers | 70 | Personal Trainers, Group Fitness Instructors |

| Sports Equipment Manufacturers | 60 | Product Development Managers, Marketing Executives |

The Poland Sports Equipment and Fitness Clubs Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increased health consciousness, rising disposable incomes, and a growing interest in fitness and wellness activities among the population.