Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2028

Pages:98

Published On:August 2025

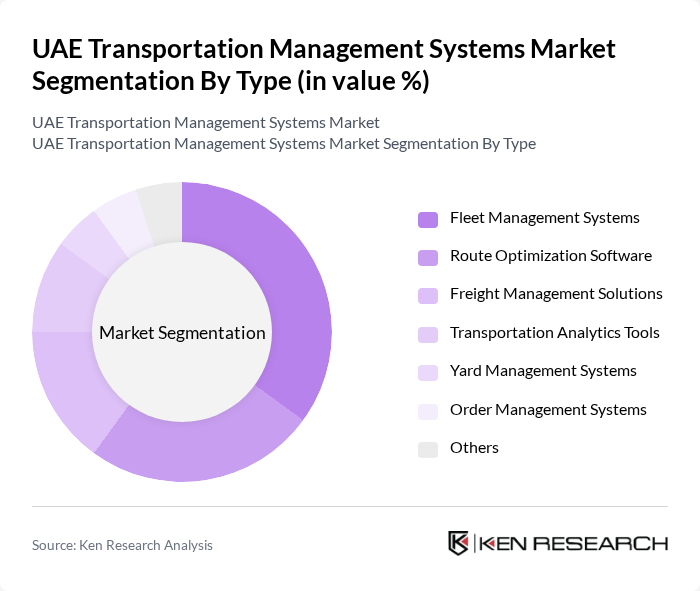

By Type:The market is segmented into Fleet Management Systems, Route Optimization Software, Freight Management Solutions, Transportation Analytics Tools, Yard Management Systems, Order Management Systems, and Others. Fleet Management Systems are currently leading the market due to their ability to enhance operational efficiency and reduce costs for businesses. The increasing need for real-time tracking, predictive maintenance, and compliance management is driving the demand for these systems. Route Optimization Software is also gaining traction as companies seek to minimize delivery times, fuel consumption, and improve last-mile delivery performance. The integration of IoT and cloud-based analytics is further accelerating adoption across all segments .

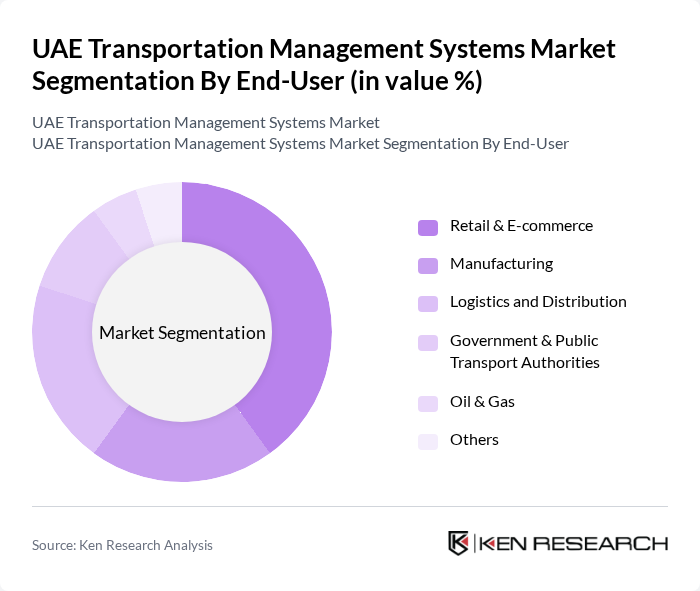

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Logistics and Distribution, Government & Public Transport Authorities, Oil & Gas, and Others. The Retail & E-commerce sector is the dominant end-user, driven by the surge in online shopping and the need for efficient logistics solutions. Companies in this sector are increasingly adopting transportation management systems to streamline their supply chains and improve customer satisfaction through timely deliveries. The Logistics and Distribution sector also plays a significant role, as it requires robust systems to manage complex supply chains and ensure regulatory compliance. Manufacturing and oil & gas sectors are adopting TMS for enhanced asset tracking and operational transparency .

The UAE Transportation Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, Manhattan Associates, Inc., Descartes Systems Group Inc., Trimble Inc., Infor, Inc., C.H. Robinson Worldwide, Inc., Transporeon Group, Freightos Limited, Project44, FourKites, Inc., Locus.sh, FarEye, Emirates Transport, Roads and Transport Authority (RTA) Dubai, Trukkin, Transworld Group, Al-Futtaim Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The UAE transportation management systems market is poised for significant evolution, driven by technological advancements and changing consumer expectations. The integration of artificial intelligence and machine learning will enhance operational efficiencies, while the shift towards cloud-based solutions will facilitate scalability and flexibility. Additionally, the growing emphasis on sustainability will push companies to adopt greener logistics practices, aligning with global trends. As urbanization continues, the demand for innovative transportation solutions will remain strong, shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Systems Route Optimization Software Freight Management Solutions Transportation Analytics Tools Yard Management Systems Order Management Systems Others |

| By End-User | Retail & E-commerce Manufacturing Logistics and Distribution Government & Public Transport Authorities Oil & Gas Others |

| By Application | Supply Chain Management Last-Mile Delivery Public Transportation Management Freight and Cargo Management Traffic Management & Intelligent Transport Systems Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Supply Chain Management | 60 | Logistics Managers, Supply Chain Analysts |

| Public Transportation Systems | 45 | Transport Planners, Operations Directors |

| Freight and Cargo Management | 40 | Freight Managers, Cargo Operations Supervisors |

| Technology Integration in Transportation | 40 | IT Managers, Systems Analysts |

| Urban Mobility Solutions | 50 | Urban Planners, Mobility Consultants |

The UAE Transportation Management Systems market is valued at approximately USD 120 million, reflecting a five-year historical analysis. This growth is driven by urbanization, logistics activities, and government investments in transportation infrastructure.