Region:Middle East

Author(s):Dev

Product Code:KRAD5094

Pages:95

Published On:December 2025

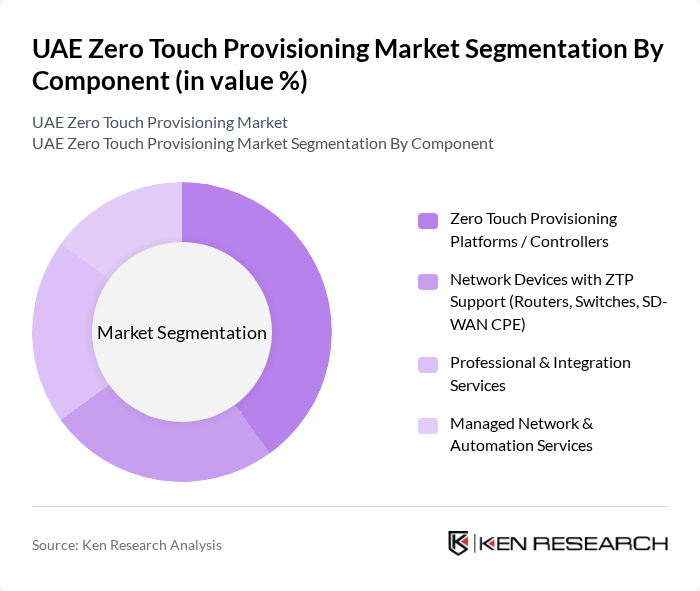

By Component:The components of the UAE Zero Touch Provisioning Market include various technologies and services that facilitate automated network provisioning. The subsegments are Zero Touch Provisioning Platforms / Controllers, Network Devices with ZTP Support (Routers, Switches, SD-WAN CPE), Professional & Integration Services, and Managed Network & Automation Services. Among these, Zero Touch Provisioning Platforms / Controllers are leading the market due to their critical role in automating the provisioning process, which significantly reduces operational costs and deployment times for enterprises, mirroring global trends where platforms account for the largest share of ZTP spending. Growing use of SD-WAN, software-defined networking, and centralized orchestration in the UAE further reinforces demand for controller-based ZTP architectures across telecom, BFSI, government, and large enterprise verticals.

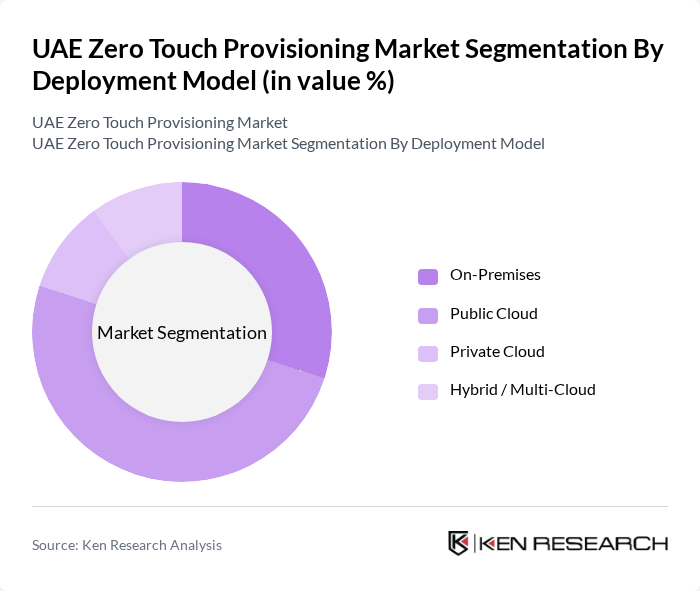

By Deployment Model:The deployment models in the UAE Zero Touch Provisioning Market include On-Premises, Public Cloud, Private Cloud, and Hybrid / Multi-Cloud. The Public Cloud deployment model is currently dominating the market due to its scalability, cost-effectiveness, and ease of integration with existing IT infrastructure, in alignment with the UAE’s rapid expansion of cloud services and strong preference for cloud-based IT and network automation solutions. Organizations are increasingly opting for cloud-based solutions to enhance flexibility, support distributed and remote operations, and reduce the burden of managing on-premises hardware, while hybrid and multi-cloud ZTP deployments are emerging as enterprises integrate multiple hyperscaler and local cloud environments.

The UAE Zero Touch Provisioning Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson AB, Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Palo Alto Networks, Inc., Fortinet, Inc., VMware by Broadcom, Aruba Networks (HPE Aruba Networking), Etisalat by e& (Emirates Telecommunications Group Company PJSC), du (Emirates Integrated Telecommunications Company PJSC), Injazat (Injazat Data Systems LLC) contribute to innovation, geographic expansion, and service delivery in this space, providing ZTP-ready network devices, orchestration platforms, cloud-managed services, and managed network automation offerings tailored to UAE enterprises and service providers.

The future of the UAE zero touch provisioning market appears promising, driven by technological advancements and increasing digital transformation initiatives. As organizations continue to embrace automation and IoT, the demand for efficient provisioning solutions will rise. Additionally, the government's commitment to enhancing cybersecurity and infrastructure will further support market growth. The integration of AI and machine learning into provisioning processes is expected to streamline operations, making zero touch provisioning a vital component of the UAE's digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Zero Touch Provisioning Platforms / Controllers Network Devices with ZTP Support (Routers, Switches, SD?WAN CPE) Professional & Integration Services Managed Network & Automation Services |

| By Deployment Model | On?Premises Public Cloud Private Cloud Hybrid / Multi?Cloud |

| By Network Type | Fixed Enterprise Networks (LAN/WAN) Data Center & Cloud Networks G & Mobile Networks IoT & Edge Networks |

| By End?User Industry | Telecom Operators & CSPs BFSI Government & Smart City Projects Healthcare Retail & E?Commerce Manufacturing & Industrial IT & Cloud Service Providers Others |

| By Emirate | Abu Dhabi Dubai Sharjah Ras Al Khaimah Ajman, Fujairah & Umm Al Quwain (Others) |

| By Enterprise Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Service & Commercial Model | License?Based (Perpetual / Term) Subscription?Based (SaaS) Managed Service / Network?as?a?Service Pay?As?You?Go & Consumption?Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators' Implementation Strategies | 90 | Network Architects, IT Directors |

| Enterprise Adoption of Zero Touch Solutions | 80 | Chief Technology Officers, IT Managers |

| Vendor Perspectives on Market Trends | 60 | Product Managers, Sales Executives |

| Regulatory Impact on Zero Touch Provisioning | 50 | Policy Makers, Compliance Officers |

| End-User Experience and Feedback | 70 | Operations Managers, Customer Experience Leads |

The UAE Zero Touch Provisioning Market is valued at approximately USD 130 million, reflecting its significant share within the global zero-touch provisioning segment and the broader UAE IT and network automation spending landscape.